Is Bitcoin Mining Profitable In 2025? How Much Does It Cost To Mine A BTC?

Is Bitcoin mining profitable? This has been a question on people’s minds for the longest time, and to put it simply, it is complicated to give a definite answer.

Last year was monumental for Bitcoin; the blockchain experienced its fourth halving event, reducing the rewards miners earned per block to 3.125 BTC; the first-ever exchange-traded fund (ETF) tracking BTC began trading in the US; its price hit the coveted $100,000 mark; and America elected Donald Trump as President, who promised to adopt Bitcoin as a strategic reserve asset for the government.

Despite the favorable circumstances, many smaller miners were forced to shut shop due to issues related to cost efficiency. This has led many to question whether it remains viable to step foot into Bitcoin mining in 2025.

In this blog, we will detail everything you need to know about Bitcoin mining, such as its core concept, the equipment and costs involved, and strategies to maximize profits to help you make a decision.

What is Bitcoin Mining?

Mining is the process by which new Bitcoins are entered into circulation. This is done by validating transactions and adding them to the network, which is a public ledger known as the blockchain. Adding transaction blocks to the chain requires miners to solve a complex mathematical problem, which is not an easy task.

For this purpose, miners employ specialized computers called Application Specific Integrated Circuits (ASICs), which perform the cryptographic calculations necessary to verify transactions and, in return, reward them with freshly minted Bitcoins. This process is essential to issuing new BTC and for maintaining the security and integrity of the network.

The rewards are paid out to the miner who solved the puzzle first, and this process is repeated approximately every 10 minutes for every ASIC miner connected to the network. The puzzle’s difficulty is adjusted every 2,016 blocks (approximately 14 days) to ensure that only one miner, on average, can solve the puzzle within the block time. Network difficulty is calculated by the amount of hashrate, or computing power, contributed to the network.

Bitcoin’s algorithm is also designed to reduce the block reward by 50% after every 210,000 mined blocks. It takes roughly four years for the network to reach that threshold, at which point, the number of BTC issued per block is halved. This is known as the “halving” cycle.

The reward that miners receive for successfully solving a Bitcoin block in 2025 is 3.125 BTC, which is worth about $347,060 today. This number will reduce to 1.5625 BTC per block mined following the next halving, which is to be expected in early 2028.

Back in 2009, when the world was first introduced to Bitcoin, mining was merely a hobby and could be done on any personal computer. Bitcoin was not even worth a penny, and miners could earn 50 BTC every 10 minutes. Today, those Bitcoins are worth over $5.5 million.

Core Components of Bitcoin Mining

While mining is the backbone of the Bitcoin network’s proof-of-work consensus, its core components are the following:

Block Reward

This is the payout that miners receive for securing the Bitcoin blockchain by validating transactions and solving the cryptographic puzzle. A block reward typically consists of two components: the block subsidy, which is the number of new coins generated, and a cut from the block’s transaction fee. It serves as an incentive for miners and is also the primary way in which new BTC enters circulation.

Mining Hardware

These are specialized computers designed solely to perform the complex calculations required to validate transactions and mine Bitcoins. While there are two main types of hardware used in Bitcoin mining: GPUs and ASICs, it is the latter that has become the dominant choice due to their ability to produce more BTC per watt of energy used.

Hash Rate

Hashrate refers to the total computing power used by miners to solve the cryptographic puzzle required to validate transactions, add new blocks, and mine fresh Bitcoins. It is measured in hashes per second (H/s), with larger units like exahashes per second (EH/s) used for the massive scale of Bitcoin transactions. A higher hash rate indicates more computational power is being dedicated to the network, thereby increasing the security and making it more difficult to be attacked. The more computing power a machine has, the more BTC it is likely to mine.

How Do Miners Calculate Their Earnings from Mining Bitcoin?

The underlying cost of Bitcoin mining is the energy consumed. To be profitable, miners’ revenue has to outweigh the energy costs and the original investment that went into the hardware.

