Cardano (ADA) Long-Term Price Prediction 2025, 2026 – 2030

Known for its scientific approach to development, strong academic foundations, and focus on scalability, Cardano has emerged as a leading blockchain platform. As the crypto market is constantly evolving and the blockchain’s overall adoption is scaling new heights, the position of Cardano remains highly vital in this scene. In this article, we will take a look at Cardano’s long-term price prediction 2026 – 2030 based on its intrinsic value and its expanding array of use cases.

What is Cardano (ADA)?

Cardano is the first-ever proof-of-stake blockchain founded on peer-reviewed research and one that uses evidence-based methods for development. Cardano aims to provide an unmatched security and sustainability to applications, systems, and societies.

The total supply of Cardano is capped at 44 billion ADA. Since it uses a proof-of-stake mechanism for its blockchain, Cardano is an environmentally friendly cryptocurrency.

The History of Cardano (ADA)

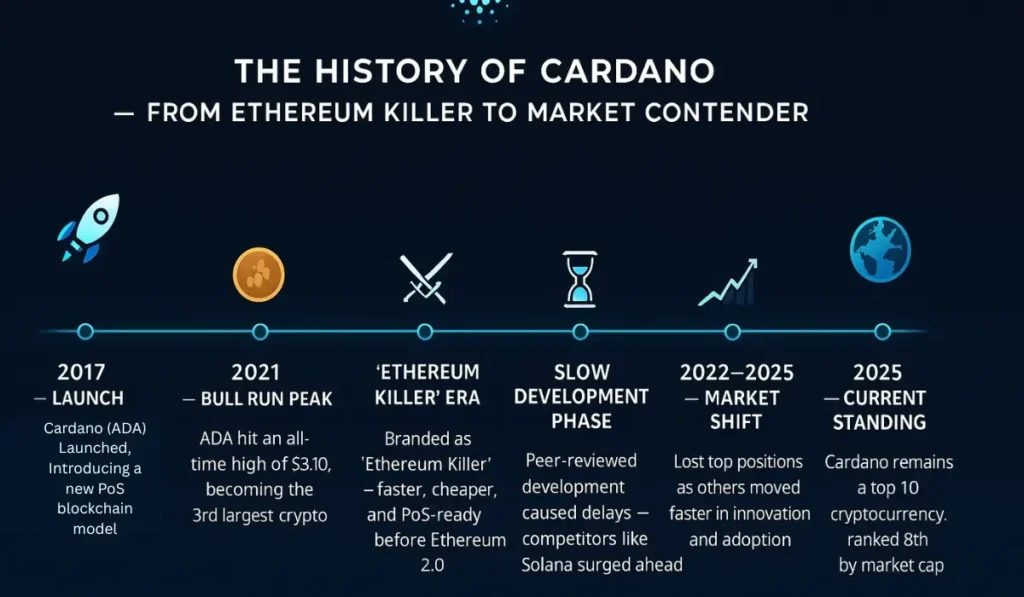

Cardano was launched in 2017. Since its arrival in the market, it has shown high volatility. Cardano prices used to spike during bull runs of the market. In 2021, ADA reached its all-time high of $3.10.

AT its peak performance, Cardano was the 3rd best cryptocurrency behind Bitcoin and Ethereum by market capitalization. Soon, Cardano was branded as the Ethereum killer since Ethereum hadn’t yet transitioned to a proof-of-stake mechanism, and it was slow and had high fees.

Cardano, on the other hand, worked on a PoS, had low fees, and extreme speeds. These were reasons enough to be branded as an Ethereum killer, especially when Cardano was targeting the domain that was dominated by Ethereum.

However, since the spike in 2021, Cardano has fallen behind the competition to other coins like Solana. A major reason for this slow progression was the peer-reviewed development process. This consumed a lot of time till deployment, and Solana overtook Cardano. After the competition pushed Cardano to the back, as of 2025, Cardano is the number 8th cryptocurrency by market capitalization.

Cardano Price Prediction

The Cardano price prediction is a complicated journey as it is affected by a multitude of factors that work in unison to decide the outcome.

Through this article, we aim to predict the future price of Cardano on a long-term basis by analysing the factors that contribute to determining the price.

If we look at Cardano’s price history, we see sharp spikes and major dips as well. However, an interesting fact is that despite the ups and downs, Cardano appears to be stabilizing itself. Even if at the present moment Cardano’s trend seems to be mildly bullish, there is a need for a higher momentum to sustain this growth. If Cardano can maintain the support above $0.67, there is a chance that it can rise to $0.7 or $0.74.

