MDT, SYRUP, And VINE Emerge As The Top Altcoins While Bitcoin Awaits Correction

The crypto market has experienced a sudden dip after rallying for most of July, with the price of Bitcoin (BTC) dropping to the $115,000 range, while Ether fell below $3,598 on Friday. The broader market tumbled as a result of more than $700 million in futures liquidations.

Despite the crash, the Altcoin Season Index has shown significant upward movement. Recent data shows that the index hit 51, up from 38 the previous week, and 16 from June. This suggests a strategic shift in market dynamics where altcoins are starting to outperform BTC, as noted by Bitcoin’s market dominance falling to 61%, its lowest level since March, and the sharpest decline since June 2022.

More than $730 million in Crypto Futures Contracts Liquidated as the Market Takes a Hit, but Altcoins Prevail

According to CoinGlass data, $585.86 million crypto futures contracts were liquidated, with Bitcoin accounting for $140.06 million of that total, followed by 104.76 million in Ether long positions. The sudden market downturn led to 213,729 traders being liquidated, with many caught off guard amid recent bullish sentiment. $731.93 million in short and long positions were wiped out across the board.

While Bitcoins endures a price correction and altcoins prepare for a boom, a few small-cap cryptocurrencies have been making some major moves in the market. Measurable Data Token (MDT), Mapple Finance (SYRUP), and Vine Coin (VINE) have emerged as the hottest trending cryptocurrencies, receiving the most visibility in the last 24 hours. Much of this demand has to do with strategic partnerships and technical indicators surrounding the crypto projects.

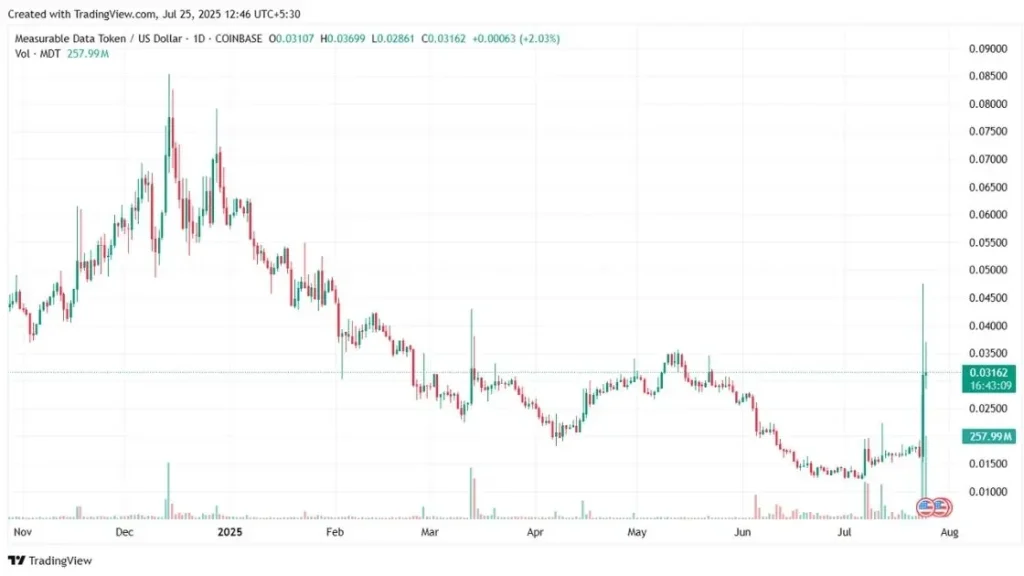

MDT Surges 103% Amid Positive Q2 Performance and Potential World ID Partnership

MDT, the native cryptocurrency of the decentralized data value creation platform Measurable, is currently the best-performing cryptocurrency in the market. The token’s price has grown by 103.18% in the last 24 hours, and is up 127% for the month.

This explosive growth comes on the back of Measurable publishing its Q2 2025 financial report, which showed a 5% growth in revenue, and rumors of a potential partnership with World ID (WLD) that will be announced in September.

