We are standing on the brink of a paradigm shift.

It is estimated that within the next decade there will around 50 billion connected devices worldwide.

This interconnected world is being dubbed the Internet of Things (IoT).

Distributed Ledger Technologies, especially blockchain and tangle, are set to play a significant role in the transition.

The premise of IoT is to make the digital space easier, quicker and more convenient for end-users. However, there are obstacles to overcome.

Solutions are underway with the development of blockchain technology, but the system is not without its flaws.

Another network of developers is working on an alternative solution they call Tangle technology. Tangle also has its flaws, but a race for supremacy is about to ensue.

So which future-tech will be triumphant, blockchain or Tangle – and what’s the difference?

What Is Blockchain Technology?

A blockchain is essentially a ledger that records transactions made with cryptocurrencies, smart contracts or any data records.

The ledger is shared publicly amongst participating nodes within the system that create a consensus protocol.

Nodes are computers that are connected to the blockchain using software which incidentally can be as simple as a graphics card.

One of the advantages blockchains will offer the general public is that information can be transferred between parties without the need of a middleman that charges unreasonable fees such as a bank or a law firm.

In theory, digital transactions will lower the costs, although with the blockchain this is not proving to be the case anymore.

Every transaction will be recorded on the blockchain and verified by all the nodes within the system. Each transaction is known as a block.

Once a specified number of blocks has been made, cryptocurrency miners create a “hash” which is essentially a seal that prevents information of transactions from being changed.

Blockchains are sealed using sophisticated mathematical algorithms that cannot be corrupted.

The mining company that completes the blockchain receives a reward in the corresponding cryptocurrency – thus there is an incentive to make sure the system is maintained and functions under the protocols of the blockchain.

Blockchain technology is poised to improve numerous industries including finance, insurance, and retail. However, blockchain has several flaws that need addressing.

One of the major issues blockchain technology is criticised for is the inability to make micro-transactions that allow consumers to pay for goods and services on the high-street, for example.

This is where Tangle technology comes in.

Like Bitcoin, Ethereum and a whole host of other altcoins, Tangle is a system that supports a cryptocurrency known as IOTA – and is specifically designed to handle large volumes of micro-transactions via connected devices.

Therefore, digital wallets on smartphones and other portable devices become more practical.

What Is Tangle Technology?

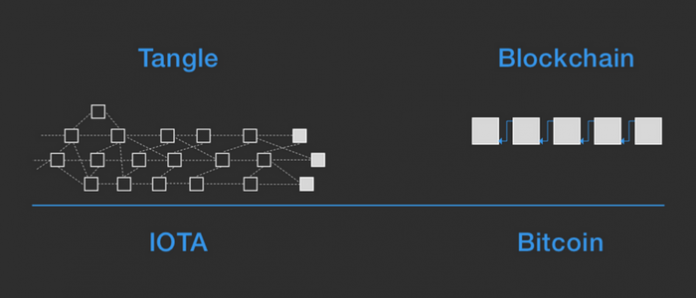

Whereas blockchains rely on validations to authorise payments together with the miners that create public ledgers, Tangle’s data structure is a collection of web-based nodes that work on a Directed Acyclic Graph (DAG) system.

The nodes are connected by “edges” which are not possible to reverse.

Tangle still records data for each transaction which is then registered in a node and validated against two previous transactions via proof of work. This method speed up the verification process so is more practical for real-world use.

Blockchain verifies transactions by cross-referencing all data recorded for that blockchain. The more blocks in a chain, the slower transactions take to validate.

Another significant difference between the functionality of Tangle is that nobody receives a monetary reward. This can be viewed in two ways.

On the one hand, there is no incentive for anybody to maintain and manage the system like there is with blockchain.

The alter argument is that transaction fees are not payable because there is no third party involved.

The field of application is set in the IoT which is an entirely computerised system and does not need human invention whereby a company can charge “admin fees”.