On the other hand, if the support breaks and Cardano falls below $0.64, the prices could consequently go lower than $0.60.From the available information, it seems Cardano is on a careful bullish path. The reason behind this bullish rise could be that the market is gradually building momentum towards more buys.

At the moment, Cardano is offering a mixed opportunity for trade. While the scalability and use case of Cardano remain unquestioned, the volatile nature of the currency is what upsets most investors. Whether Cardano is a good investment is a topic that is often debated. One of the major reasons why Cardano ever got to join the top three was because of its peculiar design that focused on peer-reviewed development. However, it was the same peer-reviewed development that slowed its pace.

So, to address the question, is Cardano a good investment? We must look beyond the technicalities of the blockchain and analyze the market data as well. Cardano’s ability to recover from its drop depends on market sentiment and adoption. With major updates and releases, for instance, the Hydra Layer-2 scaling, on the way, there is an increased buzz around Cardano’s comeback. This could positively affect the price if investor sentiment becomes more optimistic.

Cardano Price Prediction 2026 – 2030

| YEAR | LOW | AVERAGE | HIGH |

|---|---|---|---|

| 2026 | $1.31 | $1.35 | $1.61 |

| 2027 | $1.87 | $1.92 | $2.24 |

| 2028 | $2.94 | $3.02 | $3.36 |

| 2029 | $4.24 | $4.39 | $5.10 |

| 2030 | $5.38 | $5.57 | $6.50 |

Future of Cardano

Blockchains like Cardano have an intrinsic value because of the technology behind them. The services they offer apply to real-world applications, and hence Cardano has a future if it can deploy its blockchain to its full potential. The value of Cardano rises when the blockchain becomes more attractive to projects and users. However, the price of Cardano depends on factors besides user attraction. This is courtesy of Cardano’s existing market environment.

A coin deployed on the market will be subject to the market’s movements as well. While the technical benefits give such assets an edge over their competition, the technical superiority alone cannot determine whether the price will spike or not.

However, we can look into the Pros and Cons of investing in Cardano.

Pros of Investing in Cardano

- Since Cardano has a capped supply, which is similar to Bitcoin, prices can increase significantly based on future demand.

- Cardano is a constantly evolving blockchain. This means real-world use cases keep on getting added to the system, making it more desirable and providing it with intrinsic value.

- Another aspect of the benefit of investing in Cardano is its partnership. Cardano has at the moment partnerships with the European Investment Bank and the Japan Bank for International Cooperation. Having ties with such financial giants is a positive sign when it comes to a cryptocurrency.

- When one of the world’s most dominant powers, the USA, accepts a cryptocurrency as a strategic reserve, it is a good sign of investment.

Cons of Investing in Cardano

- Slow development has been plaguing Cardano’s future. The peer-review process is rather time-consuming. This was one of the major reasons why, despite being launched in 2017, it took Cardano four years to launch its smart contract.

- The slow development makes room for competitors to get ahead and position themselves among the potential investors.

- The high volatility of Cardano makes it a bad choice for investors looking for short-term profit.

Conclusion – Cardano Price Prediction

Like any volatile asset, the accurate prediction of prices is not possible for Cardano. However, by making use of industry news, technical analysis, and market sentiments, we can make informed decisions. With cryptocurrencies, navigating the domain of price is a complicated and precarious task. The best way to approach this ever-shifting landscape is to be armed with knowledge and information.

| Disclaimer: These crypto price forecasts are based on predictive modeling and should not be considered financial advice. |

FAQs

Cardano is in constant evolution; the technical nature of the blockchain speaks to a larger group of developers and users, so technically, its currency, ADA, may still have a future.

No. Technical updates have proven to fail sometimes; in such instances, the more volatile an asset already is, the higher its volatility becomes.

Cardano’s delayed development has cost it some of the major industry partnerships that Solana was able to capitalize on; however, with plenty of such institutional powers waiting to enter the market, Cardano still has a chance to pose a threat to Solana or even overtake it.

Cardano uses a peer-to-peer review model for verifying the technical stability and validity of its projects. This is a time-intensive process and is the primary reason why several of Cardano’s projects got delayed.

A project or development’s success does not correspond to market success, as its real-world adoption is what will determine its finality. A successful project adopted by the global market could mean Cardano’s financial success and thereby rising prices of ADA.

Crypto & Blockchain Expert