Why Solana Ecosystem Coins Are Growing Faster Than Ethereum

With each crypto cycle, a particular narrative, chain, or technology outperforms others. In recent years, Solana, once considered too young and experimental, has upstaged other blockchains, including giants like Ethereum. From meme tokens to DeFi assets, coins in the Solana ecosystem have consistently outgrown the Ethereum coins at a steady rate. This growth is a result of the architecture, economic, and cultural advantages integrated into the design and developer ecosystems of Solana.

In this article, we will break down why Solana ecosystem coins are growing faster compared to the Ethereum coins and what this indicates about the future of blockchain technology.

Solana’s Steady Growth

Solana, with its meme coins to dApps, is attracting traders, builders, and validators equally. According to a report released by 21Shares, a Swiss investment firm, Solana has managed to pull an annual revenue of $2.85 billion over the last year alone, making it the fastest-growing blockchain of 2025.

Most of Solana’s revenue comes from trading platforms, which have contributed to nearly 40% of the total revenue, that is, around $1.12 billion. Solana, during the past year, has made an average of $240 million in monthly revenue. In January 2025 alone, this number reached $616 million due to the meme coin frenzy led by tokens such as Official Trump, something no other blockchain has hit during its early years of growth.

Also, validator fees, including DeFi, meme coins, AI tools, DEXs, and launchpads in the Solana blockchain, continue to amplify the network’s financial momentum.

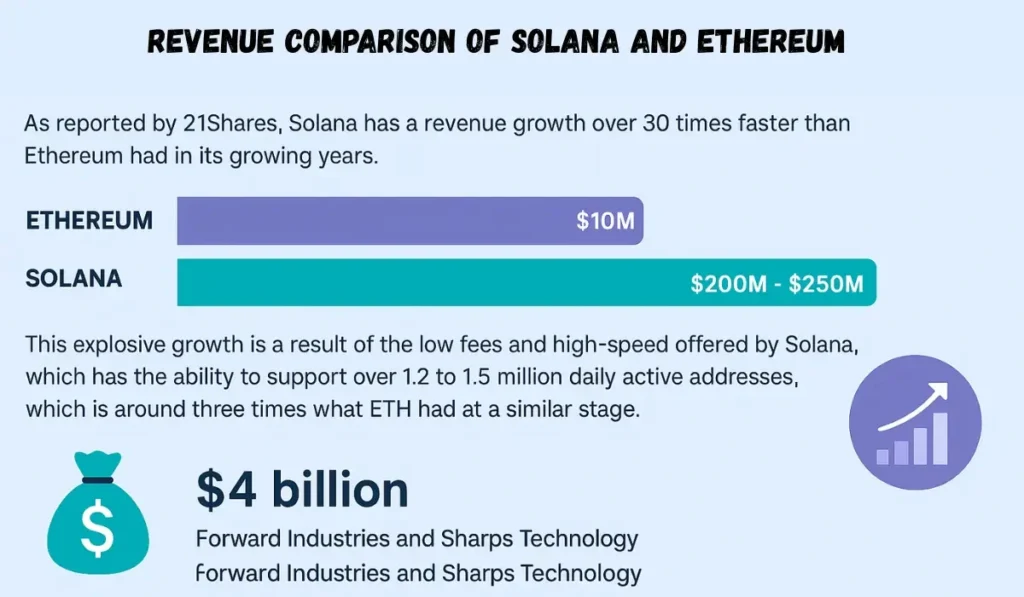

Revenue Comparison of Solana and Ethereum

As reported by 21Shares, Solana has a revenue growth over 30 times faster than Ethereum had in its growing years. Ethereum, during the first five years post-launch, gathered around less than $10 million a month, while Solana is making around $200 – $250 million. This explosive growth is a result of the low fees and high-speed offered by Solana, which has the ability to support over 1.2 to 1.5 million daily active addresses, which is around three times what ETH had at a similar stage.

Not just the efficiency, Solana’s popularity is also backed by a strong corporate interest. A huge number of new Solana treasury companies have emerged, with public companies adding SOL to their assets. Currently, 18 tracked entities, including Forward Industries and Sharps Technology, have been holding around $4 billion worth of SOL.

Major Factors Influencing the Explosive Growth of Solana

Transaction Speed and Scalability

Compared to Ethereum, Solana’s biggest advantage is its transaction throughput. Solana is capable of handling over 50,000 transactions per second, even during peak hours. On the other hand, Ethereum can process around 15-30 transactions per second on its base layer.

Although Ethereum’s Layer-2 network has the capacity to handle a much greater number of transactions, Solana has a monolithic design that runs everything on a single, fast, highly efficient chain, creating a smoother user experience at a very affordable cost.

The higher traction in Solana is due to the fast chain momentum, which means that when transaction fees are low, more users interact. As a result, the creation of new wallets and the minting of more tokens leads to higher volatility. This results in faster price movement for ecosystem coins.

