Japan Exchange Operator Looks to Set Rules to Limit Crypto Holdings by Listed Companies: Report

Key Takeaways

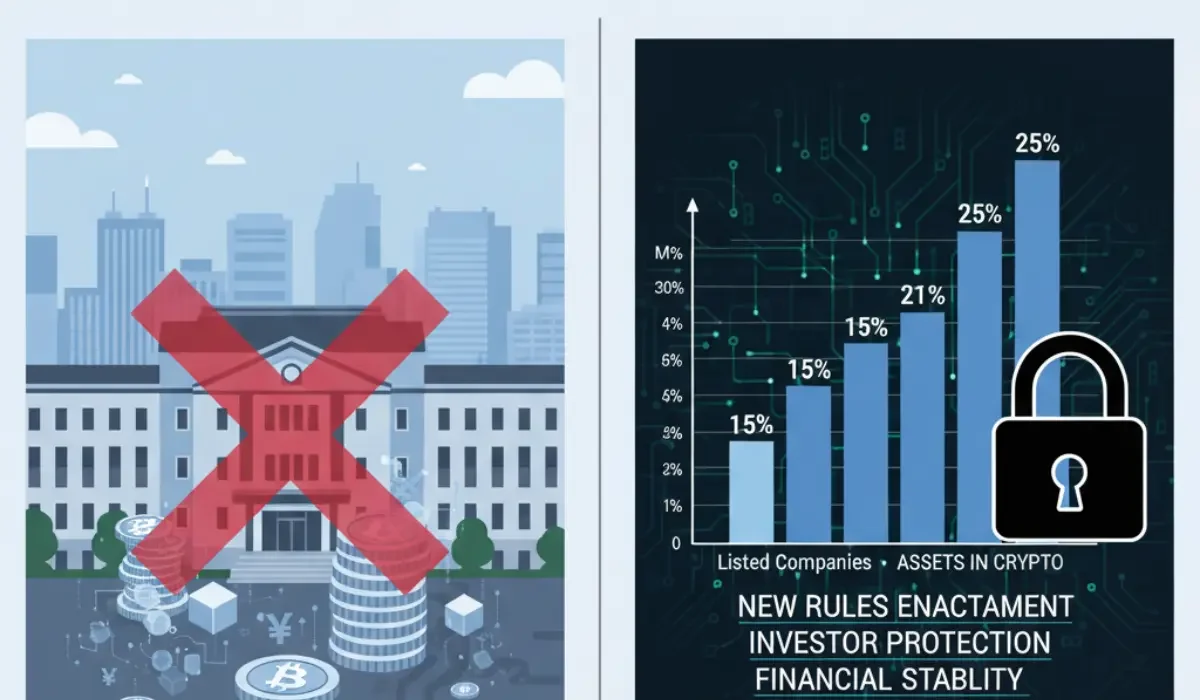

- JPX, the Tokyo Stock Exchange regulator, is considering strict rules to prevent backdoor listing to prevent firms from rebranding or pivoting into digital asset treasuries without following the proper procedures or listing on initial public offerings (IPOs).

- It intends to monitor companies that have risk management and governance concerns, thus protecting the investors and shareholders.

- JPX’s strict audits and regulatory moves may have far-reaching implications on stock exchanges of other Asian countries, as the number of companies holding cryptocurrencies in their balance sheet is increasing.

- There are also chances that an international consensus will emerge in handling such matters.

Japan Exchange Group (JPX) is searching for new ways to bring in listed companies that accumulate large cryptocurrency holdings as a core corporate strategy. With this move, JPX is planning to protect the integrity of the investors and preserve the market from significant volatility and losses faced by retail investors.

JPX’s Considerations

The key considerations that JPX is looking into include:

- JPX is considering strict rules to prevent backdoor listing to prevent firms from rebranding or pivoting into digital asset treasuries without following the proper procedures or listing on initial public offerings (IPOs).

- The firm is considering conducting re-audits on crypto holders to check the valuation and custody of crypto assets.

- JPX is checking out the implementation of rules and regulations to assess these firms’ ability to raise capital through equity and debt markets.

All these checks and laws are implemented to counter the systemic risks associated with companies that are planning to convert their balance sheets to crypto assets. The timing of these implementations is important, as Japan is now the largest economy with the largest number of Bitcoin-buying companies.

The rules are currently under consideration and have not been officially confirmed. However, the trends are signalling a possible tightening of the regulatory environment for listed crypto-holding companies in Japan. It is expected that other Asian countries will follow suit and take adequate measures to protect ordinary investors and ensure robust corporate governance.

Implications of JPX’s Move

JPX’s strict audits and regulatory moves may have far-reaching implications on stock exchanges of other Asian countries, as the number of companies holding cryptocurrencies in their balance sheet is increasing. JPX is moving forward with clear principles and enforcement related to corporate governance and internal investigations. This will clearly be a norm of precedence for other exchanges.

Such audits will force companies to make fair disclosure of their assets and reduce hoarding of cryptocurrencies, which will have a negative impact on the market. Thus, the interests of retail crypto investors will be protected. Stock exchanges of other countries have shown a tendency to adopt or adapt guidelines and compliance measures initiated by major exchanges like JPX. This will be particularly useful when issues involve financial reporting transparency and risk management. There are also chances that an international consensus will emerge in handling such matters.

The Bottom Line

Japan has been an innovator in crypto-related areas, and other countries have followed suit. Crypto is a sector that needs regulations and constant monitoring, but without disrupting its decentralized nature. JPX’s initiatives will have far-reaching implications on the policies of other countries, too.

Also Read: Taiwan Considers Adding Bitcoin to National Reserves in Policy Shift

Crypto & Blockchain Expert