What is CBDC: How Central Bank Digital Currencies Reshape Finance

Digitalization has an essential influence on the global finance system, and it is completely reshaping the whole finance system. This reframing is significantly marked by the emergence of new digital assets such as cryptocurrencies and stablecoins, financial technologies, the enhanced usage of cloud computing and artificial intelligence in financial services, and the potential for Central Bank Digital Currencies (CBDCs).

CBDCs have become a relevant topic in the Global Finance system because they essentially redesign finance by modernizing payment systems, developing efficiency, enhancing financial inclusion for the unbanked, and also improving the security of cross-border payments. Let’s know more about the CBDCs and their potential features that impact in reshaping of the Global Finance system. This article will explain what Central Bank Digital Currencies (CBDCs) are, their Different types, and their impact in reshaping Finance.

What are CBDCs?

Central Bank Digital Currencies (CBDCs) are a digitally issued type of fiat currency of the country, which is regulated and backed by the central bank. This delivers straight access to the digital central bank money without the necessity for 3rd party entities for assuring a proficient, secure, and government-connected method of payment. CBDCs are different from cryptocurrencies as they are backed by the government and not any private firms, delivering huge stability and significantly enhanced features such as programmability or enhanced financial inclusion.

The primary features of Central Bank Digital Currencies that stand out from other currencies are Financial inclusion, Monetary Policy enhancement, Programmable Money, Efficiency, Lower cost, and Innovation. CBDC is recognized as a legal mode of payment within the Jurisdiction, a differentiation from other e-payment techniques. It is a liability of the central bank, which is equivalent to physical cash. Despite cryptocurrencies, the value of CBDC is pegged one-to-one with the national currency of the nation to ensure stability.

Additionally, Central Bank Digital Currencies (CBDCs) are being reshaped to be regulated and centralized, and their main aim is to boost efficiency as well as financial inclusion by delivering a low-cost and public payment infrastructure. The main difference between cryptocurrencies and CBDCs is that CBDCs are issued by the government, while cryptocurrencies are not issued by a central authority.

On the other hand, the major difference between CBDCs and Stablecoins is that CBDCs are public instruments highlighting a central bank liability, while stablecoins are private digital currencies linked to a fiat currency.

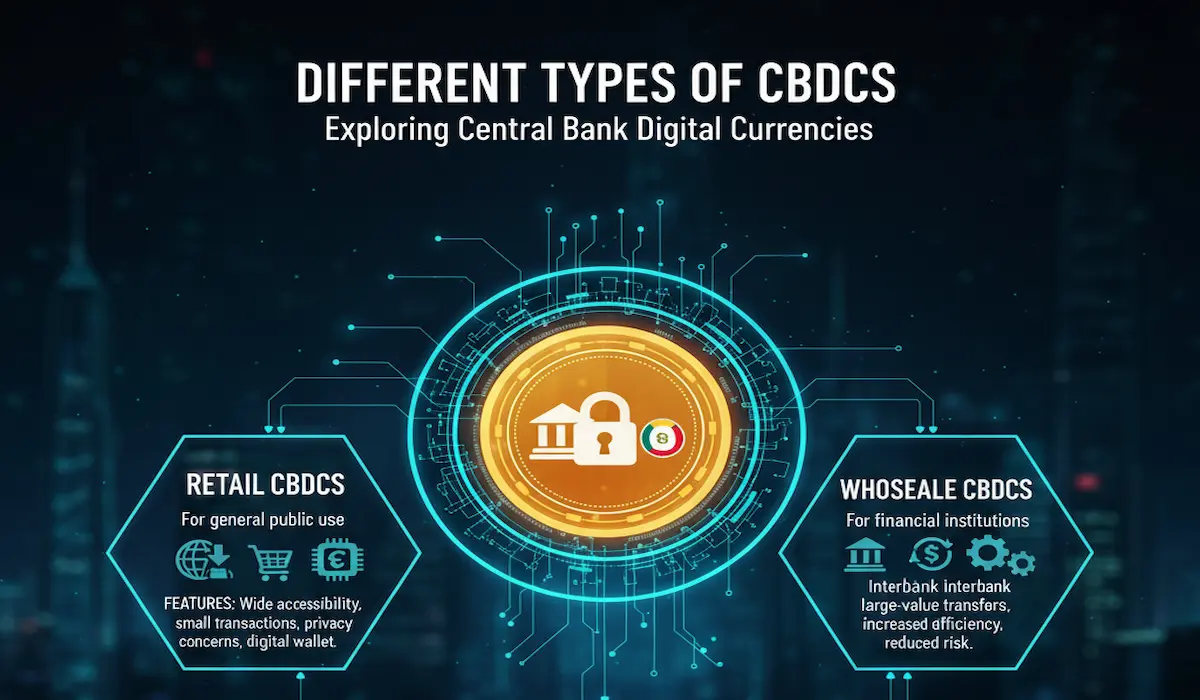

Different Types of CBDCs

The different types of Central Bank Digital Currencies (CBDCs) are Wholesale CBDCs for financial firms and Retail CBDCs for public usage.

