What Is A Limit Order In Crypto Trading?

Whether you are trading crypto or stocks, orders play a key role in the overall process. They are a set of instructions sent to an exchange that specify how a trader wants to buy or sell crypto or equities.

Orders are crucial to implementing an investor’s trading strategy and achieving their goals. In this article, we will discuss what a trade order is, the different types of orders, and take a deep dive into limit orders.

What is an Order in Trading?

An order defines the price, timing, and conditions under which a trade should be executed, allowing traders to control whether their transaction takes place at the best market conditions or waits for the asset to reach a specific target. It is one of the foundational pillars of crypto trading, and is matched based on price and quantity in the exchange’s order book system.

There are several order types, including market order, limit order, stop limit order, stop loss order, trailing stop order, if done order, one cancels the order (OCO), and next order – but the most fundamental are market orders and limit orders.

Market Order and Limit Order

A market order instructs the exchange to buy or sell a cryptocurrency immediately at the best available current price, enabling instant trade execution but not guaranteeing the exact price. This type of order is suited for traders who need immediate action, especially in a high-liquidity market.

Conversely, a limit order allows a trader to specify the exact price at which they want to buy or sell a crypto token, offering greater control and helping avoid the slippage that comes with market orders. It is ideal for traders who want to enter or exit a market position at a specific price, even if it means waiting for the market to reach that level eventually.

What is a Limit Order?

In crypto trading, a limit order serves as an instruction to buy or sell an asset at the best available price. This order type offers investors more control over the price and is only executed when the market value of the crypto reaches or exceeds the pre-determined limit.

Unlike market orders, where trades are executed almost instantaneously at the current market price of the crypto, and need to be done manually, limit orders are automated, as traders just have to set the parameters, and the exchange will handle the execution.

When buying crypto, the orders are executed at the set limit price or cheaper, and when selling, they will be executed at the limit price or higher. This allows traders to avoid unexpected costs or slippages caused by sudden price movements.

However, it is not guaranteed that a limit order will be executed. If the asset’s price never reaches the set limit price, then the trade will remain unfilled on the exchange’s order book. Furthermore, placing a limit order requires careful market observation and strategic considerations.

How Does a Limit Order Work?

Several parameters work together to execute a limit order. Let’s take a look at them.

- Limit Price:

A limit price order is the exact value threshold you set for activating your trade. It serves as a boundary for a buy or sell limit order. Oftentimes, traders depend on technical tools, such as support and resistance levels or moving averages, to decide the right limit price.

- Buy Limit Order:

A buy limit order allows you to purchase crypto at a specified price or less than that amount. This limit order type is useful for traders who want to enter the market at a lower price during temporary dips without having to constantly monitor prices. This approach is suited for traders in fast-moving markets, where prices change frequently. A buy limit helps you trade ahead of time without feeling the pressure to execute your trade immediately.

- Sell Limit Order:

A sell limit order guarantees that you only sell crypto when its price reaches or slightly exceeds your specified limit. This offers traders much more control over when they want to cash in their profits. The strategy is useful in dealing with downside risks since you can sell off your asset and exit a particular position at a favorable price before the market turns unfavorable.

Example of Limit Order

Let’s take an example to better understand this trading technique. Say Token A is currently trading at $100, and you believe the price to drop, then you set a buy limit order at $80. If A’s price drops to $80 or lower, your order is executed, allowing you to buy the token at a favorable price.

Similarly, if you already own Token A and want to sell it at a higher price, say at $150. Then you set a sell limit order at $150 and wait for the order to be executed. The sell-limit order only goes through when the price reaches your set target, which is crucial in a highly volatile market.

