What Would Happens If Satoshi Sell All His Bitcoins in A Single Day

Satoshi Nakamoto, the enigmatic creator of Bitcoin, has become a figure of legend in the digital landscape today. As the creator remained inactive in the past years, almost turning into an urban myth, his wallet, presumably worth billions, remains a lingering concern in the crypto world. Any movements in Satoshi’s wallet could trigger a chain reaction in the crypto market.

Crypto analysts and experts have been discussing and speculating on any possible movements in Satoshi’s wallet and the shockwaves it can send across the crypto market. The discourse around the inactive wallet worth billions of dollars gained further traction as crytocurrencies, including Bitcoin, are gaining more institutional support and have become mainstream investment options for many.

Any dramatic occurrence related to Bitcoin would have an overarching influence on the entire digital asset landscape, as it is the most dominant cryptocurrency in existence today. So, what exactly is going to happen if Satoshi sells all his Bitcoins at the same time? What are some worst-case scenarios? Or will the Bitcoin ( BTC) ecosystem remain resilient and unaffected? Read on to find out.

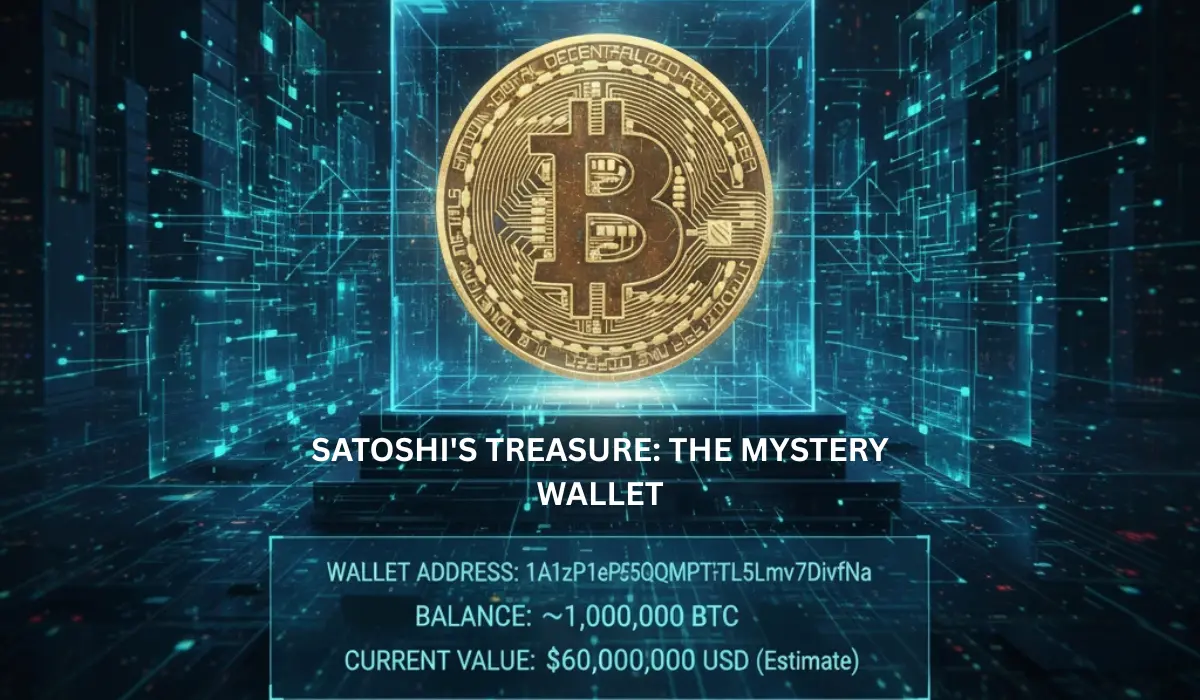

What Exactly is Satoshi’s BTC Wallet and How Much is it Worth?

The Satoshi Nakamoto mined 1.1 million BTC; the current value of Satoshi Nakamoto’s assets stands at a whopping $129 billion, making him one of the richest in the world. His total holding may spread across several accounts as well.

The wallet remained inactive since 2010. The long-standing activity became the symbol of decentralization ideology in the cryptoworld. The BTC network has remained running freely without any central authority, reinforced by the accounts’ inactivity.

According to crypto experts, since the wallet remained inactive for more than a decade, any possible movement may not necessarily come from Satoshi. Rather, it may be attributed to quantum computing. Theoretically, quantum computing poses threats to the blockchain network built around cryptography.

The Bitcoin network has two cryptographic layers: ECDSA (Elliptic Curve Digital Signature Algorithm) and SHA-256 hashing. In a post-quantum computing era, both layers are vulnerable.

Potential Impacts of Movements in Satoshi’s Wallet

As we discussed earlier, any movement in the legendary wallet can shake up the Crypto exchanges. According to crypto experts, the following are the potential impacts.

1. A Sudden Market Crash

The release of such a large number will dramatically increase the supply of Bitcoins. Such a dramatic increase in supply would cause the prices to crash. The sudden fall in prices can cause panic selling. Investor confidence will go down and trigger more selling off. Despite such crash speculations, the experts also predict that the Bitcoin network is currently resilient enough to absorb such shocks and can recover.

2. Increased Regulatory Scrutiny

Any such movement is bound to attract the attention of regulators across the globe. It will prompt an increased scrutiny over digital assets and networks. The regulating bodies would likely move towards stricter regulations.

3. Impact on Altcoins

Any drastic changes in the BTC’s value can have an impact on altcoins as well. Since BTC has the highest market dominance, altcoins may face a similar downturn, with their values plummeting.

4. Psychological Impact

Beyond monetary value, Santoshi’s wallet has a symbolic value. It represents the very spirit of decentralization around which the entire crypto system operates. The psychological impact can be far-reaching, and some investors may leave the crypto space.

Nevertheless, a movement from Satoshi’s wallet is something investors and experts have long considered. The large exchanges today are capable of detecting any large-scale bitcoin transactions and analysing them in real-time.

Bottom Line

A possible movement from Satoshi’s crypto wallet is no longer speculative matter discussed to satisfy curiosity; rather, it’s a real market scenario considered and analyzed by crypto experts. Although any movement from the legendary wallet is seen as a supply risk that could send shockwaves in the market, the investors remain optimistic about the resilience of the Bitcoin network.

In fact, the crypto community believes that the move could generate dramatic changes for the short term, but in the long term, it will only strengthen the network and decentralization ethos it represents. Experts in the field are also proactively discussing countermeasures against any possible threats from quantum computing.

Crypto & Blockchain Expert