Tangle, therefore, has a financial incentive for end-users and not businesses.

According to the IOTA team, Tangle will resolve a lot of vulnerabilities that exist with blockchain.

Some members of the blockchain community have hit back by declaring Tangle has practical issues and will encounter problems the founders aim to resolve.

Blockchain developers may have a point. After all, they have more experience of tackling obstacles.

We are now into the third-generation of blockchain technologies, and developers are still encountering issues.

So can Tangle deliver on its promise?

Blockchain vs Tangle – The Differences

Transaction Fees

When Bitcoin and other early altcoins were launched, one of the fundamental benefits was low transaction fees. While fees are still significantly lower than standard bank charges, the cost of cryptocurrency transactions has increased.

If banks get their way and gain control of blockchains, expect transaction fees to rise again.

Even without the intervention of financial institutions, the cost of digital transactions will continue to rise on the blockchain.

As the networks grow over time, nodes need more storage capacity which ultimately requires more bandwidth to store transactions added to the ledger.

The founders of IOTA claim there are no transaction fees on the Tangle network. This is not strictly true, as every computer is used as a node and will use more electricity every time you make a digital transaction.

However, the cost of electricity usage will still probably be substantially lower than blockchain fees.

Processing Times

The biggest challenge for blockchain developers at the moment is slow processing times.

Blockchain cannot compete with the mainstream systems that are already in places like PayPal and Visa so. Hence the struggle to convince mainstream adoption of cryptocurrency.

To put it into context, Bitcoin can manage just 7 transactions per second. Ethereum can process 20. Visa on the other handles 1667 transactions per second.

Furthermore, as a cryptocurrency becomes more popular, blockchain transactions become slower as there is more data to validate.

Users that want speedier transactions can pay a higher transaction fee to cryptocurrency exchanges. This is significant criticism of crypto payments and the blockchain community in general.

The system is supposed to be decentralised and endorse low transaction fees, but the cost is gradually rising, and control is becoming more centralised.

Tangle, on the other hand, speeds up when more people join the network because the validation process only requires two previous transactions rather than an entire blockchain.

Not only that, when more people join the Tangle ecosystem, the more secure the process becomes.

Decentralised Financial System

Another feature of blockchain technology that should benefit society is the decentralisation of the financial system.

The overriding idea is that the public ledger supported by a blockchain is not owned by anyone controlling authority such as a financial institution or government.

On closer inspection, this ideal is not strictly right, and the issue raises another vulnerability with the blockchain community.

There is more potential for the system to be exploited, and as we have already seen with the Mt. Gox case and other hacking offences, investors risk losing their money.

At the moment, the majority of blockchains are controlled by a small group of mining companies.

The exception to this are digital coins that have an ACIS-resistant algorithm such as Monero.

These type of coins are mined by shareholders and cannot be monopolised by companies that have invested in expensive mining rigs with immense power to seal blockchains quicker.

Blockchain critics argue that such a small pool of operators give rise to a system that is fundamentally centralised.

At the moment, the companies involved in developing blockchains are open source thus the system is substantially owned by the public and self-regulated by a peer-to-peer network.

Although any discrepancies within a blockchain will immediately be picked up by other influential stakeholders, there is still the potential for mining operators to abuse their privileges.

At the moment, all stakeholders are independent of each other and, in major coins such as Ethereum and Bitcoin, there are plenty of interested parties that make the network function as intended.

There is potential for this to change, however, and if it does, the entire network of end-users can be exploited, i.e. consumers.

Blockchain data shows that 75% of mined blocks are owned by just eight mining pools – six of which are in China.

Thus China is the majority stakeholder of Bitcoins. And the Chinese government has banned exchanges from trading cryptocurrencies.

If the Chinese government bring in laws that declare Bitcoins illegal, they may have rights to cease assets of independent cryptocurrency exchanges.

Although it is unlikely they will hold the world to ransom over Bitcoin, the Red Dragon could dictate codes and supporter cryptocurrency how they see fit.

