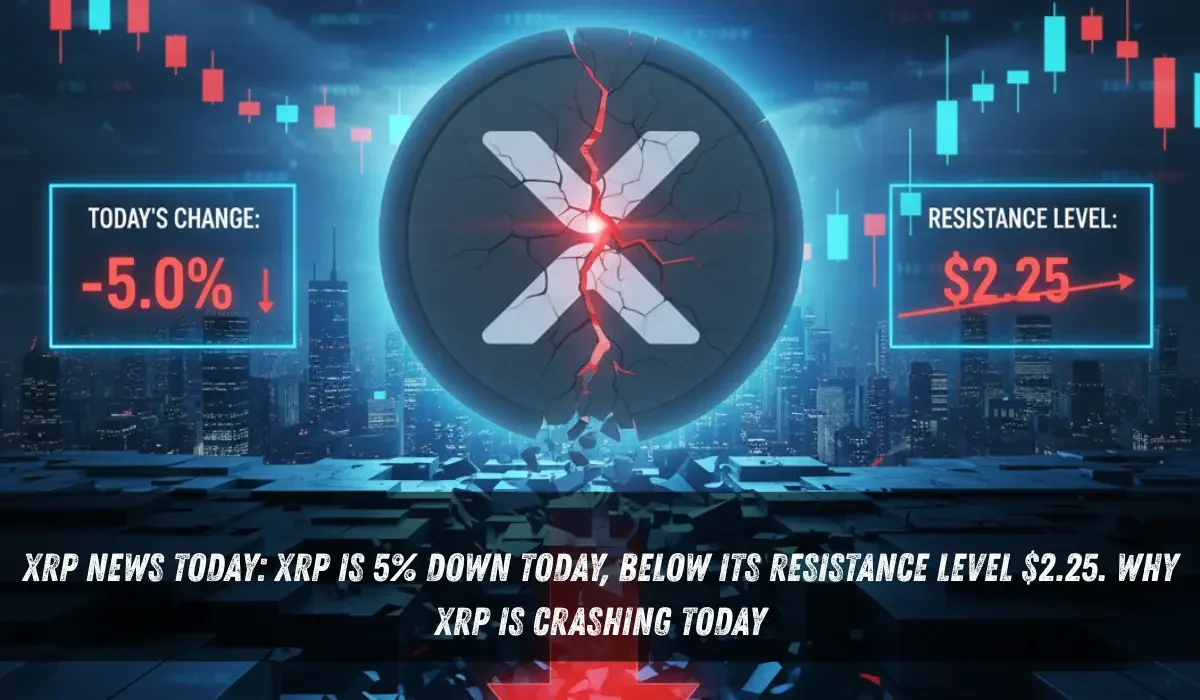

XRP News Today: XRP is 5% Down Today, Below Its Resistance Level $2.25. Why XRP is Crashing Today

Key Takeaways

- XRP is nearly 5% down today and trading below its resistance level of $2.25.

- The fourth-largest cryptocurrency by market cap is trading at $2.24 and shows an extreme bearish momentum in the crypto market.

- XRP fell to its lowest price today and touched $2.08, escaping a steep price correction below the $2 price point with a small margin.

- XRP broke below its critical $2.17 support level today, accelerating selling pressure, indicating that bears are gaining control after the breakdown.

- Experts conclude that XRP’s price recovery could depend on Bitcoin dominance and market sentiment.

XRP price today is $2.24, and the fourth-largest cryptocurrency by market cap is showing a significant bearish momentum and accelerated selling pressure in the crypto market. XRP fell to its lowest price since the October flash crash today and has reached $2.08, barely escaping a deep price correction below the $2 psychological point. XRP’s sharp drop comes along with the price correction of other major cryptocurrencies, including BTC, SOL, and ETH. On November 4, the total market capitalization fell by over 4% to $3.45 trillion. BTC slipped below $102K and is trading closer to hitting $100K again today. Ethereum, on the other hand, is 8.5% down today, whereas Solana is not far from sinking to the $150 price point.

Experts analyze that the broader crypto market weakness, powered by Bitcoin’s 5% decline and overall digital asset sell-offs, is the major reason behind XRP’s downtrend and other altcoins’ recent dip. According to XRP’s technical analysis, the digital asset has breached its support levels, triggering automated liquidations and increasing sell pressure among the investors. As per the latest market analytics, institutional sellings or accelerated whale outflows would create an additional downward momentum and probably take XRP below the $2 psychological level again today.

XRP’s technical chart displays continued weakness or extended bearish momentum. Experts say that the downtrend was mainly due to XRP’s inability to hold above the $2.68 to $2.84 range. They claim that XRP’s immediate resistance is between $2.42 and $2.51, and as long as it trades below this particular price range, further decline cannot be ruled out. XRP is trying to maintain its support level at $2.30, but no signs of positive momentum at the moment. If the native crypto of XRP Ledger falls below the $2 psychological level, the next support levels will be near $1.77 and $1.72, which will be the price points that decide whether XRP price can stabilize or be subject to deeper correction.

XRP Spot ETF Momentum Escalating: Why XRP Is Crashing Today Amid the ETF Updates?

Currently, XRP is exhibiting a significant price correction that has nearly taken it below $2, which is an important dividing line. XRP’s $2 resistance level is a base for a future rebound once the awaited spot ETF launches on November 13 or 14 takes over the driving seat of the crypto market sentiment. The sharp decline XRP faced today or in recent days, despite the accelerated spot ETF momentum, is due to the broader crypto market weakness and Bitcoin’s unprecedented downtrend that took the most precious digital currency below the $100K, for the first time after it reached its all-time high of $126,198.07 on October 07, 2025. According to the market experts, XRP’s market momentum is driven by the broader market and technical dynamics rather than the immediate spot ETF updates and launches.

According to the market experts, XRP spot ETF momentum and new filings are generating enough excitement in the crypto community, but they are not enough to provide a sufficient buying pressure to diminish the current selling pressure. XRP spot ETF updates are in full swing, with multiple firms set to launch their ETF products this month. TheCryptoBasic posted on X that Franklin Templeton had updated its XRP ETF filing, mentioning that the firm had submitted Amendment No. 2 to its Form S-1, which removed the 8(a) language that could delay approval. It was signaled by a Bloomberg ETF Analyst that Franklin Templeton’s XRP ETF launch could be that month. So far, it was noted that Canary Funds, Bitwise Invest, and now Franklin Templeton had updated their XRP S-1s.

The current XRP spot ETF momentum is not making any difference in the short-term price rally. The experts believe that the filings from firms like Canary Capital and Bitwise will generate a significant long-term optimism among the community members. What matters to XRP at the moment is the factors that fuel the fourth-largest cryptocurrency and prevent it from going below the $2 psychological point.

Crypto & Blockchain Expert