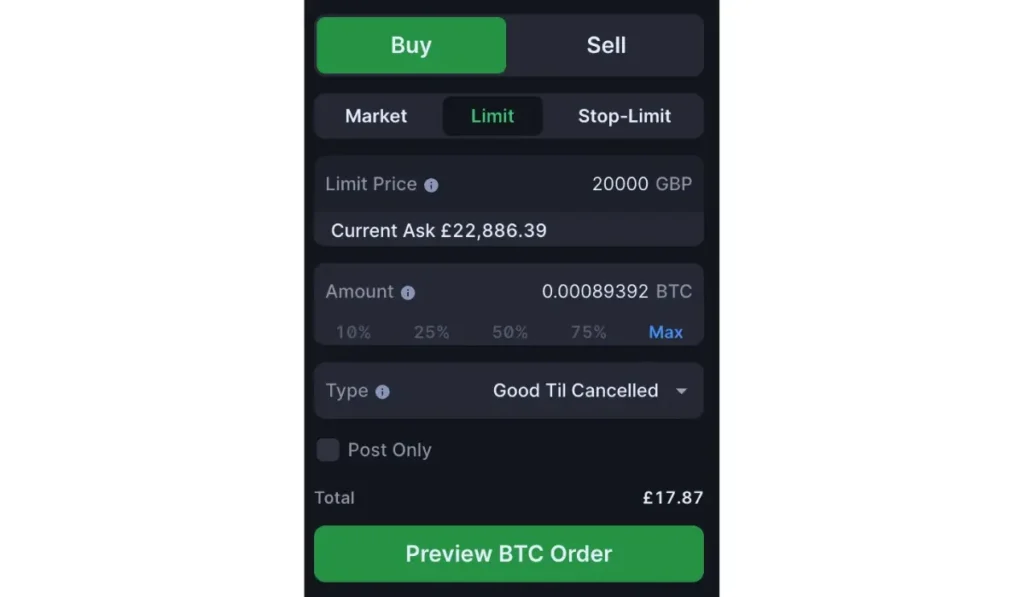

How to Set a Limit Order on a Crypto Exchange?

Here is how you can set a limit order when trading crypto on an exchange:

- Choose Crypto

Choose the crypto you wish to trade.

- Select Order Type

Select ‘Limit Order’ from the list of available order options.

- Set Price

Set the limit price by entering the value at which you wish to execute your trade.

- Specify Amount

Specify the number of tokens you would like to buy or sell.

- Confirm Order

Double-check the details of your order, such as the limit price and amount, before confirmation.

Advantages and Disadvantages of Limit Orders

Here are the benefits and risks of limit orders that you need to be aware of:

Advantages:

- Volatility Protection:

During highly volatile market periods, limit orders can ensure that you buy or sell crypto at a price that you are comfortable with. This protects you from any sudden market swings.

- Risk Tolerance:

Setting a limit order allows you to define your acceptable level of risk tolerance. This strategy provides greater control over your crypto investments compared to market orders, which are subject to unpredictable price volatility.

- Wide Time Frames:

Limit order options that allow you to set time frames, enabling you to remain active in the market for extended periods. This is particularly helpful when trading in crypto markets, which are open 24/7 and global, for anticipating future price movements.

Disadvantages:

- Failure to Execute:

The biggest risk in limit order trading is non-execution. Setting your limit price far from the token’s current market price makes it difficult for the order to be executed, potentially causing missed opportunities because the market may not reach your preferred price within the time you wish.

- Liquidity Requirements:

Liquidity plays an important role in limit order trading. In low-liquidity markets, especially small-cap cryptos, even if the price reaches your pre-determined target, there might not be enough buyers or sellers to fulfill your trade.

- Potential Losses in Partial Fills:

On rare occasions, only a part of your limit order may get executed, leaving you with an incomplete position. This can be a disadvantage in crypto markets, where conditions can change rapidly. Partial fills may disrupt your trading plans, requiring additional strategy adjustments to maintain portfolio balance.

Final Thoughts on Limit Orders in Crypto Trading

Limit orders are one of the most recommended trading strategies when buying or selling a cryptocurrency at favorable and profitable prices. It is a versatile tool that can be used to maximize your unrealized gains or limit potential losses. Once you fix a specific price level, it is guaranteed that you will not overpay or undersell your crypto.

However, no trading tool is without its risks or complications. The case of non-execution risk, liquidity requirements, and partial fills is to be kept in mind before approaching a limit order trade. Also, before choosing an order type, you should consider the different options and evaluate how each one can play into your overall crypto portfolio and trading strategy.

Whether you are trading in cryptocurrencies or equities, limit orders offer direction and discipline.

Crypto & Blockchain Expert