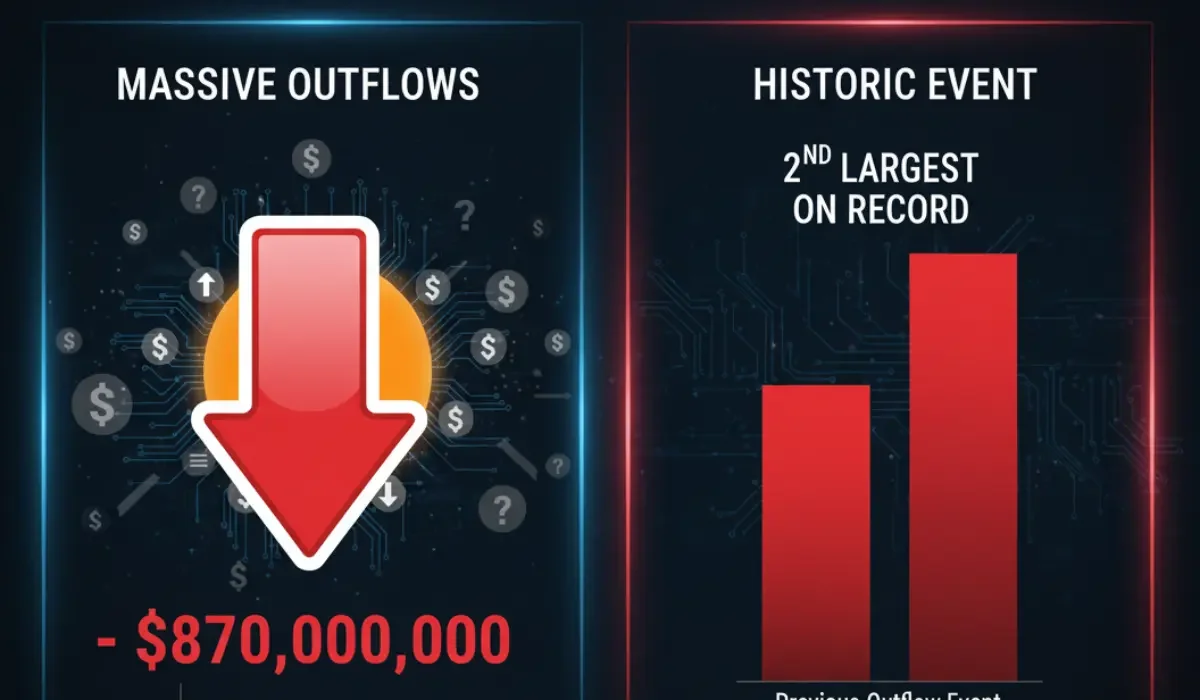

U.S. Spot Bitcoin ETFs See $870M in Outflows, Second-Largest on Record

Key Takeaways

- Spot Bitcoin ETFs registered their second-largest daily outflows on November 13, after nearly $870 million exited the funds. The largest outflow occurred in February 2025, when the BTC-backed products witnessed $1.14 billion in liquidations.

- Grayscale’s BTC ($318.2 million) led in outflows, followed by BlackRock’s IBIT ($256.6 million), Fidelity’s FBTC ($119.9 million), and Bitwise’s BITB ($47.03 million).

- These outflows also coincided with Bitcoin’s price dropping below $100,000 for the first time in over 6 months. Liquidations across leveraged BTC longs hit $190.65 million, a signal that investors are taking a risk-off approach amid macro uncertainty.

U.S. spot bitcoin exchange-traded funds (ETFs) reported total net outflows of $869.86 million, marking the second-largest single-day outflows from the investment products tracking the price performance of the world’s most valuable digital asset.

The largest daily outflows occurred on February 25, 2025, when the funds saw $1.14 billion exit the market. Meanwhile, investors have pulled out around $2.64 billion from the ETFs in the past three weeks, signalling market-wide caution amid looming regulatory uncertainty.

Bitcoin ETFs See $870 Million in Daily Outflows, Second-Largest on Record, Amid Uncertainty Surrounding Fed Policy

According to data procured by SoSoValue, Grayscale’s Bitcoin Mini Trust (BTC) saw the largest outflow at $318.2 million, followed by BlackRock’s IBIT, which recorded $256.6 million in net exits. Meanwhile, Fidelity’s FBTC saw $119.9 million, Bitwise (BITB) had $47.03 million, Invesco’s BTCO ($30.80 million), Ark Invest and 21Shares’ ARKB ($15.68 million), VanEck’s HODL ($8.34 million), Franklin Templeton’s EZBC ($5.69 million), and Valkyrie’s BRRR ($3.05 million) also posted outflows.

Thursday’s exits also coincided with Bitcoin (BTC) slipping below the $100,000 mark for the first time in more than 180 days. The world’s largest crypto asset by market capitalization dropped as low as $96,682 during Asian trading hours.

CoinGlass data showed that daily liquidations in leveraged long positions across the cryptocurrency market hit $316 million, prompting several traders to take profits. Liquidations for bets anticipating prices to rise for BTC reached $190.65 million, while Ethereum (ETH) hit $49.88 million. Meanwhile, spot Ethereum ETFs registered a net outflow of $259.72 million, its highest daily exit since October 13.

Market Analysts Say ETF and Derivatives Liquidations-Led Decline is a Gateway for Opportunistic Investors

Vincent Liu, chief investment officer at Kronos Research, noted that large ETF outflows signal a “risk-off reset” and reflect institutions “pulling back” amid macro shocks. He suggested that inflow and outflow weigh on short-term momentum but don’t affect the broader structural demand, and the “bleed-outs” align with oversold conditions, which opens the door to “long-term opportunists”.

Min Jung, research associate at Presto Research, echoed Liu’s sentiments, stating that the outflows are a signal of a broader de-risking across capital markets. He argued that investors are pulling capital from high-beta assets such as crypto and equities and rotating it to cash, bonds, or gold.

This de-risking behavior can be associated with uncertainty surrounding the Federal Reserve’s policy direction, which has deteriorated macro sentiment.

Speaking on bitcoin’s price decline, Liu said that it is likely to have come from “cascading liquidations” meeting “thinning bid stack.” According to him, demand support is clustered around the $92,000 to $95,000 one, with buyers here gradually helping rebuild market depth. Liu says that until fresh flows refill the order books, volatility stays “front and center”.

Justin d’Anethan, head of research at Arctic Digital, said that the bitcoin market is currently sitting in a support zone, but if the prices were to go lower, then it could drop below the next key level, which is in the lower $90,000 range. He noted that those ranges would be interpreted by many investors as a buying opportunity, especially those who didn’t enter the market when BTC was pushing the mid $120,000.

Presto’s Jung said that there was no single catalyst driving the ongoing decline, and it appears to be caused by a mix of macro uncertainty and weakening investor risk appetite.

Softening labor market data has triggered a cautious stance from the Federal Reserve. The CME FedWatch index has slashed its odds for a Fed rate-cut expectation in December to 52.1%, signaling a tightened liquidity market.

At the time of writing, Bitcoin (BTC) is trading at $96,712 – down 6.14% in 24 hours.

Crypto & Blockchain Expert