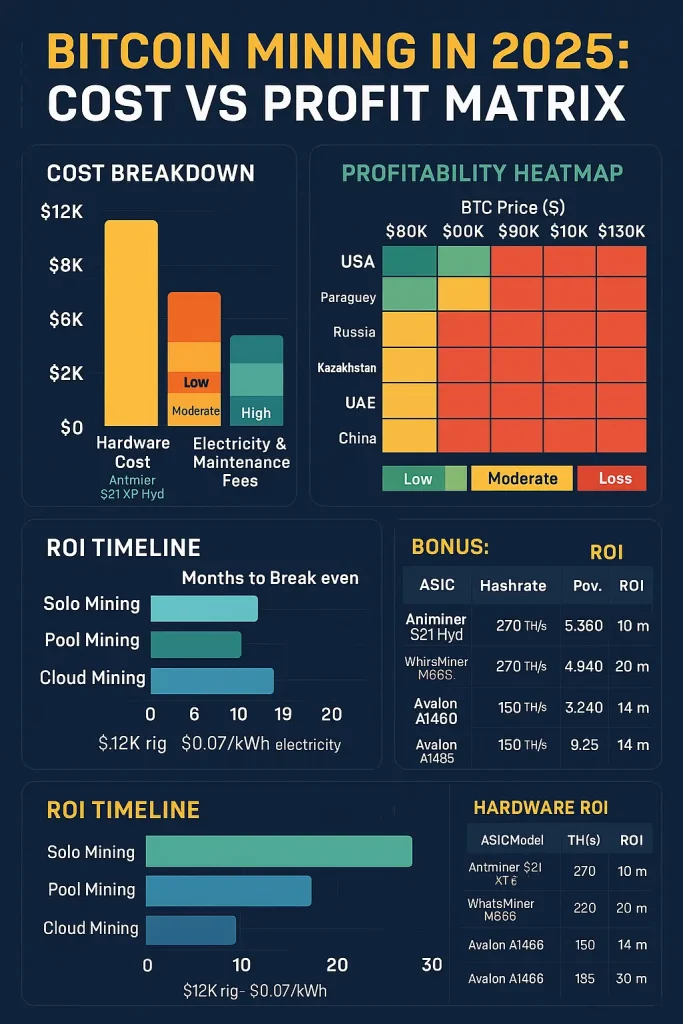

- The primary source of income for Bitcoin miners is the block reward, which is paid out roughly every ten minutes in the form of newly minted BTC to the machine that was the first to discover the new block. Bitcoin’s code is predetermined to halve this payout every 210,000 blocks. The original mining reward, set in 2009, was 50 BTC, which was reduced to 25 BTC in late 2012, halved again to 12.5 BTC in mid-2016, and then to 6.25 BTC in early 2020. During the fourth-ever halving, which took place in April 2024, the block reward was reduced to 3.125 BTC. The next halving cycle is estimated to occur in March 2028. At an electricity rate of $0.05 per kWh, using the Antminer S21 XP Hyd producing 860 TH/s, a miner would need BTC to stay above $85,000 to break even monthly. At higher rates like $0.12/kWh, profitability drops unless Bitcoin exceeds $130,000.

- The second revenue source for miners is the transaction fees that users pay when they transact with BTC. Since Bitcoin is a decentralized network that does not rely on a single intermediary, it is the miners who record transactions, and a copy of each transaction is sent to every miner on the network, thereby maintaining a ledger proof that is unchangeable. Miners charge a cut from the transaction fee for securing the blockchain.

- Miners also pay taxes on their rewards, and it is important for every miner to know the relevant tax laws for Bitcoin mining in their respective jurisdictions. It is important to use software that helps track the amount of tax that needs to be paid on the block revenue earned.

Factors Affecting Bitcoin Mining Profitability in 2025

Here are the key factors that could affect your Bitcoin mining profitability in 2025:

Hash Rate

The Bitcoin hashrate has been growing at breakneck speeds as more miners participate in the network. As of May 1, 2025, the total computational power of the blockchain has reached 831 EH/s, peaking at 921 EH/s earlier this year. This represents a 77% increase from the 2024 low of 519 EH/s. The growing hashrate reflects the industry’s focus on efficiency, with larger mining firms investing in more powerful machinery that is energy optimized to maintain high productivity and profits.

