Crypto Market Liquidations Near $2 Billion As Bitcoin Drops Below $82,000 For First Time Since June

Key Takeaways

- $1.97 billion in leveraged positions were liquidated across the crypto market in 24 hours, as Bitcoin (BTC) dropped below $82,000 and Ethereum (ETH) fell under $2,900 for the first time in nearly 6 months. The total crypto market cap has dipped below $3 trillion.

- Leveraged longs represented $1.78 billion, while shorts accounted for $129.3 million of the liquidations, which resulted in nearly 400,000 traders closing their positions. $960 million in BTC, $52.27million in ETH, and $98.18 million in SOL are at a loss.

- Analysts suggest that the primary driver of today’s losses comes from leveraged whale positioning. The crypto market has lost $1.3 trillion in overall value since last month, but there have been little to no bearish fundamentals.

- Though the Crypto Fear and Greed Index lies in the “Extreme Fear” zone, bullish catalysts like the end of the Fed’s QT cycle, spending resumption by the U.S government, and the potential $2,000 tariff dividend by the Trump administration are yet to be at play.

The ongoing rout across the cryptocurrency market continued on Friday, as nearly $2 billion was liquidated over the past 24 hours. This has resulted in the total crypto market capitalization dropping below $3 trillion for the first time since June 2025.

The decline was triggered by Bitcoin (BTC) – the alpha cryptocurrency – shedding nearly 10% of its value in 24 hours to an intraday low of $81,868, which further amplified the monthly downtrend.

Crypto Market Cap Falls to $2.9 Trillion as $1.97 Billion in Leveraged Positions were Liquidated in Under 24 hours

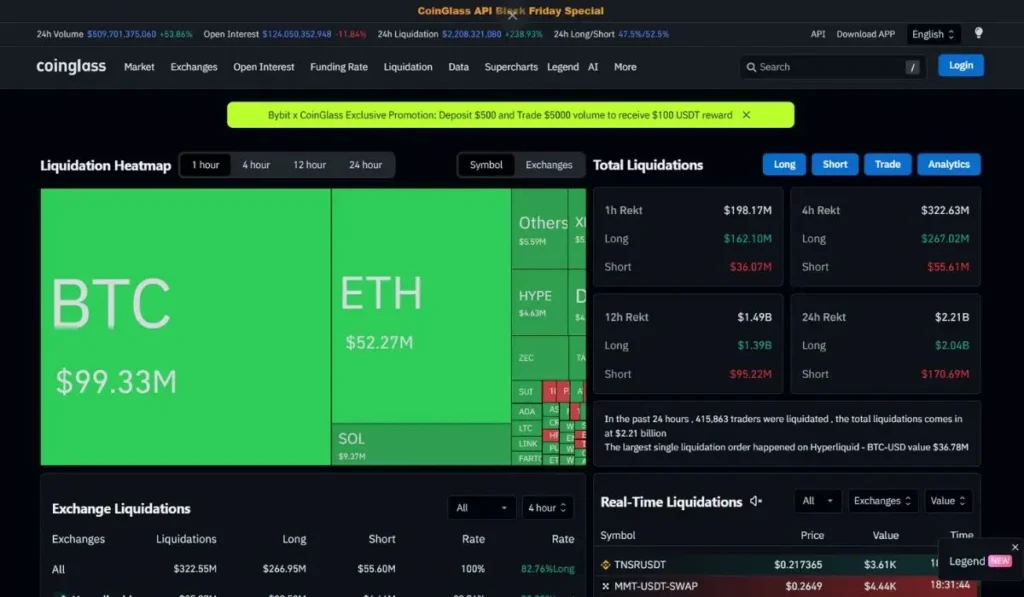

According to data from CoinGlass, total crypto liquidations hit $1.98 billion over the past 24 hours, with 391,164 traders forced to exit their leveraged market positions. The top 10 cryptocurrencies by market cap, bar stablecoins, have posted double-digit losses during that time.

BTC led the liquidation chart at $990 million, with $929 million of that total stemming from long positions. Ethereum (ETH), the second-largest crypto by market cap, followed with $52.27 million, with leveraged longs accounting for $183 million of the losses. $98.18 million was liquidated in Solana (SOL), with longs contributing $56 million.

Leveraged longs represented $1.78 billion of total liquidations, while shorts accounted for just $129.3 million. The single-largest liquidation event occurred on the decentralized perpetual exchange Hyperliquid, where a BTC-USD position worth $36.78 million was closed.

While the broader bearish market sentiment stems from macroeconomic and geopolitical uncertainties, today’s drop is more localized, potentially driven by leveraged whale positioning in the market.

One whale investor has suffered $37 million in unrealized losses on his BTC and ETH long positions. The trader’s profits dropped from $63 million on November 10 to just $4 million as of Friday, a 93% decline in 10 days.

Leveraged Whale Position Exits Piled Downward Pressure on Crypto Prices

Blockchain analytics platform PeckShieldAlert reported in an X thread that several major whales were liquidated after ETH fell below $2,900, with individual losses in the crypto ranging from $2.9 million to $6.52 million.

Meanwhile, Lookonchain reported that high-profile crypto trader, Jeff “Machi” Huang, who has deposited $6.96 million in USDC on Hyperliquid since the October 11 market crash to long ETH and XRP, has suffered a total loss of $20.23 million, with his account now down to a balance of only $15,538.

He had deposited $115,000 in USDC to support his long position only hours earlier. In late September, Huang’s total profits stood at $44.8 million. He has suffered nearly $650,000 in losses over the past 24 hours.

Andrew Tate, who had opened two BTC longs today, was liquidated in under an hour. The millionaire social media influencer has been liquidated 84 times in total on Hyperliquid.

This massive sell-off event comes as the total crypto market cap dipped over 6% in the past day to $2.9 trillion. Market analytics platform The Kobeissi Letter emphasized that the sector has lost $1.2 trillion in value since early October, claiming that this is “one of the fastest-moving crypto bear markets ever.”

The Kobeissi Letter suggests that the “mechanical bear market” was caused by heavy leverage and sporadic liquidations, as traders were forced to sell with prices dropping fast, which created a feedback loop of downward pressure.

However, the analysts noted that throughout the course of the 45-day bear market, there have been little to no bearish fundamental developments.

“The market is efficient; it will iron itself out,” the X post read.

Crypto Market Could Reverse Losses as Key Liquidity Catalysts are Yet To Play Out

The Crypto Fear and Greed Index remains at “Extreme Fear” levels, but Derek Lim, head of research at Caladan, told crypto media outlet Decrypt that the current market activity does not align with key economic indicators.

He argued that market liquidity boosting catalysts, such as the end of quantitative tightening by the Federal Reserve, the end of the U.S. government shutdown and resumption of its spending, and a potential $2,000 stimulus package announced by President Trump, are still at play.

The analyst noted that these factors will take time to influence market sentiment, creating a scenario where the market has yet to catch up to what experts view as strong economic fundamentals.

Crypto & Blockchain Expert