According to the quarterly report, the MDT ecosystem brought home a revenue of $1.35 million in the last quarter, thanks to its partnership with some of the largest ride-hailing and food delivery companies in the world. The platform also saw significant growth in users, with more than 130,000 new wallets now holding MDT tokens.

Rumors about an integration with World ID’s decentralized digital identity verification system are also growing strong. The Sam Altman-owned crypto firm is forming partnerships with established brands like Visa and Tinder to expand its user base. Visa is set to launch a World Visa Card later this year that will allow users to spend WLD tokens at merchants across the world. Meanwhile, Tinder will adopt World ID’s personal identity verification system to authenticate users and dating profiles on the app.

At the time of writing, Measurable Data Token (MDT) is trading at $0.0296, up 85.26% in the last 24 hours.

Maple Finance (SYRUP) Trading Volumes Soar Following Listing on Upbit

Decentralized finance (DeFi) platform Maple Finance, which provides crypto lending and borrowing services, primarily targeting institutional players, through secured lending, Bitcoin yield, and other structured products, has seen the price of its native SYRUP token surge 16.22% in the last 24 hours.

This comes after South Korean crypto exchange Upbit announced the listing of SYRUP on its platform in the KRW, BTC, and USDT trading pairs. This opens the door for Maple Finance to the country’s $160 billion crypto market, and one of the world’s strongest DeFi economies. The exchange also launched a 228,000 SYRUP prize pool, worth $130,000, and a $6,666 “super jackpot” promotion, which drove retail FOMO for the token and triggered a surge in its trading volume, which hit $768 million, with Upbit accounting for 62% of global SYRUP trades.

Meanwhile, the Maple Finance community is currently voting on the MIP-018, which proposes increasing protocol revenue allocated to SYRUP token buybacks from 20% to 25%. With the firm’s annual recurring revenue (ARR) hitting $15 million, advancing the proposal would directly boost yields for SYRUP staking, impacting the token’s long-term value. This also coincides with Maple’s partnership with Wall Street giant Cantor Fitzgerald to expand on-chain credit markets to institutional investors.

SYRUP reclaimed its 200-day EMA at $0.305 and broke above the 50% Fibonacci retracement at $0.5307. Its RSI sits at 67, indicating that the token is currently closing in on overbought territory, and the widening Bollinger Bands signal volatility expansion. If SYRUP can close above its current all-time high of $0.6532, then it could target a $0.70 valuation next. Despite the optimism, there remains a profit-taking risk near the $0.56 to $0.58 support level.

At the time of writing, Maple Finance (SYRUP) is trading at $0.5745, up 16.22% in the last 24 hours.

VINE Price Skyrockets After Elon Musk Teases Relaunch of Twitter’s Short-Form Video Platform, Vine

Vine (VINE), the memecoin based on the once-popular short-form video sharing platform, went parabolic after X (formerly Twitter) owner Elon Musk teased that Vine could make a roaring comeback. The billionaire’s tweet led to the token surging by 49% to hit a daily high of $0.0825 before cooling.

According to crypto analyst “Moby Agent”, VINE is currently the most heavily accumulated token by whale wallets across the market over the past 24 hours, accounting for a net whale inflow of $7.93 million.

Musk has hinted that the video platform, which was shut down by Twitter in 2017, will be relaunched, with plans to create a creator economy that offers tips and other reward features. VINE is being touted as the next viral gateway to the crypto economy.

The token’s ongoing surge is also driven by technical momentum and meme coin speculation. VINE has broken above key Fibonacci resistance at $0.0515, triggering algorithmic buy signals, and the 1,117% spike in trading volume, which hit $265 million, signals strong trader conviction. Its 14-day RSI sits at 54.57, indicating that there’s room for further upside before overbought conditions.

At the time of writing, Vine (VINE) is trading at $0.05351, up 43.03% in the last 24 hours.

Crypto & Blockchain Expert