Best Cryptos To Buy Now For Big Gains: $HIFI, $PEPE, $SLAY

The cryptocurrency market rose 1.56% in the last 24 hours, extending its weekly gains by nearly 7%. This upward momentum is attributed to improving investor confidence and risk sentiment as altcoins gain momentum over Bitcoin and institutional inflows surge.

According to our analysis, the best cryptos to buy now are: HiFi Finance (HIFI), Pepe ($PEPE), and SatLayer ($SLAY). These alts are rallying on the back of catalysts such as altcoin rotation, exchange listings, whale accumulation, and bullish technical signals.

Today’s Altcoin Season Index reading of 69/100 suggests that alts are outperforming Bitcoin. BTC dominance fell 0.89 percentage points to 56.6%, while the altseason index is up 64% month-over-month, signaling capital rotation from BTC to alts, largely driven by Ethereum ETF inflows and the growth of the Solana ecosystem. Traders are diversifying into altcoins, seeking higher beta plays, as Bitcoin consolidates near $113,000.

Tether minted $2 billion USDT this week, while Circle created $5.9 billion USDC, which boosted market liquidity. This was fueled by the September Fed rate cut odds hitting 97%, and risk appetite favoring alts like BNB, XRP, SOL, and ETH. Watch for the BTC dominance threshold at 50%, as a break below could signal a broader altseason. The Federal Reserve’s September 18 meeting is also crucial because a rate cut could extend the capital rotation, but hawkish signals might trigger profit-taking.

3 Best Cryptos To Buy Now (09/13): $HIFI, $PEPE, $SLAY

| Token | 24h Performance | Market Cap / Liquidity | 2025 Price Forecast (Min / Avg / Max) | Risk Level |

|---|---|---|---|---|

| Hifi Finance (HIFI) | 🚀 +656% | $88M market cap, turnover ratio 7.64x | $0.298 / $0.348 / $0.486 | ⚠️ Very High (pump-risk, correction likely) |

| Pepe Coin (PEPE) | +13.17% (24h), +23.8% (7d) | $1.33B 24h volume, OI $606M | $0.00000829 / $0.00000929 / $0.00001203 | ⚠️ High (whale-driven, leveraged longs) |

| SatLayer (SLAY) | +29.18% (24h) | $38.7M 24h volume, turnover 2.95x | $0.0199 / $0.0223 / $0.0289 | ⚠️ Medium-High (fragile confidence, down 39% in 30d) |

1. Hifi Finance (HIFI)

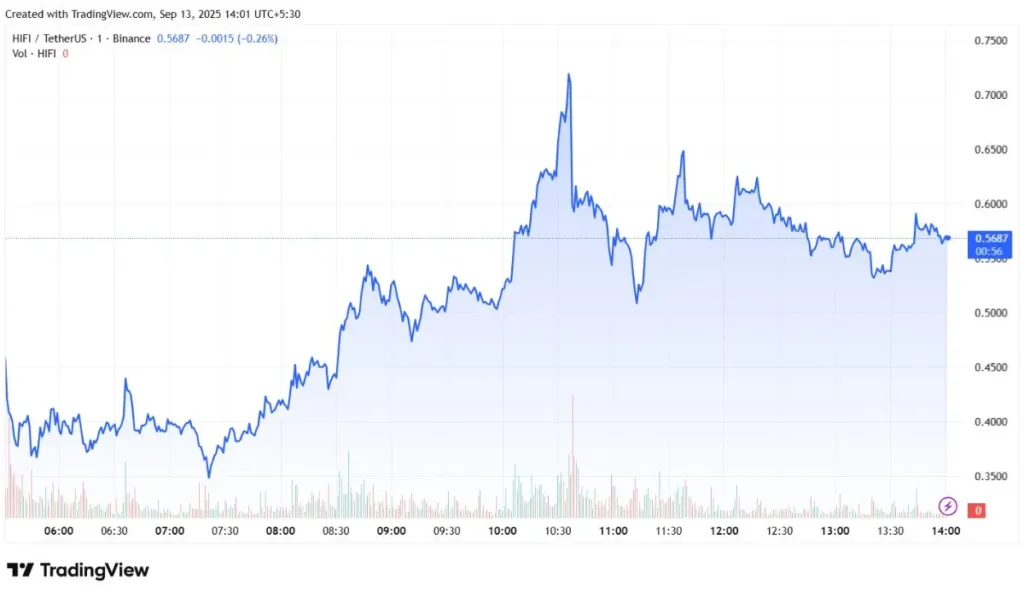

HIFI surged 656% in 24 hours, outpacing the broader crypto market’s growth. Its rally was driven by macro liquidity shifts, altcoin rotation, and positive technical momentum.

