Centralized vs Decentralized Exchanges: Comparison 2025

Centralized and Decentralized crypto exchanges are both important types of exchanges, but choosing the best-suited one for you mainly depends on the Business needs of the project.

Decentralized Exchanges (DEX)

A DEX or Decentralized Exchange is a peer-to-peer marketplace where users can trade cryptocurrencies without the need for an intermediary like a Bank or financial institutions to facilitate the transfer and custody of funds. DEXs, unlike traditional institutions like banks, brokers, and payment processors, use blockchain-based smart contracts that enable the exchange of assets.

Types of DEXs

- Automated Market Makers (AMMs): Automated market makers are a type of decentralised exchange that uses algorithmic “Money robots” to make it easy for traders to buy and sell crypto assets.

- Order Book DEXs: Such as dYdX and Serum, integrate the speed of centralised trading with the benefits of decentralisation, giving users the best of both worlds.

- DEX aggregator: is a service that brings together liquidity from various decentralised exchanges and market makers, aiding users in finding an optimal price for a trade.

Benefits of Trading on Decentralized Crypto Exchanges

- Anonymity: Investors who choose cryptocurrency for its anonymity would be defeating the whole purpose by trading on a centralised crypto exchange, since they have to register and undergo a verification process.

- Security: Decentralised crypto exchanges are a more secure option since there is limited sharing of data with any third party. Additionally, the very setup makes it impossible for hackers to break in.

- Non-custodial trading: Such platforms do not hold a crypto trader’s passwords or funds. They let the users trade directly from their wallets using smart contracts. This way, users can swap their crypto funds directly without depositing them into the DEX platform.

- Lower Fees: DEXs function through self-executing smart contracts, which allows them to charge less compared to centralized exchanges.

Centralized Exchanges(CEX)

A centralized cryptocurrency exchange, or CEX, is very similar to traditional payment systems like banks and other financial institutions. They behave like intermediaries between buyers and sellers, providing a secure space with a user-friendly interface with various other services to enhance the trading experience.

Major CEX platforms

- Binance

- Bybit

- Coinbase

- Upbit

- OKX

- Bitget

- Gate

- MEXC

- KuCoin

- HTX

Features of Centralized Exchanges

- All users must create accounts and provide their personal information, and complete identity verification (KYC) processes in order to have access to centralised exchange systems.

- Due to a larger user base, Centralised exchanges have comparatively higher liquidity. This enables faster transactions and better price stability.

- Advanced trading tools like charts, Indicators, Stop-loss, etc., which are essential for trading, are available on centralised Exchanges

- CEXs provide customer support to assist users with issues or inquiries.

Disadvantages of Centralized Exchanges

- Risk of single-point failure or loss of funds. In case of cyber attacks, users can lose all assets stored in their wallets if the company lacks sufficient resources and security measures to protect itself.

- No full control over your funds. On a CEX, you transfer your cryptocurrency to wallets controlled by the exchange, which means that in situations like bankruptcy or account suspension, recovering assets may be difficult.

- KYC procedures and reduced anonymity. Most Centralized exchanges require mandatory identity verification, which significantly reduces anonymity and demoralizes those who value privacy.

- High fees on transactions. Each trade, deposit, and withdrawal from a centralised exchange requires fees.

