XRP News: XRP Rises as Franklin Templeton’s ETF Launch Ends Seven-Day Losing Streak

Key Takeaways

- XRP, the official cryptocurrency of Ripple, gained 1.3% today, breaking its seven-day losing streak as optimism over ETF developments builds.

- XRP is currently trading at $2.18, eyeing to break above the $2.20 key resistance level.

- Franklin Templeton officially launched its spot XRP ETF under the ticker EZRP on the CBOE on November 18, 2025.

- Three more spot XRP ETFs are set to launch this week: Bitwise will launch its XRP ETF between November 19 and 20 after filing the amendment with the U.S. Securities and Exchange Commission.

XRP ended its seven-day losing streak and finally rebounded on Wednesday, following the launch of Franklin Templeton’s spot XRP ETF. According to the latest market analysis, XRP, the fourth-largest cryptocurrency by market cap, is trading at $2.18, closing down the gap to the $2.20 key resistance level. The recent losing streak was XRP’s longest one since 2023, and the imminent launch of four spot ETFs this week ended the streak that nearly took XRP below the $2 psychological level. XRP’s price recovery is not only because of the renewed ETF optimism, but also due to its ability to defend the $2.10 support level despite the 5.29% drop on Wednesday. According to the market experts, a steady close above the $2.25 price point could invalidate the bearish trend completely and trigger a steady positive momentum in the cryptocurrency market.

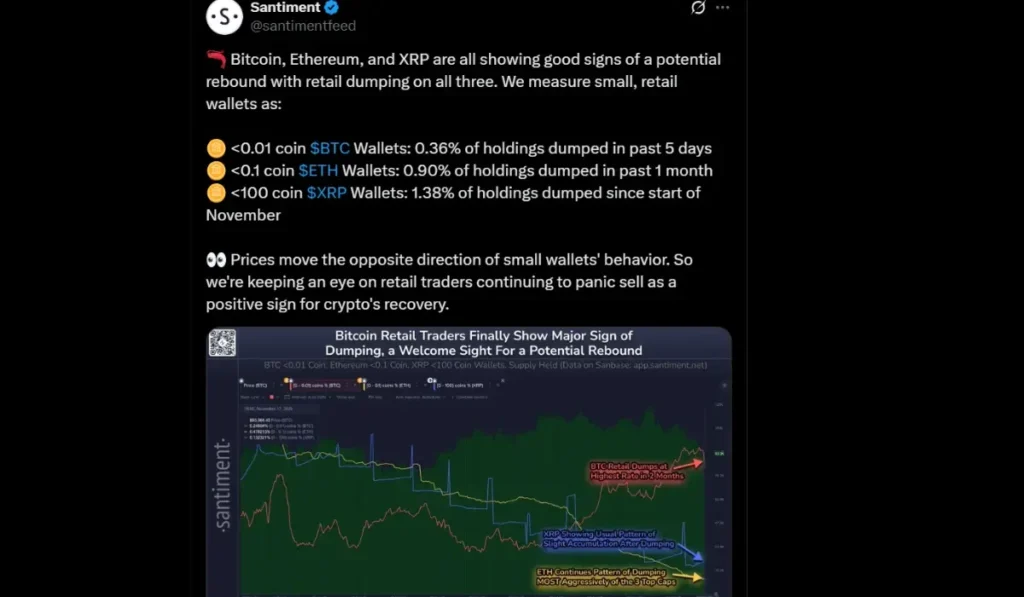

The ETF optimism, dip buying, and the crypto-friendly legislation are some fueling factors for XRP, along with the progress on the United States Market Structure Bill. The broader cryptocurrency market exhibited a short-term bullish sentiment on Wednesday, with prominent coins BTC and ETH demonstrating a price increase of 1.7% and 2.5% respectively. Market intelligence platform Santiment reported that Bitcoin, Ethereum, and XRP were all showing good signs of a potential rebound, with retail dumping on all three. They measured small, retail wallets as: <0.01 coin $BTC Wallets: 0.36% of holdings dumped in the past 5 days, <0.1 coin $ETH Wallets: 0.90% of holdings dumped in the past 1 month, <100 coin $XRP Wallets: 1.38% of holdings dumped since the start of November. They noted that prices move in the opposite direction of small wallets’ behavior and mentioned that they were keeping an eye on retail traders continuing to panic sell as a positive sign for crypto’s recovery.

Canary Capital’s XRP ETF launched last week and attracted $58 million in opening-day volume, surpassing the Solana ETF. This enhanced opening-day volume reflects the deep institutional interest and growing excitement surrounding XRP. Franklin Templeton’s XRP ETF, officially launched on November 18, 2025, under the EZRP ticker symbol, is also a strong catalyst that helped save XRP from the recent sharp price correction. The expert analysis concluded that on November 18, XRP surged to around $2.24, and its trading volume also spiked 70%. Franklin Templeton’s XRP ETF officially launched on the Chicago Board Options Exchange (CBOE), with Coinbase Custody Trust Company, LLC serving as the custodian.

Franklin Templeton’s XRP ETF Could Make A Statement in the Crypto Market!

XRP price surged following Franklin Templeton’s XRP ETF launch on Tuesday, and it is likely to continue its impact on the crypto market. The ETF launched under the ticker EZRP is expected to bring day-one trading volumes between $150 and $250 million, outpacing recent crypto ETF debuts. Franklin Templeton is a $1.6 trillion asset management firm. Its entry into XRP legitimizes the digital asset and gives institutional credibility. The influence it has on the current market sentiment will be crucial because the broader crypto market is struggling, and tokens like XRP, BTC, and ETH are now exhibiting early signs of market recovery. The impact of the spot XRP ETF in this early recovery period will change the narrative of the crypto market and push the digital assets further forward, enhancing institutional adoption.

Jungle Inc Crypto News posted on X that Franklin Templeton’s XRP ETF was poised to make a statement. Analysts projected that Franklin Templeton’s EZRP could hit $150M–$250M in DAY ONE volume, which was as much as 5× the massive debut of Canary’s XRPC ETF. They highlighted why this mattered: Franklin managed $1.53 TRILLION and provided direct access to pensions, banks, RIAs, wealth managers, and institutions, meaning EZRP reached investors who would never touch a crypto exchange. With Franklin entering the arena and several other issuers lining up XRP ETFs, they noted that institutional exposure was widening faster than most people realized. They mentioned that the next few weeks would show whether this demand started to surface or if the real flow was still ahead of them.

Also Read: MSTR Stock Attracts Dip Buyers As BTC Finds Floor at $90K, Lifting MicroStrategy to $210

Crypto & Blockchain Expert