1. Wholesale CBDCs for financial firms

The main purpose of the Wholesale CBDCs is to enhance the proficiency of interbank and securities settlements among financial firms. These CBDCs are mainly utilized by banks and other financial firms, and their analogy is comparable to present central bank reserves, which are utilized for interbank transfers. The key features of wholesale CBDCs are to reduce settlement delays and transaction charges and increase the efficiency of the whole financial system.

The major use cases of Wholesale CBDCs include real-time clearing of huge transactions, boosting faster interbank payments, and slower banking networks, decreasing reliance on traditional and cross-border settlements. Major examples are Project Jura, Project Helvetia, and Project Ubin.

2. Retail CBDCs for Public Usage

Retail CBDCs are government-issued digital currencies for business and consumers. The main benefit of these CBDCs is that they decrease the difficulties of losing digital assets if a private digital asset issuer fails. Retail CBDCs can be categorized into two types: Account-based retail CBDCs and Token-Based retail CBDCs. Account-based retail CBDCs need digital identification for account availability, while token-based retail CBDCs are available with public keys, private keys, and both.

Retail CBDCs are mainly utilized by the general public for commercial transactions, like peer-to-peer payments and purchasing services or goods. The major users of the Retail CBDCs are businesses and individuals, and their analogy includes the digital form of physical cash. Its use cases consist of public transport charges, e-commerce, everyday payments, and peer-to-peer transfers.

Retail CBDCs are available via payment platforms, digital wallets, government digital IDs, and mobile banking apps to ensure broad accessibility. Additionally, these CBDCs help in enhancing financial inclusion by providing underbanked and unbanked populations with access to a protective digital payment system. Best examples of Retail CBDCs for public usage are Nigeria’s eNaira, the Digital Yuan of China, and the Bahamas’ Sand Dollar.

How CBDCs Could Reshape Finance?

CBDCs have the capability to essentially reshape finance by increasing the payment speed, financial inclusion, modifying the global balance of monetary power, and changing the roles of commercial banks. Further, the extent of the impact of CBDCs will depend highly on the unique design choices of each nation and approach to its implementation.

CBDCs could deliver digital financial services to populations that lack access to the traditional banking system, rarely requiring a digital wallet and phone. It tends to cheaper and quicker payments, mainly for cross-border transactions, and it decreases the necessity of intermediaries.

Nations such as the Bahamas and Nigeria have already established retail CDBCs like Sand Dollar and eNaira. One of the main benefits provided by CBDCs in the financial system is that it may lead clients to hold cash directly with the central bank by challenging the traditional banking system, and influencing the credit availability and profitability of the bank.

CBDCs could reshape global trade by operating cheaper cross-border transactions, significantly influencing existing systems such as SWIFT and impacting currency dominance. It motivates new financial services and products, boosting innovation in digital payments, Decentralized Finance (DeFi), and cross-border transactions. Like benefits, CBDCs have some drawbacks, such as being vulnerable to data breaches and cyber attacks, and increasing difficulties regarding surveillance and government oversight of financial actions. Similarly, CBDCs could potentially exacerbate the difficulties of bank operations or deposit disintermediation, mainly in the period of financial crisis or in nations with a smaller number of developed banking industries.

Moreover, CBDCs could offer central banks new and more tools to handle interest rates, money movement, and overall financial stability, effectively activating instant and more targeted policy reactions to financial situations. Initiatives such as mBridge are expanding platforms for multi-CBDC interoperability to operate effectively in cross-border transactions

Bottom Line

In the Digitalized world, CDBCs are becoming a reality, shaping the future of economies across the world. The key features of CDBCs, such as efficient security measures and government-backed digital payments, made an efficient variation in the global finance system. The influence of Central Bank Digital Currencies could be transformative from financial inclusion to cross-border transactions, and the main thing that provides more care is its implementation process. Currently, the majority of countries utilize CBDCs; their future adoption is quite probable. The upcoming decade will provide Artificial Intelligence-powered financial solutions, smart contract integration, and multi-CBDC platforms for strengthening the efficiency of Central Bank Digital Currencies to become the essential mode of digital money.

Crypto & Blockchain Expert