Volatility Explained – What is Volatility in Crypto

What is Volatility in Crypto

Volatility of a cryptocurrency refers to the extent to which its price has increased or decreased in a given time. It is an important metric to measure the risk associated with a particular cryptocurrency. Investing in highly volatile currencies has two possible outcomes: they will either get high profits or incur huge losses.

Cryptocurrencies are highly volatile as they are highly speculative. While they are in high demand, the rapid shift in supply and demand metrics, engaged investors, vast changes, and new developments make these tokens volatile. The unpredictable nature of most cryptocurrencies makes them more volatile. Other factors, such as regulatory oversight, changes in the overall sentiments of the currency, and media representation and influence, also affect volatility.

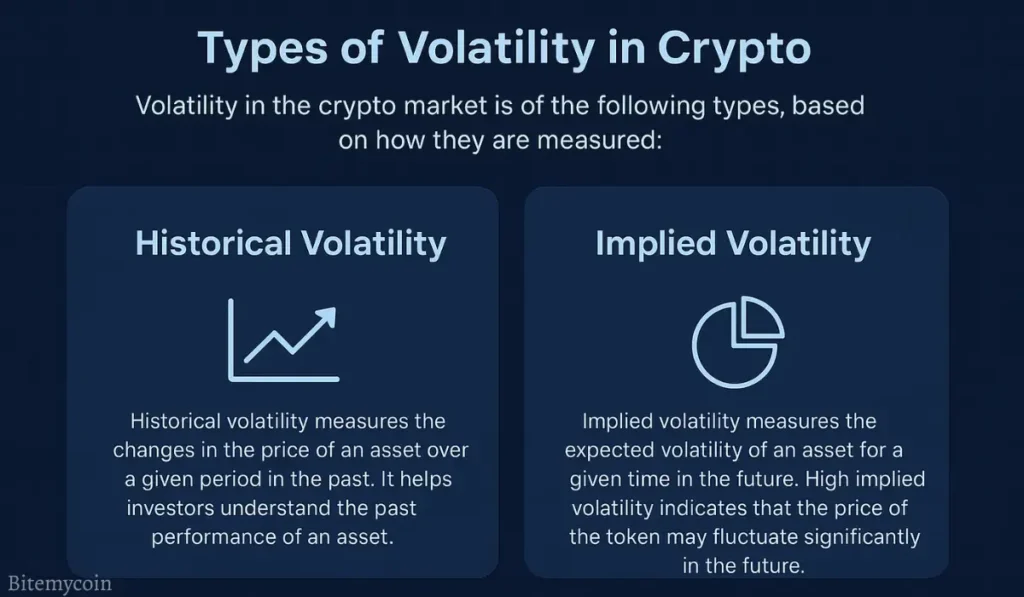

Types of Volatility in Crypto

Volatility in the crypto market is of the following types, based on how they are measured: historical volatility and implied volatility

- Historical Volatility: Historical volatility measures the changes in the price of an asset over a given period in the past. It helps investors understand the past performance of an asset.

- Implied Volatility: Implied volatility measures the expected volatility of an asset for a given time in the future. High implied volatility indicates that the price of the token may fluctuate significantly in the future.

How is Volatility in Crypto Measured?

Volatility is generally measured as the standard deviation of the historical price of an asset. Here is how the volatility of cryptocurrencies is calculated.

- The price data of the asset for a given period of time is collected.

- The daily returns are calculated. It is the average between the current day’s closing price and the previous day’s closing price.

- The average return for the given period is calculated by dividing the total daily returns by the number of days.

- The standard deviation of the annual return is measured.

A higher standard deviation represents higher price fluctuations and thus, high volatility.

Bollinger Bands and Average True Range (ATR) are two indicators that represent the volatility of cryptocurrencies.

- Bollinger Bands: They are a technical analysis tool used to indicate volatility. It has three bands: the upper band represents the simple moving average, the middle band represents the moving average plus a specified number of standard deviations, and the lower band indicates the moving average minus the same number of standard deviations. The gap between the bands increases during high volatility and decreases during low volatility.

- Average True Range (ATR): ATR is calculated as a comparison of the current price range of a token with its past price range. At times of volatility, the price moves beyond this range.

Why is Volatility in Crypto Important to Understand?

Volatility of an asset is an important parameter to consider before investing in a cryptocurrency. It gives you the real picture of a token so that you can understand the risk elements or the potential benefits of investing in a currency. With an understanding of volatility, you can strategize your investments and prevent any risks.

Volatility is an important tool for risk assessment. An asset with a higher volatility will have frequent price fluctuations and should be carefully monitored. While these assets have a potential for high returns, the price can also dip to an all-time low.

Volatility is important for risk assessment and risk management. If you know the volatility rate of an asset, you can decide if you should invest in it alone or invest in other currencies too. Investors can get insights into the movements of the market. They can also make rational investment decisions.

Are There Ways to Reduce Crypto Volatility?

Cryptocurrency volatility is a problem that most investors face. However, there are ways to reduce and manage it so that investors do not face a problem while investing.

Regulatory oversight can reduce the potential for volatility of a cryptocurrency. With regulatory oversight, investors can expect some amount of certainty in the price of currencies. This is because regulators prevent pump and dumb schemes and implement uniformity in taxation and trading.

Another method of reducing volatility is to add liquidity. This is done by crypto market makers. They do this by placing large buy and sell orders, thus ensuring that there is enough trading volume to satisfy the demand.

Cryptocurrencies need to have real-world utilities to reduce volatility and slippage of prices. Then the pricing would become more realistic and less speculative. This is why stablecoins are less volatile, as they are used for real-world payments and deposits. The stability of cryptocurrencies can also be ensured by linking them to products such as Crypto ETFs, futures, and options.

The Bottom Line – Volatility in Crypto

Volatility of cryptocurrencies should be fixed, and stability should be ensured to make these digital currencies practically viable for use. Only if stability is brought in can you use these digital currencies for real-world purposes. Lower volatility will attract more institutional investors to invest in cryptocurrencies.

With the eventual maturity of the market and wider adoption of cryptocurrencies for everyday use, the volatility of these coins will eventually subside, and these assets will become stable.

Crypto & Blockchain Expert