How Crypto ETFs Impact Market Prices

To understand the impact of crypto ETFs on market prices, we must first address what an ETF is. An ETF, short for Exchange Traded Funds, is a regulated version of the underlying asset that can be traded like stocks.

The introduction of ETFs or Exchange Traded Funds has attracted a lot of attention from institutional traders. These traders are often engaged in high-volume trading, which brings more liquidity into the market.

The increased institutional capital will naturally impact the market prices of assets, as the liquidity is now directly impacted by the entry of institutional investors. In this article, we will specifically look at ETFs and how they impact the market prices.

What is an ETF?

An ETF is any asset that is listed for trading on a regulated exchange against a fiat currency. Purchasing a crypto ETF is different from purchasing the crypto because, as far as we are trading on crypto ETFs, we do not need to own the underlying cryptocurrency, as is done in its spot markets.

This feature brings a certain crowd to the table: straightforward traders. These traders know that the underlying asset’s tradable volume is backed by an equivalent amount of cryptocurrency at the given moment, stored securely.

This feeling of security, of not worrying about losing funds while taking full benefit of the trading experience, was a long-awaited dream for many traders.

What Happens When Crypto Gets an ETF?

Gaining an ETF is a great achievement for a cryptocurrency. This improves the prices and overall strength of the asset in the market since the institutional investments bring larger and better trading parameters that can have a significant impact on price, liquidity, and volume.

But having an ETF brings with it certain non-crypto properties. This is not fundamentally challenging to the blockchain, but it may upset the purists among cryptocurrency traders. Gaining an ETF for a cryptocurrency will bring with it greater scrutiny, regulatory involvement, and potential volatility. These parameters can alter the entire market dynamics of the underlying crypto asset.

In this section, we will look at the traditional spot markets where one cryptocurrency is exchanged for another, and the ETF-based trading, both of which are crucial to the market. This will give us an additional insight into the nuances of what happens when a cryptocurrency gains an ETF.

Traditional Spot Trading of Cryptocurrencies

While comparing traditional exchange-based spot trading and ETFs, there are some clear differences. These differences are not just limited to the technical data but rather to the market makers and their sentiments as well.

In the traditional spot market, traders buy and sell cryptocurrency as a digital commodity. This can be simply explained as follows.

Two traders exchange their assets for each other’s. So, in a spot market, when you buy Bitcoin or any other cryptocurrency, you are spending some amount of cryptocurrency or fiat and getting its worth in Bitcoin. Now your balance is updated with Bitcoin.

Impact of Institutional Recognition for Cryptocurrencies

In October 2021, the first bitcoin ETF was approved by the Chicago Mercantile Exchange, marking the entry of crypto ETFs into the market. With this, the first-ever cryptocurrency could now be legally traded on an international exchange.

The main characteristics of the ETF were that no technical knowledge about Bitcoin was needed to trade this asset, as traders never had to handle Bitcoin at all. They could simply study the market and place trades depending on their perspective of price.

This caused the trading volume to increase rapidly. Traders flooded into the market to trade Bitcoin, and this had some substantial effects on the underlying spot market.

Benefits of Trading Crypto ETFs

- Crypto ETFs are simpler to trade: A standard brokerage account used for buying stocks and bonds can be used to buy cryptocurrency ETFs. This eliminates the need for setting up accounts in multiple places.

- Portfolio Diversification: Crypto available as ETFs allows traders to diversify their portfolio alongside stocks and bonds.

- No technical knowledge about cryptocurrencies or blockchain required: Those who trade crypto ETFs don’t need to manage wallets, private keys, or other aspects of the blockchain. They can trade the asset with the choice of their base currency.

- Institutional-level security: Traders can leverage the advanced security and custody provided by the trading platform, which surely trumps the security level an individual can achieve.

- Effective dispute management: In cases of disputes, trading on a crypto ETF has more effective resolution methods.

Impact of Institutionalization of Cryptocurrencies

The Bitcoin ETF became highly popular within a few days of its launch. The ease of trading meant that inexperienced traders with no technical knowledge were also trading the asset. With such high buy volumes quickly flooding the market bitcoin price skyrocketed.

On October 1st, 2021, the price was $43835. By October 20th, 2021, a high of $67017 was reported, indicating that since the regulatory approval, Bitcoin had been on a bullish run with nearly a 53% price increase within 20 days.

With the SEC’s approval of a spot Ethereum ETF and favorable court rulings in 2024, Ethereum prices soared, and Ethereum was able to attract an expected 10 to 12% of the Bitcoin spot ETF market share.

Since institutions were handling the Bitcoins that were associated with the shares, regular traders could take advantage of the price movements without holding actual coins. This became popular, leading to a price surge. With institutional-level security at hand, investors became fond of the new asset, and a huge inflow took the prices high.

The popularity of ETFs comes from their ease of setup. One account can be used for all sorts of assets with a general sense of ease. There will be one currency like USD, GBP, or USDt denoting all sorts of metrics like margin, profit, and loss, etc., for ETFs.

