How to Pick Crypto Coins with Real Future Value : All You Want To Know

Crypto markets, known for their volatility, speculation, and hype, offer hundreds of thousands of coins and tokens. However, not every coin promises long-term success, with several fading into oblivion. This makes it necessary to identify the crypto assets with a real, long-term future.

While the future of the digital assets cannot be predicted with absolute certainty, some indicators point to the coins with actual long-term potential. In this article, we will break down the essential factors that help in determining whether a cryptocurrency can sustain its value for a long period of time.

Understand Your Investment

Before you think about investing in crypto, having a clear understanding of cryptocurrencies is highly essential. This is because there are plenty of scams surrounding crypto that have drained the investors.

Understanding what cryptocurrencies are, how blockchain works, and what each coin stands for is necessary. For example, Bitcoin is a valuable asset, while Ethereum supports most of the decentralized applications. The motive behind each coin will give you an idea of whether it is a fleeting trend or has the potential to leave a lasting impression in the market.

Each successful crypto projects have a clear utility and real-world purpose. Those coins that mostly operate on hype or memes may lack long-term value. Coins that focus on issues like scalability, privacy, payments, interoperability, or decentralized storage options, or such high-demand problems, have a stronger future.

How to Do Research About Crypto?

Researching about each crypto, being aware of what their actual usage is, does they solve any real-world problem, the technology used, checking if the roadmap has some major milestones, and if the project works in partnership with market giants, all speak volumes about the coin or token.

There are several places you can check to see the emerging trends and future of cryptos.

- Cryptocurrency exchanges, including Binance, Coinbase, Crypto.com, Kraken, etc.

- Data aggregators like CoinGecko and CoinMarketCap will help you understand whether a coin has potential.

- Social media platforms like Discord, Telegram, and X offer insights about the latest trends in the crypto world.

- Tools like Kryptview and Token Sniffer let you investigate the complete details of the coin with its name or address.

- DeFi platforms like Maker, UniSwap, and Aave.

- Non-Fungible Token (NFT) marketplaces provide information related to the assets.

- Read white papers related to crypto, as they outline the utility of the projects and how the token or coin will interact with the blockchain.

- Look through the website of the crypto you are planning to invest in, while ensuring that the information provided is up-to-date.

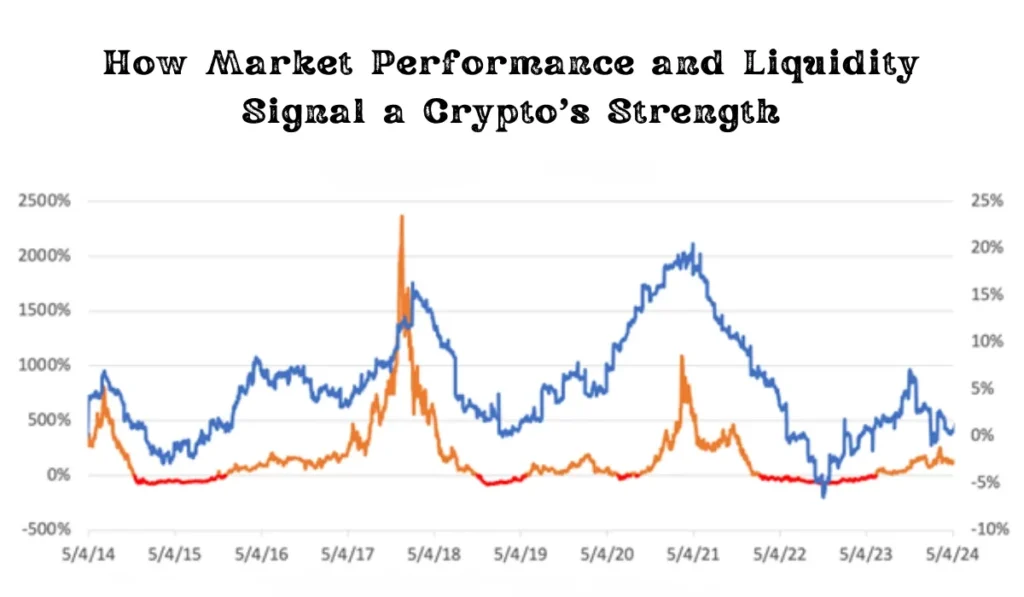

What Does Market Performance and Liquidity Say About a Crypto?

Analysing the coin’s market performance can give a pattern of development, growth, and risks attached. Though history won’t predict the future, the sudden fluctuations in the past can point towards the instability of the coin, and you might want to stay away from it.

Small-cap coins have greater potential for making gains, even though they are riskier investments. On the other hand, large-cap coins, such as Bitcoin or Ethereum, can offer security. Coins with a high volume of liquidity make it simple to buy or sell without a significant fluctuation in price.

Community Engagement and Support

The audience has a huge role in determining the coin’s long-term success. A coin with a large, active community shows that the coin is widely accepted and trusted by investors.

Check social media sites like X, Telegram, Reddit, or Discord, and find out whether the community speaks mostly about getting rich faster, or has conversations that explain the benefits, or major updates in the ecosystem. Projects that regularly interact with the community, offering support and frequent updates, are generally considered more trustworthy.

Examine the Project Team and Leadership

Just like community support is essential, a highly capable and credible team is also necessary for the success of the project. Projects with an anonymous team of developers and unverifiable credentials are most likely to turn out as a scam. While decentralization is a key to the success of cryptos, early development and success rely on strong leadership.

How Long-Term Value is Tied to the Technology and Innovation Level of the Project

The technology and level of innovation explain how competitive the coin is. Examine scalability, security, decentralization, development activity, and innovation of each token to assess its longevity.

Watching the Tokenomics

Tokenomics is a core factor that influences the price sustainability of each coin. Paying attention to supply and issuance, whether the coin has an uneven distribution, which can later result in massive dumps or price manipulation, utility, and demand, all indicate the better value retention of the coin.

Red Flags and Scam Indicators to Beware of

Rug pulls and scams are more or less common in crypto. Hence, keeping yourself safe from scams by recognizing the warning signs is necessary.

- Coined offering guaranteed returns.

- Coins with anonymous, unverified teams with no credible history.

- No audit code.

- White papers that use complex language, without actually explaining the proper use cases.

- Overly aggressive marketing and advertising.

- Sudden price increases with no clear reason.

- Suspiciously small liquidity pools.

Best Practices for Crypto Investment

- Diversifying your crypto investment portfolio can protect your assets from unexpected market fluctuations.

- Watching the market trends and news, and staying updated with new regulations and technology.

- Consider the long-term pathway of the crypto coin, as short-term hype can be dangerous.

- Make sensible investments, as investing in more than what you can afford to lose.

Top Long-Term Cryptos to Invest In

- Bitcoin

- Ethereum

- Solana

- Chainlink

- Avalanche

- XRP

- Aave

- Cardano

- Tether

- Tron

Conclusion

Choosing crypto coins with real future value is highly essential, as it can make or break you financially. The key is to look beyond the hype and speculation, while focusing on utility, technology, tokenomics, roadmaps, and the strength of the community. Conducting a thorough analysis and research of factors helps you make better decisions.

As crypto continues to evolve, with constant, dramatic shifts in the coming years, investing in a stable coin or token will help you gain a better outcome, with a thriving future in digital finance.

Crypto & Blockchain Expert