ReFi: Regenerative Finance – The Green Crypto Revolution

DeFi is a familiar word in the crypto space; it refers to Decentralized Finance. Cryptocurrencies depend heavily on technology and computational power. The Bitcoin network’s annual energy consumption has been compared to entire countries like the Netherlands and Argentina. This is due to the digital mining process using Proof-of-Work (PoW) consensus mechanisms, and it leaves behind huge carbon footprints. ReFi or Regenerative Finance is here to reverse the negative effect crypto has on the environment.

Even before crypto, the world was facing environmental issues like climate change, pollution, and deforestation. Traditional finance was in no way helping bring any changes, but ReFi could have a greater impact on the planet. It’s a movement to make our surroundings greener and healthier for us and the future generations to come.

What is ReFi?

ReFi or Regenerative Finance uses the technology and features of blockchain networks to promote sustainability and regeneration. Compared to traditional finance, which is based on extracting value, ReFi aims at regeneration. Instead of cutting down a tree for value-generation, a tree is tokenized and added to the blockchain as an environmental asset to generate value. This will promote sustainability, money that can make an environmental difference with each transaction.

ReFi aims at bringing carbon credits into the blockchain, allowing individuals and businesses to offset emissions through Decentralized Autonomous Organizations (DAOs). The secure and transparent blockchain network can help ReFi in tracking the effect it has on the environment and in ensuring the funds are used as promised.

Major ReFi Projects

ReFi is not just in theory; it is already in existence and actively creating a positive effect on the planet. Here are some of those projects:

1. Toucan Protocol

Bridges carbon credits to the blockchain by turning them into Carbon reference tokens (TCO2). This project aims to make a carbon credits marketplace, where it’s tokenized and traded in transparency. They created BCT (Base Carbon Tonne), a standardized liquid pool for carbon tokens.

2. KlimaDAO

KlimaDAO is a decentralized autonomous organization (DAO) that is designed to drive carbon credit token prices up. It acts like a decentralized carbon reserve currency. The idea is to make pollution expensive and carbon credits profitable.

3. Celo

Celo is a carbon-neutral, proof-of-stake blockchain that is available on mobile, aimed at making DeFi tools accessible for everyone. This network uses very minimal computational power and energy, and still, the small carbon footprint is offset through a partnership with Climate Collective.

4. Regen Network

This network creates a marketplace for tokens that are verified ecological impacts or improvements. Scientists and ecologists create protocols that can be used by farmers and landowners for regenerative agriculture, reforestation, or any other ecologically beneficial practice, like no-till farming, improving soil health, etc. This is verified using means like satellite imagery, on-ground sensors, and such to be provided as verifiable tokens. Individuals, investors, and companies can fund these for positive outcomes.

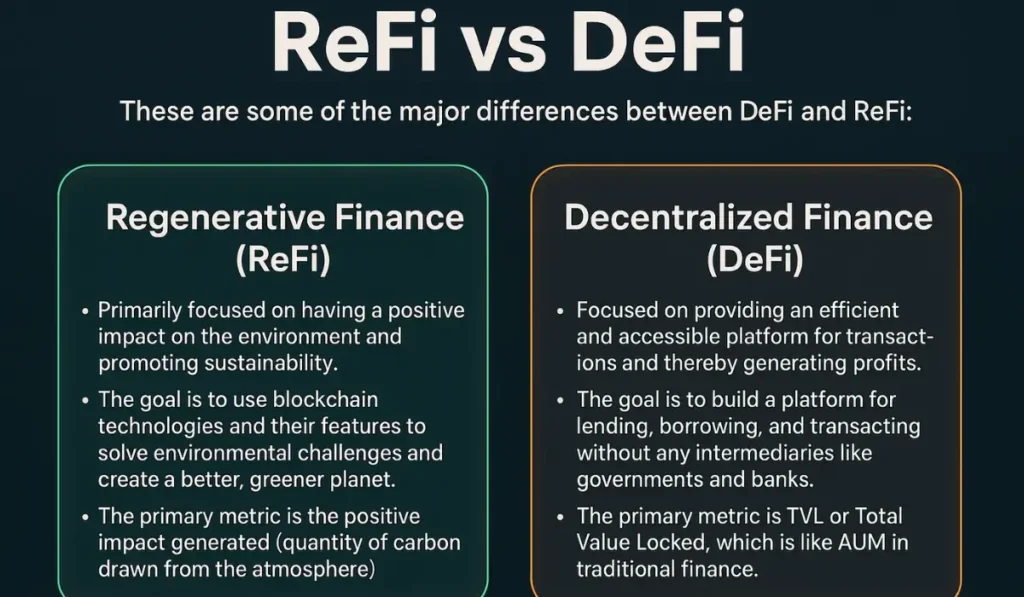

ReFi vs DeFi

These are some of the major differences between DeFi and ReFi:

| Regenerative Finance (ReFi) | Decentralized Finance (DeFi) |

|---|---|

| Primarily focused on having a positive impact on the environment and promoting sustainability. | Focused on providing an efficient and accessible platform for transactions and thereby generating profits. |

| The goal is to use blockchain technologies and their features to solve environmental challenges and create a better, greener planet. | The goal is to build a platform for lending, borrowing, and transacting without any intermediaries like governments and banks. |

| The primary metric is the positive impact generated ( quantity of carbon drawn from the atmosphere) | The primary metric is TVL or Total Value Locked, which is like AUM in traditional finance. |

How ReFi Works

When large factories or companies mass-produce, they leave behind huge carbon footprints. It’s legally required to limit these footprints, and one of the ways companies do so is by buying carbon credits. A carbon credit is equal to one metric ton of carbon dioxide equivalent, which can be bought, sold, or retired. So if a company emits more carbon than the legal limit, they can buy carbon credits to offset the effect. This carbon credit is brought into the blockchain network through ReFi.

- A methodology for measuring, reporting, and verifying a positive impact on the environment is created by ecologists or scientists. Rules for issuing carbon credits will also be provided along with these.

- A project developer will implement the methodology and collect data for reporting and verifying, as stated.

- The collected data is then verified against the methodology through the decentralized network, just like how transactions are verified in the Bitcoin network. After verification, the positive impact is measured and tokenized.

- These tokens are then listed on markets, which creates liquidity, allowing them to be bought, sold, or retired.

Why ReFi Matters

When DeFi came, it changed how people conceived money. Cryptocurrency is digital money that is not controlled by governments or banks. ReFi or Regenerative finance aims at the regeneration of the environment rather than extraction like other currencies. Instead of competition in terms of value, this promotes collaboration, and rather than short-term gain, it aims at long-term impact. ReFi empowers local communities by incentivising sustainability and promotes a greener planet.

Final Thoughts – ReFi

Climate change is real, and one of the primary reasons for that is carbon emissions. With an increasing population and their demands leading to deforestation, pollution, and global warming, it’s high time people start giving attention to sustainability. Money has always been extractive in nature till ReFi came around. Instead of cutting down trees for profit or value generation, this crypto concept tokenizes these ecological assets and builds value for them.

Cryptocurrency disrupted the global financial markets, changing everything about how people viewed money. ReFi has the potential to bring more to the table than just a decentralized currency; it’s aimed at making the world greener by making the process more rewarding and inclusive to people from all walks of life. Regenerative Finance globalizes sustainability, breaking borders and norms, helping individuals and organisations in building a better environment in a verified, scalable, and transparent model. Maybe one day, ReFi would help see trees and forests as more valuable than timber and bring down carbon emissions for a greener and healthier planet.

Crypto & Blockchain Expert