HIFI has reclaimed its 200-day SMA at $0.1839, while its 14-day RSI spiked from oversold conditions in the 30 range to an extreme overbought level at 92.7, and MACD histogram hit its strongest bullish divergence since May. The rally started as a short squeeze after prolonged undervaluation and was amplified by stop-loss triggers and momentum traders chasing volatility. High turnover ratio of 7.64x confirms speculative activity. Traders need to look out for RSI14 above 90, which historically precedes 30-50% corrections. The 38.2% Fibonacci retracement at $0.53 now acts as near-term support.

The Altcoin Season Index hit 69/100, with HIFI’s weekly gains beating 95% of the top 500 cryptocurrencies by market capitalization. This means investors are rotating capital from Bitcoin into high-risk/reward alts. HiFi’s low market cap of $88 million, compared to its trading volume, makes it vulnerable to pumps but also responsive to sentiment shifts.

Meanwhile, the U.S. money market funds hit a record $7.26 trillion, with analysts predicting that a Fed rate cut could redirect capital to risk-on assets like crypto. HIFI stands to benefit from a narrative proxy, with its 2025 lows coinciding with peak Treasury yields, while the current rally aligns with declining traditional yields.

| $HIFI Market Price | Minimum Price (2025) | Average Price (2025) | Maximum Price (2025) |

| $0.6833 | $0.2984 | $0.3485 | $0.4866 |

2. Pepe Coin (PEPE)

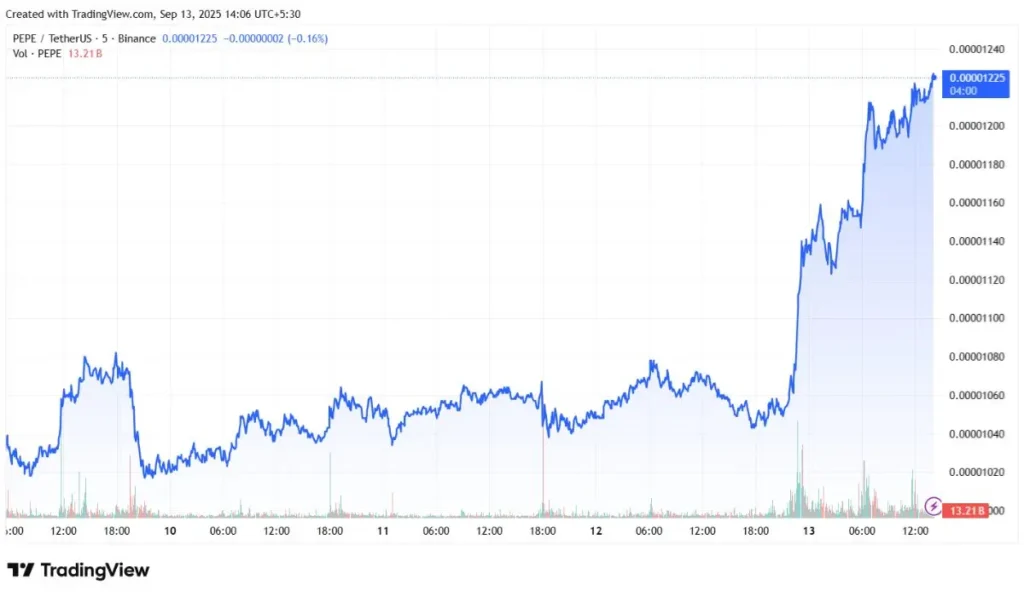

PEPE rose 13.17% over the last 24 hours, outpacing the broader crypto market’s 1.45% gain. This move aligns with a 23.86% weekly surge but remains down 2.69% monthly. The key catalysts behind the rally include positive technical breakout, memecoin rotation, and increased whale activity.

PEPE broke above its $0.00001132 resistance level on September 12, triggering a cascade of buy orders. Its price is now testing the 23.6% Fibonacci retracement level at $0.000011826, with the 7-day RSI at 80.08 signalling overbought conditions in the short-term. This breakout confirms a bullish ascending channel, with traders targeting $0.00001350 – $0.00001400. However, the 200-day EMA at $0.000011284 acts as a dynamic support, as a close below could invalidate the uptrend. Sustained daily trading volume above $1.38 billion and a positive MACD histogram will be key to extending the rally.

PEPE’s 24-hour trading volume spiked 143% to $1.33 billion, outperforming 93% of the top 100 cryptocurrencies. Retail traders are chasing memecoins amid neutral market sentiment, as reflected by the Fear & Greed Index reading of 53. Binance South Asia offered a voucher campaign to boost PEPE’s market accessibility. Watch for a drop in BTC dominance below 55%, which could further extend altcoin rallies.