Ultra-Low Fees

Another major reason for the boom in Solana’s ecosystem is its extremely low transaction cost, often less than $0.001 per transaction. Developers and investors equally opt for Solana tokens and coins because launching and trading a token is cheap here. Air drop participation and moving liquidity are also highly affordable, making Solana a micro-fee economy with high transaction volume. This helps in discovering the trends, liquidity rotation, and creation of hype cycles much faster.

On the other hand, for Ethereum, it has a high transaction cost that can cost anywhere from $5 to $40, depending on the congestion in the network. This slows down the user experience and reduces the participation of new or casual traders.

Faster Growing Developer Ecosystem

Solana now has one of the fastest-growing developer communities in the blockchain world, driven by grants and ecosystem funding, easy-to-use tools, a strong community that supports experimentation, and high-visibility events.

While Ethereum still leads in total developers, many new developers prefer Solana because the deployment of smart contracts is easier and cost-efficient. Furthermore, the blockchain supports real-time, high-frequency applications and lets developers go beyond the limits without worrying about gas limitations.

Meme Coin Culture

Though not considered a serious investment method by traditional users, meme coins bring in massive engagement. And Solana has turned into a leading blockchain that supports meme coins, with tools like Pump.fun, Solflare, Phantom, Raydium, etc.

Creating a token on Solana is easy and can be launched with just a click, which is something Ethereum cannot match. This easier launching process leads to the creation of thousands of new meme coins, higher liquidity rotation, constant narrative changes, and frequent viral breakouts.

The meme culture in Solana is extremely fast-moving, accessible and totally fun, attracting young traders into crypto.

Strong Institutional and VC Support

Solana has substantial backing from market giants like Multicoin Capital, Jump Crypto, a16z, Anatoly Yakovenko (founder), Coinbase integration, and other major market makers. These companies support the liquidity and encourage developers.

The ecosystem funding launched during the 2023-2025 cycles resulted in faster onboarding of new projects that are higher in quality and had rapid value creation.

Faster NFT Activity Recovery

Solana has always been a hub for active NFT communities, and currently has a huge number of new mints, major projects migrating to the blockchain, expansion of gaming NFTs, and integration with Solana Mobile and Saga phones. These NFT activities result in increased on-chain transactions, token usage, and market liquidity, all contributing to the price appreciation of the tokens in the ecosystem.

Mobile Strategy

The introduction of Solana Mobile and the Saga phone resulted in the creation of built-in crypto tools, integration of native wallets, Airdrop farming cultures, and token launches that give priority to mobiles. This mobile-first strategy of Solana allowed the blockchain to reach new participants on a global scale with an explosive growth rate.

Slower Growth of Ethereum’s Mature Ecosystem

Ethereum’s ecosystem is considered more mature, and mature ecosystems grow slowly compared to newer ones. Ethereum is established, widely adopted, highly liquid, and trusted by all the major institutions. This stability of the blockchain offers it sustainable growth at a slower rate. The largest tokens of the ecosystem, such as ETH, UNI, LINK, and AAVE, already have multi-billion dollar market caps, making massive percentage gains harder.

Solana, on the other hand, has a younger ecosystem that has tokens with lower market caps, and encourages high-risk and offers high rewards. As a result, Solana-based tokens and assets grow exponentially, 10x, 20x or even 100x, much easily.

Solana’s Economic Loop Outperformed Ethereum in 2026

Solana has a tighter, responsive economic loop, with high activity feeds and protocol revenue, attracting more developers to the network. Even after the recent price drop, Solana has managed to stay intact with the transaction flow, giving Solana an advantage when demand increases.

For Ethereum, the loop is fragmented as the activity has shifted into the Layer 2s, resulting in a revenue cut. Though settlement fees exist, they can’t match the economic momentum that Ethereum had when the activities were taking place on the L1. ETFs provide stability, but are unable to bring back the reflexive cycle that was once linked with the strength of the token.

If the Firedancer ships on time and volume remains high, 2026 for Solana will be a year of high potential.

Conclusion

Solana ecosystem coins and tokens are clearly outperforming Ethereum, as it is faster, cost-efficient, and developer-friendly. The high TPS and near-zero fees, the rapid growth of the developer community, the increase in the meme coin culture, mobile-friendliness, support from major institutions, and the highly active NFT ecosystem all contribute to the popularity and exponential growth of Solana.

Though Ethereum remains dominant in the smart contract platforms, Solana has made its own unique niche that focuses on speed, cost, and a vibrant community. If this momentum continues, Solana may eventually become the leading blockchain for consumer-oriented crypto applications, especially in gaming, memecoins, and real-time trading.

Also Read: What Are Crypto Index Tokens? Exploring Crypto Index Tokens: A Smarter Way to Invest

Crypto & Blockchain Expert