Bitcoin (BTC) Mining Energy Consumption & Trading Strategies: Top Signals to Look For

The increase in competition through higher participation in the pools and the use of advanced devices has made Bitcoin mining an intensive process that demands exponential energy consumption, which is again raising concerns about its environmental impact.

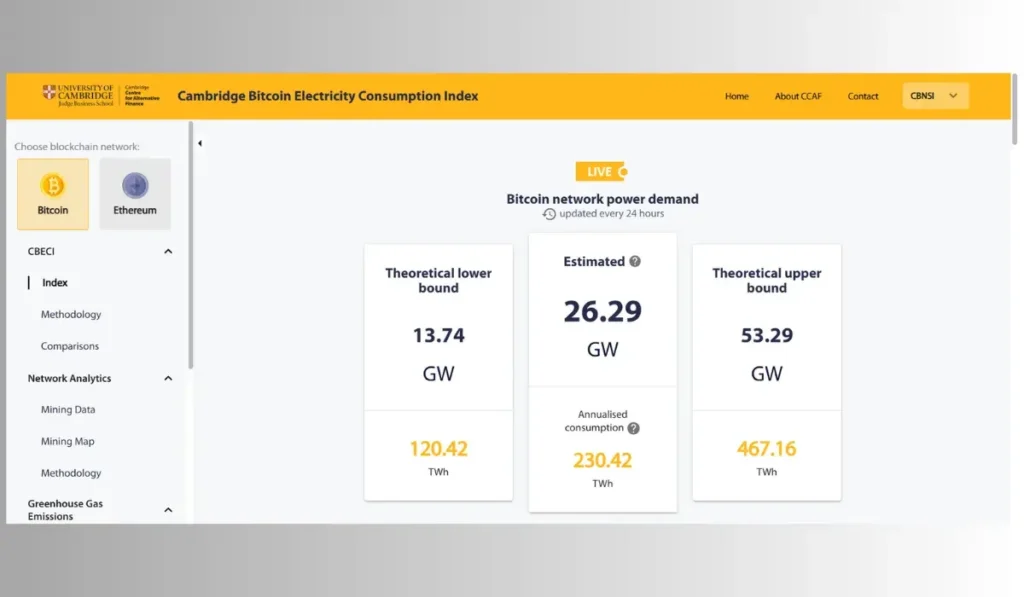

According to the Cambridge Bitcoin Electricity Consumption Index (CBECI), Bitcoin’s current energy consumption is estimated to be 121.22 TWh, with an annualized consumption of 231.13 TWh.

Since the energy consumption of Bitcoin is a critical factor that affects its price movements, professional traders and investors need to understand how to navigate the market in accordance with the changes in mining techniques, hashrate, climate, power costs, and regulatory frameworks.

This article delves into the details of Bitcoin mining’s impact on both the environment and its own charts, providing major long-term trading strategies that one can employ.

Additionally, it details the complex connection between Bitcoin’s price and the environmental issues.

How Does Bitcoin’s Mining Energy Consumption Influence Its Price?

Bitcoin mining’s energy consumption influences BTC’s price in multiple ways, primarily in connection to the environmental impact of the process. Out of 21 million total supply, around 1.06 million Bitcoins are left to be mined, a process which will likely end by 2140. The massive energy required for this has already been a global concern, resulting in shifts in regulatory frameworks and the detachment of investors, which creates price fluctuations.

- Energy Concerns: Bitcoin’s annual electricity consumption of 231.13 TWh is greater than the total energy consumption of various industrialized nations. Also, it is significantly higher than the consumption of major tech companies such as Google (12 TWh) and Meta (5 TWh). If more miners are unable to shift to renewable energy, we will see detachment from both institutional investors and retail traders.

- Regulatory Risks: The Environmental impact of Bitcoin has resulted in a ban on Bitcoin mining by various countries. In 2021, China announced a complete ban on all crypto mining, citing environmental concerns as the primary reason. If Bitcoin continues to have high carbon emissions, we can expect strict regulations from various governments in the future.

- KOL Influence: Key Opinion Leaders (KOLs) who have environmental concerns can also influence the charts of Bitcoin. Elon Musk’s 2021 decision to suspend the use of Bitcoin for Tesla purchases due to the asset’s dependence on coal and other fossil fuels for energy was a major triggering point for the bear market.

