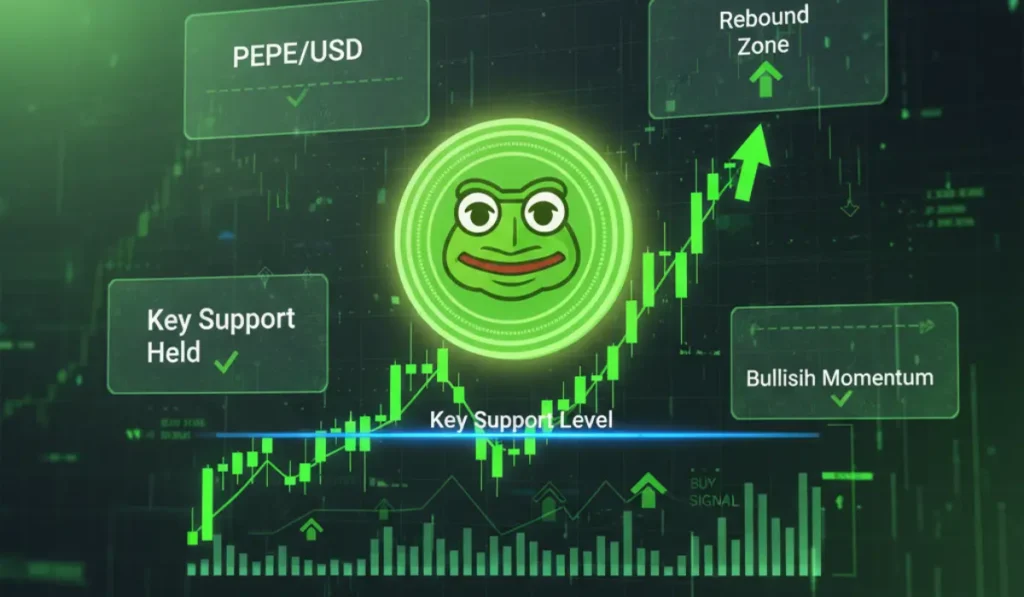

Pepe (PEPE) Price Prediction: Pepe Coin Rebounds From Key Support

Key Takeaways

- The current price of Pepe Coin is $ 0.0₅4311. This piece is forecasted to reach $ 0.0₅3093 by December 23.

- Pepe Coin is currently trading -59.89% below the 200-Day SMA, which is $ 0.00001071.

- Pepe Coin shows mixed whale activity in late 2025, with recent accumulation against the earlier profit-taking pattern.

- There has been limited direct institutional involvement in Pepe Coin, primarily through large-scale whale transactions rather than traditional funds.

- Slower Federal Reserve rate cuts and slowing growth at 1.5% have reduced liquidity for volatile assets such as Pepe Coin.

Pepe Coin Current Market Scenario

Pepe (PEPE) coin has shown a recent rebound from key support levels around $0.000004, trading at approximately $0.00000431 with a 3.36% daily gain.

- Market Sentiment: Bearish

- Fear & Greed Index: 16 (Extreme Fear)

- Supply Inflation: -0.01% (Low)

- Dominance: 0.06%

- Volatility: 5.33% (High)

Pepe Coin Price Prediction: Today, Tomorrow, & This Week

The table below shows the expected price of Pepe Coins for the next week, till December 23.

| Date | Price Prediction |

|---|---|

| December 15 | $ 0.0₅4311 |

| December 16 | $ 0.0₅4316 |

| December 17 | $ 0.0₅3872 |

| December 18 | $ 0.0₅3558 |

| December 19 | $ 0.0₅3402 |

| December 20 | $ 0.0₅3314 |

| December 21 | $ 0.0₅3161 |

| December 22 | $ 0.0₅3140 |

| December 23 | $ 0.0₅3093 |

Market Outlook: Technicals, Institutional Activity & Macro Trends

Pepe Coin (PEPE), a meme-based cryptocurrency, currently trades around $0.0000043 with a market cap exceeding $1.8 billion. Recent data shows a modest daily gain of about 3%, though it’s below key moving averages. Volatility of this meme coin also remains high.

Technical Analysis

The price of Pepe Coins has decreased by 81% over the last year. It was outperformed by 99% of the top 100 crypto assets, including Bitcoin and Ethereum, by -78.96% and -77.03%, respectively.

Pepe Coin is currently trading -59.89% below the 200-Day SMA, which is $ 0.00001071. The 14-Day Relative Strength Index (RSI) is at 38.78, which indicates that Pepe is currently neutral and may trade sideways.

The number of green days in the last 30 days is 14, which is 47%. The price of Pepe Coin is currently down -84% from the all-time high. Pepe Coin is currently trading at -14.84% below the cycle high and 8.20% above the cycle low. The 30-day volatility is below 30% and is currently at 5%.

Pepe Coin has high liquidity with a 0.1843 volume to market capitalization ratio. The current market capitalization of Pepe is $1.81B, while the 24-hour volume is $333.15M.

On-Chain Scenario

Pepe Coin shows mixed whale activity in late 2025, with recent accumulation against the earlier profit-taking pattern. Large holders accumulated around 30 billion tokens in early December despite price declines. Top 100 wallets increased holdings by 3-4% over 30 days, while some whales boosted positions by nearly 13%.

However, there were no protocol upgrades or network changes reported for PEPE.

Institutional Activity

There has been limited direct institutional involvement in Pepe Coin, primarily through large-scale whale transactions rather than traditional funds. There are no established crypto ETFs for Pepe Coins. Exchange listings on Binance and Coinbase enable easier access for institutions to Pepe Coins. The price rise for the coin depends on short-term hype than on institutional activities.

Macroeconomic Factors

Tight monetary policy considerations and the larger geopolitical issues have had a long-standing impact on Pepe Coin’s price performance. Slower Federal Reserve rate cuts and slowing growth at 1.5% have reduced liquidity for volatile assets such as Pepe Coin. Global liquidity under a weak dollar is favoring Bitcoin over altcoins like PEPE. Ongoing conflicts in Ukraine and the Middle East have heightened a risk-aversion mindset among investors, pushing investors toward safer assets and amplifying meme coin sell-offs.

The Bottom Line

Pepe Coin (PEPE) has shown signs of rebounding from key support levels around $0.0000040 in mid-December 2025, with the token climbing to $0.00000438-$0.00000441. This stabilization follows weeks of declines and is supported by reduced exchange reserves. Whale accumulation and the rising demand for altcoin amidst the federal rate cut have been reasons for this increased support. However, investors should not ignore the volatility persisting in the market, which is driven by sentiment rather than fundamentals.

Disclaimer: These crypto price forecasts are based on predictive modeling and should not be considered financial advice.

Also Read: Aevo DeFi Loses $2.7M in Oracle Manipulation Attack on Options Vault

Crypto & Blockchain Expert