In other words, higher transaction fees, inflated prices of tokens and hidden gateways for moneymen to launder dirty money.

Although this is pure speculation on the part of the writer, and other commentators in the crypto space, it is no secret that corruption is rife in the upper echelons of society and the puppet masters will not give up their control of power easily – even if they regain control “legally”.

Advocates of Tangle claim their technology will resolve this issue.

Every time a transaction is made with IOTA, everyone in the network participates in the consensus. This means validation is entirely decentralised.

There is no potential for IOTA to be controlled by a monopoly.

Tangle technology inherently promotes stakeholders to act as independent miners.

Thereby the general public is the nodes that communicate with each other in the same way the blockchain protocol is supposed to.

The difference between the two is that Tangle cannot be exploited.

Smart Contracts

A new system made possible by blockchain technology is smart contracts – an agreement between two or more parties that enforce the conditions of the agreement using a cryptographic validation.

A new system made possible by blockchain technology is smart contracts – an agreement between two or more parties that enforce the conditions of the agreement using a cryptographic validation.

If the terms are not met, the transaction is void.

Smart contracts were first patented in 1993, but up until blockchain technology emerged, the idea could not be appropriately executed.

Virtual currencies such as Ethereum and HyperLedger are leading the way for smart contracts to function while Bitcoin was the first digital coin to support standard smart contracts.

Tangle, on the other hand, cannot support smart contracts because transaction orders are subjective to individual nodes and would create uncontrollable forks. Blockchains agree on the order of the blocks, so forks are less conventional.

If IOTA were to use smart contracts, transactions would have to be continuously validated whether they are valid or not.

Thus smart contracts are null and void, and the system collapses. The exclusion of smart contracts doesn’t mean that IOTA and Tangle are not functional as a digital solution, but developers will have to find a way to that makes room for both.

Leading the way with smart contract is Ethereum which allows users to create their smart contracts using a set of computational instructions to determine whether the terms of the contract has been fulfilled.

This will be particularly useful when purchasing goods and services online and offline.

When more than one party is involved, smart contracts can function as ‘multi-signature’ accounts.

Users can even set up transactions that only become available if a certain number of people agree – therefore dispensing with the crippling system of non-refundable deposits.

Smart contracts can also store information. It is, therefore, a useful tool for applications such as company or domain registration, membership subscriptions and protecting intellectual property with copyrights.

Longevity

Technology is moving at such as fast pace; switching systems becomes expensive.

The digital age has effectively wiped out trillions of dollars worth of media in households worldwide.

One of the biggest threats to the cryptocurrency market is that quantum computers will eventually replace blockchain technology.

Quantum computers are already being developed and one day, in the not too distant future, will provide home users with more processing power than modern machines. Quantum computers will do to blockchain what digital downloads did to CD and DVD.

However, Tangle will not be affected by future developments in the tech space.

IOTA uses quantum resistant cryptographic algorithms which, we are told, are immune to quantum projects.

Overall

There is still plenty of time for blockchain to thrive in the next decade or so, but the question arises whether the current protocols are worth pursuing if the technology will soon be retired.

Tangle could resolve many of the issues blockchain developers are struggling to overcome. Despite its advantages, the technology is very new and is yet to prove the claims of its founders.

As cryptocurrency becomes mainstream, it will be interesting to see how the Tangle and Blockchain tussle develops.

For more details on Blockchain vs Tangle read our guide to What Is Blockchain Technology and What Is Tangle Technology.

![Bitcoin Buyer Review of Official Website [2022] bitcoin buyer review featured image](https://bitemycoin.com/wp-content/uploads/2022/04/bitcoin-buyer-review-featured-218x150.jpg)

![Bitcoin Digital | Official Website Review [2022] bitcoin digital review featured](https://bitemycoin.com/wp-content/uploads/2022/04/bitcoin-digital-featured-218x150.jpg)