PEPE futures open interest rose 10% to $606.59 million, while whales have accumulated 4.02 trillion tokens since August. Large-scale holders are positioning themselves for extended gains, but funding rates are showing a market dominated by leveraged longs, increasing liquidation risks if the ongoing momentum stalls.

| $PEPE Market Price | Minimum Price (2025) | Average Price (2025) | Maximum Price (2025) |

| $0.00001199 | $0.00000829 | $0.00000929 | $0.00001203 |

3. SatLayer (SLAY)

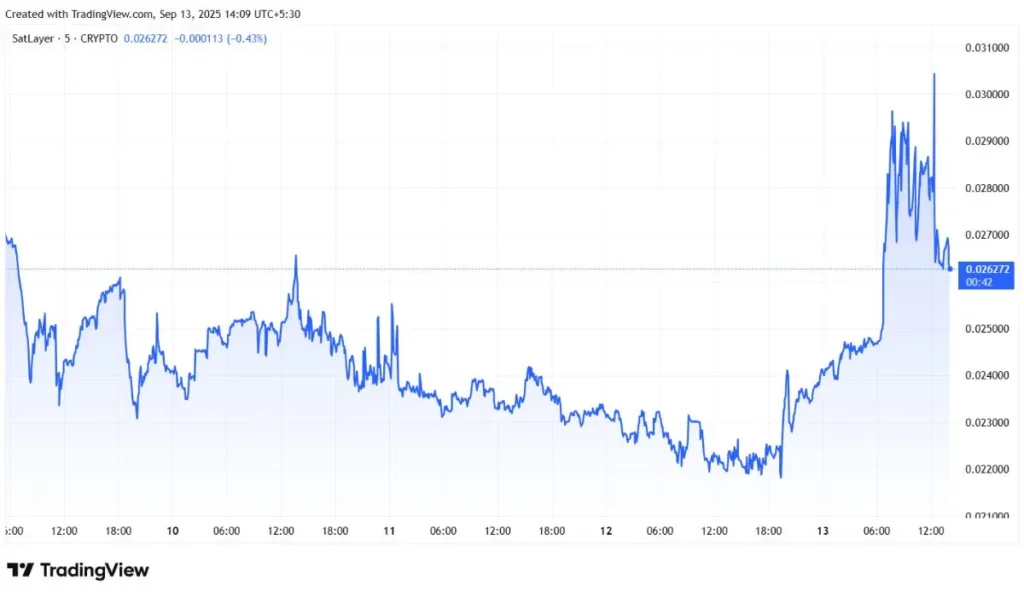

SLAY surged 29.18% in the past 24 hours, outpacing the broader crypto market’s 1.03% gain. Key drivers behind the rally include exchange listings, airdrop incentives, and technical momentum.

SLAY’s price broke above its 7-day SMA at $0.025 and 30-day SMA at $0.26, with RSI14 at 39.08 lying below overbought thresholds. Traders may interpret this as a bullish divergence, especially with the 24-hour trading volume surge confirming upward momentum. The nearest Fibonacci resistance is at the 38.2% retracement at $0.0358. SLAY must hold above $0.028 if Bitcoin retests the $122,000 resistance.

Toobit exchange listed SLAY for spot trading on August 12, expanding SatLayer’s access to retail traders. The token’s 24-hour trading volume spiked 7.04% to $38.7 million following the launch, with a turnover ratio sitting at 2.95x, indicating high liquidity demand. New listings often trigger short-term buying pressure as traders front-run perceived liquidity inflows. SLAY’s surge coincides with its market position as a re-staking protocol for BTC, aligning with the Altcoin Season Index’s 70/100 reading.

On August 14, Binance Alpha announced an airdrop for the OVL token, which was allocated to users holding 200+ Alpha Points. While OVL is not linked to SLAY, it drove attention to BNB-linked platforms like SatLayer, spurring cross-platform activity. However, SLAY’s 30-day price remains down 39.66%, suggesting fragile investor confidence. Watch for post-airdrop sell pressure if participants start to rotate capital.

| $SLAY Market Price | Minimum Price (2025) | Average Price (2025) | Maximum Price (2025) |

| $0.02804 | $0.019937 | $0.022332 | $0.028939 |

Final Thoughts on Best Cryptos to Buy Now

The rallies of today’s best-performing cryptocurrencies – $PEPE, $SLAY, $HIFI – can be attributed to the broader altcoin market outperforming Bitcoin.

BTC’s market share fell to 56.55%, while the altcoin season index jumped to its highest level since December 2024 at 70/100. This is reflected by a $166 billion liquidity shift to alts over the past week, largely driven by Ethereum Exchange Traded Fund ETF inflow momentum and Solana’s ecosystem growth, suggesting that traders are rotating profits from BTC into higher-beta alts.

Meanwhile, altcoins comprised 71% of Binance futures daily trading volume, with perpetuals funding rates turning positive for tokens like ETH. Open interest for SOL and XRP futures rose 22% in 48 hours. This means leveraged traders are backing altcoins to extend their gains, though rising leverage increases short-term volatility.

Readers should note that cryptocurrencies are highly speculative and volatile assets, and it is recommended that you conduct proper due diligence and seek expert opinion before making an investment decision. Furthermore, the contents of this article are for informational purposes and should not be construed as investment advice.

Crypto & Blockchain Expert