XRP Price Prediction Today — Expert Analysis on Ripple’s Next Move

Key Takeaways

- The market remains stable and sideways.

- The overbought condition could trigger a small bullish run.

- Trading volume has risen to over 25% from the last week

- A green flag for the ETF onboarding could usher in a bull run.

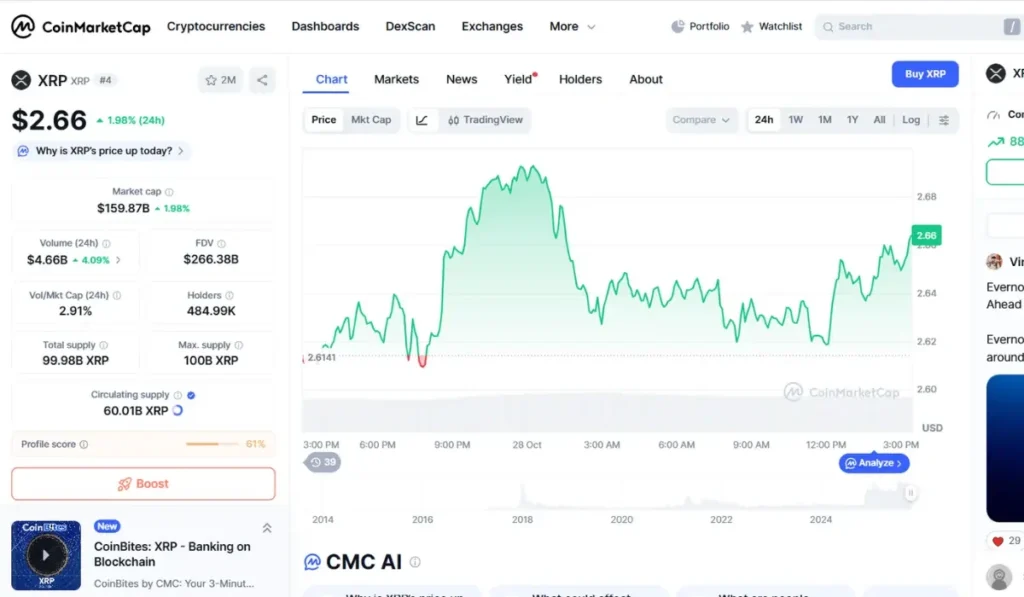

XRP is trading around $2.66. This price indicates certain key data as it is above both Moving averages 20 and 200, while it is below the MA-50($2.766). This implies that XRP price is affected by medium-term resistance; however, the good news is that it has a potential for making a bull run since it has a long-term support indicated by MA 20 and 200.

Image Source: CoinMarketCap

XRP Short-Term Price Prediction

| Month | Minimum | Average | Maximum |

|---|---|---|---|

| October | $2.00 | $2.35 | $2.60 |

| November | $2.1 | $2.55 | $2.85 |

| December | $2.40 | $2.80 | $3.20 |

Analysis of Trading Volume

When looking at the weekly averages of XRP, we see a 26% rise in trading volume. This is an indicator of increasing trader interest and institutional involvement in the XRP market.

The exchange reserves, which are the assets stored within the exchange orderbooks, are showing a decrease. This is an indicator that traders are holding XRP with them in anticipation of a price hike. All of this is without any major institutional news or advancements.

Indicator Analysis Shows Possible Overbought Market

The data that can be collected from momentum indicators remains mixed as of now. While ADX on a one-day chart is indicating the continuation of the trend, MACD is indicating otherwise. This MACD indication of a bearish momentum should be met with caution.

Coming to the Relative Strength Index and CCI indicators, the prices tend to lie in a neutral to bullish territory. With overbought signals being flashed by the Stochastic RSI, a potential warning for a short-term bearish run is on the horizon. However, neither buyers nor sellers dominate the market; however, with a moderate market volatility, the intraday strategy is indicative of succumbing to the selling pressure.

Sideways Market For Coming Days

With all the possible assumptions that can be made using the available technical indicators, it appears that XRP prices are going to fluctuate. The upper level of $2.7472 remains stable, but the lower level of $2.7373 could be broken because of what the indicators have pointed out – an overbought condition.

However, if the lower level can act as a support level, the market may remain sideways oscillating between the said levels for somewhat of few days(approximately 5). The whale inflow, courtesy of the upcoming institutional integration, could mean that the prices are moving sideways because of the lower volatility the market is currently experiencing due to larger holdings in expectation of the XRP ETF onboarding and the consequent bull run.

ETF Onboarding Has an Impact

With the US government shutdown being lifted, hopes for the process of onboarding XRP ETFs seem to be on track again. This could be a major reason why there is an overbought condition in the market.

If this is the case, prices are going to remain stable for the most part, but with a bearish tendency looming around the market. Market updates are key during this time, as a single news can change the way the market operates.

If regulators wave the green flag for XRP ETF, it will add yet another layer of certainty to the asset, boosting its interest in the market. This could trigger a widespread bull run courtesy of massive inflows from various sources. For the time being, however, the market seems to be at its saturated point in anticipation of this event.

This significantly impacts the intraday possibilities of XRP as the market either stabilizes on the current price or goes down slightly due to the existing bearish momentum.

Conclusion – XRP Price Prediction

For the current day’s market, XRP prices may remain largely stable with some minor dip possible due to the market’s overbought condition. As news about the institutional onboarding gets clearer, there is a chance for more investor inflow, and prices could rise once again.

But for today, the market may remain stable and sideways.

| Disclaimer: These crypto price forecasts are based on predictive modeling and should not be considered financial advice. |

Crypto & Blockchain Expert