XRP Slips Below $2 as Ripple Wins Conditional Approval for National Trust Bank

Key Takeaways

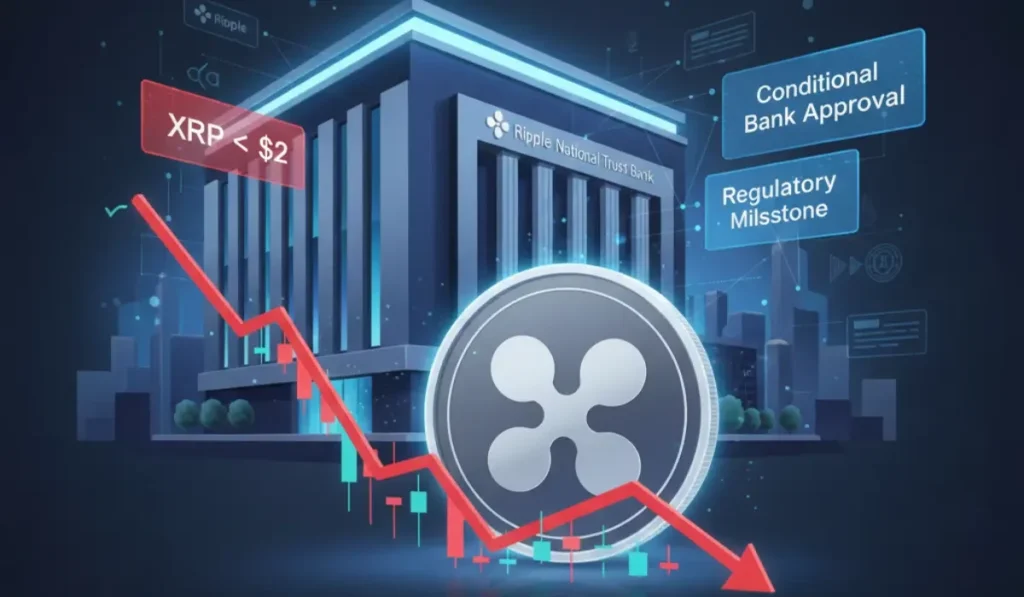

- Currently, XRP is crashing in the cryptocurrency market and has plummeted below $2 psychological level today.

- XRP is trading at $2.02, holding just above the key psychological level after briefly dipping to $1.99 earlier in today’s session.

- XRP’s market crash is attributed to technical weakness, altcoin liquidation pressure, and profit-taking.

- Ripple received conditional approval for its application to establish Ripple National Trust Bank (RNTB) yesterday, fueling the integration of digital assets into the banking system.

XRP, the fourth-largest cryptocurrency by market cap, is crashing in the cryptocurrency market and is trading just above the $2 psychological level today. According to the latest market data, XRP is trading at $2.02, down 0.18% from yesterday’s price. XRP broke below its 30-day SMA ($2.12) and 50% Fibonacci retracement level ($2.18), entering a bearish technical structure. Technical analysis shows that traders exited positions after the $2.10 support level broke, intensifying downward pressure on XRP. XRP’s ongoing bearish momentum is primarily attributed to technical weakness, altcoin liquidation pressure, and profit-taking.

XRP shows mixed-to-bearish signals in the cryptocurrency market, trading below its 50-day and 200-day simple moving averages. Its support level lies between $2.00 and $2.15, acting as a psychological floor for the upcoming surge. If XRP failed to maintain the price range, a drop closer to $1.80 becomes inevitable. ETF inflows and utility growth are substantial factors, but have failed to make a significant impact on the XRP rally. General altcoin weakness and improved Bitcoin dominance are other factors pushing XRP below its market potential. XRP holders remain disappointed as the price lingers below its perceived potential. Despite numerous catalysts and ETF-driven momentum, the token has displayed mixed performance for an extended period. Steve Ball, a Canadian investor, posted on X that he was not a hater and continued to HODL XRP. However, he said he was frustrated with constant hype predicting the token would “moon” soon, only for the price to collapse. He noted that XRP had performed poorly over the past few months and criticized repeated claims of new catalysts that ultimately led to further declines.

Ripple’s National Trust Bank Approval Marks Turning Point for XRP Investors

Crypto giant Ripple has received conditional approval from the Office of the Comptroller of the Currency (OCC) to establish Ripple National Trust Bank (RNTB), a federally supervised trust bank, on December 12, 2025. Multiple crypto firms, including Fidelity Digital Assets, BitGo, and Paxos, have all received approval from the OCC to establish federally chartered trust banks. These firms have received only preliminary approval, with final authorization from the regulator still required before the banks can begin operations. According to the latest reports, if the OCC finalizes legal approval, the agency would permit financial companies to manage and hold customer assets while enabling faster payment settlements.

The OCC released the official news release on December 12, 2025, and stated that the Office of the Comptroller of the Currency (OCC) announced that it had granted conditional approval for five national trust bank charter applications. It stated that, subject to meeting the OCC’s conditions, these institutions would join approximately 60 other national trust banks currently supervised by the OCC. The OCC reported that it had conditionally approved applications for de novo national trust bank charters for First National Digital Currency Bank and Ripple National Trust Bank. It also mentioned that it had conditionally approved applications to convert from a state trust company to a national trust bank for BitGo Bank & Trust, National Association, Fidelity Digital Assets, National Association, and Paxos Trust Company, National Association. The OCC news release stated that.

Ripple Hails OCC Approval as Compliance Milestone; Regulator Cites Boost to Competition

Ripple CEO Brad Garlinghouse said that the company’s conditional approval from the US Office of the Comptroller of the Currency (OCC) to charter Ripple National Trust Bank marked a major milestone. He emphasized that the move set the highest standard for stablecoin compliance under both federal and state oversight, specifically citing the OCC and NYDFS. Garlinghouse added that, despite criticism from banking lobbyists, Ripple was demonstrating that the crypto industry could operate directly under regulatory supervision, prioritizing compliance, trust, and innovation for the benefit of consumers.

Comptroller of the Currency Jonathan V. Gould responded to the preliminary approval and commented that new entrants into the federal banking sector were good for consumers, the banking industry, and the economy. He mentioned that they provided access to new products, services, and sources of credit to consumers and ensured a dynamic, competitive, and diverse banking system. He added that the OCC would continue to provide a path for both traditional and innovative approaches to financial services to ensure that the federal banking system kept pace with the evolution of finance and supported a modern economy.

Also Read: Binance Red Packet Codes Today: Dec 13, 2025, How to Claim? How to Find More Codes?

Crypto & Blockchain Expert