- Price Surge: While energy consumption influences the price, the reverse also occurs. Bitcoin achieved its all-time high of $126,198.07 two weeks ago, and this has increased the mining activity due to increased on-chain activity and higher returns. Historically, BTC’s energy consumption increases in parallel with the price surge. However, the costs for higher energy consumption usually reduce the profit margin.

Top Bitcoin Trading Strategies in Relation to Mining Energy Consumption and Its Environmental Effects

Expert traders are keen on Bitcoin’s environmental impact due to the effect it has on the charts. Top strategies a trader can employ in relation to BTC’s mining energy include staying updated with regulatory frameworks, referring to academic research, looking for opinions from key people related to Bitcoin, studying on-chain data, and observing the power costs. Let’s delve into the details.

Stay Updated With the Regulatory Frameworks

As we covered in the above section, shifts in regulatory frameworks have a broader impact on the cryptocurrency market. So, professional Bitcoin traders should monitor the environmental laws as well as crypto laws. U.S. traders can track federal actions, state-level policies, and federal agency reports.

The Trump administration in the U.S. has been seriously studying Bitcoin’s environmental impact in relation to the government’s motto to make America the crypto capital of the world. The proposed mining-related bills could suspend mining operations that are unable to meet the clean energy standards. Agencies such as the U.S. Office of Science and Technology Policy (OSTP) and the Environmental Protection Agency (EPA) have published various reports that assess the climate impact to rework the current regulations.

Delve Into the Academic Research

Academic research is a key area that traders often ignore while forecasting their Bitcoin movements. While many Bitcoin price predictions delve only into the surface of the iceberg, papers that result from years of academic research by scholars can provide deep insight into the Bitcoin market.

Various universities and private parties have studied the environmental impact of Bitcoin, helping traders to understand what the true picture is and how to navigate the space with a long-term plan. A good starting point for academic papers is Google Scholar, in which you will be able to find the latest research on Bitcoin and its effects on the environment.

Look For Signals From the Key Opinion Leaders

As we pointed out earlier in the Elon Musk example, key opinion leaders have the power to drive the market with their remarks. Follow scholars on Bitcoin’s environmental impact who can provide deep insights and create an impact on the market as well.

Some notable KOLs other than Elon Musk include Alex de Vries, who tracks Bitcoin’s energy use and e-waste, and Kaveh Madani, who led a UN-driven study that focused on Bitcoin’s broader environmental costs, Michel Rauchs, a Cambridge research scholar who developed the Bitcoin Electricity Consumption Index, Joshua Rhodes, research scholar at the University of Texas, and George Kamiya, energy analyst at the International Energy Agency (IEA).

Study On-Chain Data Such as Hashrate, Block Rewards, & Network Difficulty

Since Bitcoin’s energy consumption is directly related to its block rewards, hashrate, and the network difficulty, it is important to track these factors to understand the market scenario. The block reward, which is currently at 3.125 BTC per block, has increased the mining activity due to the price increase. Since only one miner wins the reward per block in this Proof-of-Work consensus mechanism, other participants are literally wasting energy.

This environmental harm is a major concern, and it increases with the price increase, which will eventually lead to action from the authorities.

The surge in trading activity increases the total network hashrate of Bitcoin, which represents the total computational power used by the network. Higher hashrate means higher electricity consumption, which will start creating concerns, especially from governments, scholars, and environmental activists. Additionally, the increase in the network difficulty, the measurement of how hard it is to mine a new block, can also increase the power consumption.

Concluding Thoughts: Is Mining Energy Consumption a Major Factor That Determines Bitcoin’s Price?

Bitcoin’s relationship with the environment is complex and requires detailed analysis to understand how the correlation influences BTC’s price movements. While the price increase boosts the energy consumption that causes climate concerns, it can also detach investors, which will eventually result in a bear market. However, miners can make the process of mining less influential on the price by using renewable energy. If the power consumption is less, Bitcoin’s price will be driven primarily by speculative trading, use cases, adoption trends, and other macroeconomic factors rather than environmental issues.

Finally, the strategies listed above are only for educational purposes and are intended for long-term holders of Bitcoin rather than day traders.

If you are interested in the Bitcoin market’s relationship to the environmental factors, try to increase your knowledge by doing your own research, so that you can build trading strategies that suit your unique goals. Always DYOR!

Also Read: Is Bitcoin Mining Profitable In 2025?

Crypto & Blockchain Expert