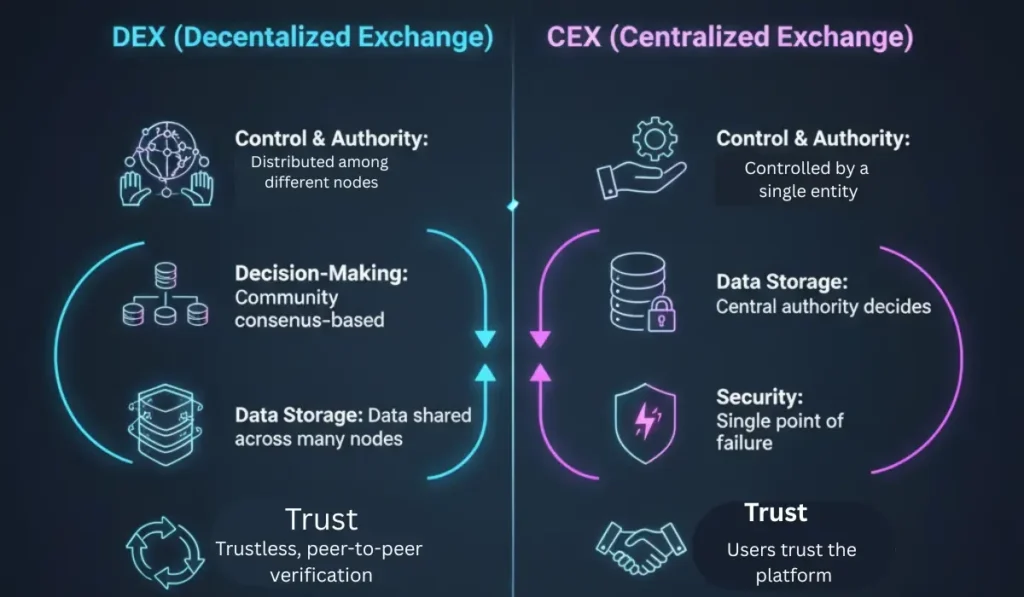

Differences Between Decentralized Blockchain and Centralized Blockchain

Decentralised and centralized blockchains are not the same thing; they both have their own areas where they serve their purpose to their respective business needs. The main factors that can tell them apart include control, data handling, security, transparency, and operational mechanisms.

Control and Authority

A single Authority or entity controls the centralized blockchain. Decentralized blockchain, however, distributes control among multiple participants or nodes. No single entity has complete control.

Decision-Making

There is a central authority that makes decisions in a centralized blockchain system. Decentralised system, decisions are made collaboratively. It’s a consensus process.

Data Storage and Transparency

Centralized blockchain systems operate by saving all their data in one place, which can be the central server or their Database. Decentralised Blockchains are transparent, meaning they store their data across multiple nodes or participants in the network. This helps ensure data transparency and data security, hence any participants can view any transactions or processes on the decentralised blockchain.

Security and reliability

A centralised Blockchain has a single point of failure because the data is stored in a central system or database. If the system is attacked or gets corrupted, it will affect the entire blockchain system. Unlike a decentralized blockchain system, where all users contribute to the system’s database, and each user has a copy of each transaction that occurs in the system.

Trust

There is no need to trust anyone on the decentralised blockchain before carrying out any transaction because there exists a peer-to-peer mechanism that allows each user to verify the transparency of any transaction; each participant or node has a copy of any transaction.

Maintenance

Centralized blockchain acts like a bank or other centralized institutions. There is an entity that has control over every transaction and every aspect of a centralised blockchain. There is a single person or organisation responsible for managing the entire blockchain. Decentralised blockchains are entirely different. There is no single point of control or a centralised authority. Data travels across multiple nodes or computers, and each one of them holds a copy of every transaction. To make a change in the network coordination between millions of nodes is required, and this makes maintaining them a complex procedure.

Comparison Table of Centralized Blockchain (CEX) and Decentralized Blockchain (DEX)

| The central authority makes all major decisions. | Centralized Blockchain (CEX) | Decentralized Blockchain (DEX) |

|---|---|---|

| Control and Authority | Controlled by a single authority or entity. | Control is distributed among multiple participants or nodes; no single entity has complete control. |

| Decision-Making | Central authority makes all major decisions. | Decisions are made collaboratively through a consensus process. |

| Data Storage and Transparency | Data is stored in one central location (server or database). | Data is stored across multiple nodes, ensuring transparency and security. Any participant can view transactions. |

| Security and Reliability | Has a single point of failure — if the central system is attacked or corrupted, the whole network is affected. | More secure and reliable — every participant holds a copy of the ledger, reducing the risk of total failure. |

| Trust | Users must trust the central authority managing the system. | No need for trust — transactions are verified through peer-to-peer mechanisms, and all participants can validate them. |

| Maintenance | Managed by a single organization or authority, similar to a bank. Easier to maintain but less transparent. | No single point of control; maintenance requires coordination across multiple nodes, making it more complex but more democratic. |

Conclusion

Decentralized exchanges and centralized exchanges are both important payment exchanges, and choosing between them mainly hinges on individual priorities. Centralized exchanges are the go-to options when you are prioritizing convenience, anonymity, liquidity, and regulatory compliance. However, if you value privacy, control, and transparency, use decentralized exchanges.

FAQs

Bitcoin is a decentralized cryptocurrency

Trust Wallet is a decentralized wallet, as it lets users have complete control over their private key.

ETH is a decentralized cryptocurrency.

Yes, Solana is decentralized.

According to our data, Uniswap is the most rated decentralized exchange.

Crypto & Blockchain Expert