It is this simplicity and straightforwardness that brought in many traders to the ETF markets. In addition to this, the ETF market offers the seasoned trader a hassle-free way to trade a much-desired asset like Bitcoin without actually owning the Bitcoin.

Then there are the regulatory protections of the bigger corporations. In light of the recent cybersecurity threats faced by cryptocurrency exchanges, users are wary of investing huge sums into custodial wallets or shared wallets of an exchange, as if lost, the future of the funds is in total uncertainty.

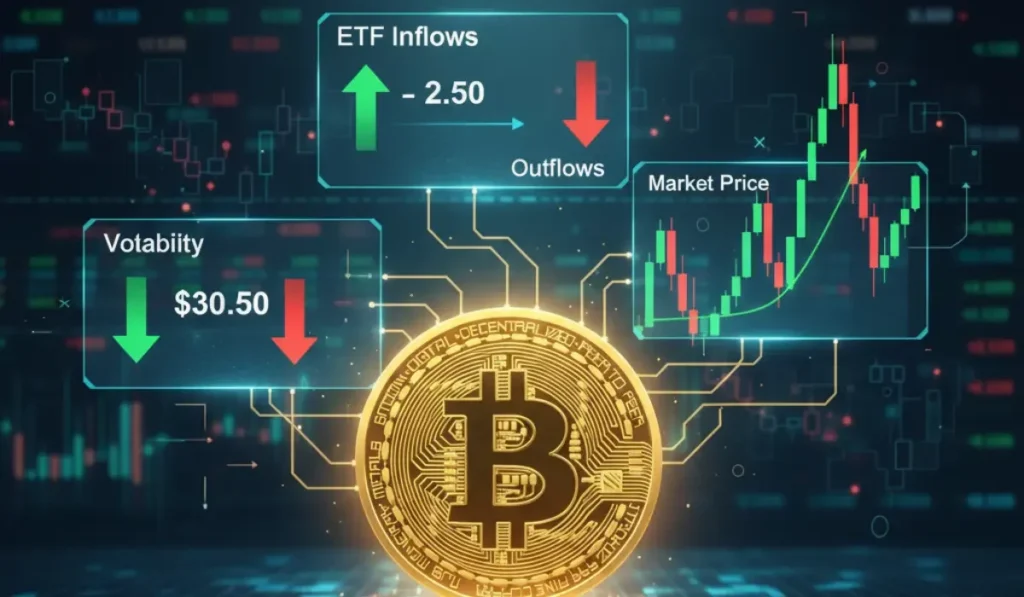

Market Impact of Bitcoin ETF

The reason for impactful bullish runs like the one that happened in October of 2021 was the sheer volume of trade. Buyers piled into the ETF market, stacking up for a piece of the action. When massive buys happen, the price keeps increasing. Increasing prices cause a sentiment that is again bullish.

This sentiment slowly transitions towards the spot market. As more and more people buy the cryptocurrency, the underlying price starts rising. This is how the price of the ETF and the spot currency are tethered to each other.

At the same time, the converse is also true. If a bearish run occurs, prices will fall on both platforms – the ETF and spot. While ETF market traders may resort to patience, spot market holders may soon cave in for panic selling – continuing the bearish run.

The additional benefit of a variety of order types and protection for orders makes the ETF market a fast-paced and active market. This, in turn, impacts the price of the cryptocurrency in the spot market.

Specific Impact Capacity of Bitcoin

Unlike any other cryptocurrency, Bitcoin holds a legacy position; it is the original cryptocurrency. It was Bitcoin’s genesis block that marked the beginning of blockchain-based financial transactions.

This popularity has a peculiar effect on the spot market pairs. Most cryptocurrencies are traded on the spot market on a crypto-to-crypto basis. This allows bigger exchanges to set aside dedicated markets for popular currencies, with the popular currency being the underlying asset.

For instance, when the XRP/BTC market is taken into account, we can see the influence of Bitcoin. While ETFs are commonly traded against underlying fiat currencies, in a crypto exchange’s spot market, the underlying asset can be Bitcoin or any other cryptocurrency.

Conclusion

If you are a seasoned trader who is looking forward to focusing on the trade more than the technicalities of blockchain and the currency, then ETFs could be your best choice.

However, ETFs in the wrong hands can mean a total loss if you do not play your game right. ETFs have short orders, which allow users to place orders without owning the funds. When this is coupled with the higher leverages of x100 and x150, the risk factor rises significantly. If you plan to keep hold of the currency and explore its potential, a spot market could be a better option for you.

FAQs

It depends on the type of trader you are. ETFs require technical knowledge of trading, while spot trading on exchanges requires technical knowledge of the cryptocurrency.

An ETF’s price is decided by the Net Asset Value-NAV and the market price.

Spot markets are relatively cheaper because of the lower fees.

Yes, regular trading restrictions apply to ETFs as well. This includes weekend holidays.

No, holding a Bitcoin ETF is backed by Bitcoin deposits, but the trader doesn’t actually hold any Bitcoin.

Crypto & Blockchain Expert