Hardware Costs

The cost of mining rigs can vary significantly depending on the model chosen by miners and their performance. High-performance ASICs like the Bitmain Antminer S21e XP Hyd 3U, which offers a hashrate of 860 TH/s while consuming 11,180W, can cost up to $17,210. Other models like the Antiminer S21 XP+ Hyd are available at a lower price point of $12,700, but with reduced performance. Despite Bitcoin being priced at over $100,000, compared to just $20,000 in 2022, the cost of mining hardware has significantly reduced, meaning miners can now purchase better machines on a lower budget, improving the overall mining efficiency.

Energy Consumption

Bitcoin mining is notoriously famous for its high energy consumption. While environmental organizations are urging miners to take a more eco-friendly approach, large-scale mining firms are turning to clean and renewable energy sources to mine BTC. This not only helps reduce electricity costs, but is also a boost for countries or regions with abundant resources but underdeveloped energy infrastructure that wish to explore Bitcoin mining.

Regulatory Environment

While an increasing number of countries are now open to Bitcoin mining, there are still some jurisdictions that have outright banned the activity. The regulatory landscape of the miner’s location can significantly impact their profitability. Stricter regulations can increase operational costs or even lead to bans. In 2025, many countries have begun adopting a more favorable stance towards crypto mining and are offering incentives for sustainable mining practices. Therefore, it is important to understand how regulations and taxes work for crypto in each country before getting into Bitcoin mining.

Market Volatility

Bitcoin is a highly volatile asset, and it directly affects mining profitability. During a bull market, BTC price can go higher, and this makes mining more profitable, while a bear market can work the opposite way. Miners need to be adept at reading market trends and adjusting their strategy accordingly.

How to Mine Bitcoin in 2025?

In 2025, there are several ways in which you can mine Bitcoin, each with its own set of pros and cons. The primary mining strategies include:

Solo Mining

In this method, miners attempt to solve blocks and mine Bitcoin using their own hardware and resources. If successful, they will receive the full block reward and transaction fees. This setup can yield high returns, especially when the BTC price is on the rise. However, the odds of a solo miner solving a block are extremely low due to the network’s high difficulty, and it requires substantial computing power, leading to inconsistent income for the miner. Additionally, miners must contend with high energy costs and infrastructure requirements. Assuming daily earnings of $35 and a rig cost of $10,000, it would take ~285 days to break even, excluding electricity and maintenance. So, solo mining is not recommended for beginners or those without significant resources.

Pool Mining

Miners can host their machines on mining pools that are managed by professional hosting service providers that combine the computational power of other miners in the farm to increase the likelihood of successfully mining a block. While the Bitcoin earned as a reward is shared among participants based on their hash rate contribution, this method is easily recommendable because it reduces the complexities of equipment management and maintenance. Miners can also benefit from lower electricity rates and a better working environment. Pool mining is the most popular method today, with two of the largest mining pools, Foundry USA and Antpool, collectively controlling nearly 60% of Bitcoin’s hashrate.

Cloud Mining

This method involves miners leasing hardware or hash power from third parties. It offers a low entry bar into Bitcoin mining, where miners do not need to own or maintain physical equipment. Cloud mining also provides flexible contract terms and computing power options, and profitability can vary depending on market conditions and the terms of agreement. Miners need to rely on the trustworthiness of the service providers to earn an income.

Strategies to Maximize Profits when Mining Bitcoin

To remain profitable mining Bitcoin in 2025, miners need to adopt advanced strategies that are tailored to the needs of the ever-evolving market and technological landscape. Here are a few approaches we believe will help enhance your profitability:

- Use energy-efficient ASIC mining rigs for your mining operation. These devices offer high hash rates and consume less energy, making them ideal for maximizing profitability.

- Leverage renewable energy resources like solar, hydro, or wind, depending on their availability, to drastically cut electricity costs and improve overall efficiency and returns.

- Join mining pools to increase the likelihood of earning block rewards. While it may be less profitable than solo mining, the cost of infrastructure management will be considerably less, making the earnings worthwhile.

- Focus on setting up your mining business in areas with lower electricity rates, as it can drastically reduce operational expenses.

- Constantly monitor market trends and stay informed about Bitcoin’s price fluctuations and mining difficulty to adjust your strategies and maximize profits.

Final Thoughts – Is Botcoin Mining Profitable?

Bitcoin mining is not an easy business to recommend. While it can still be profitable in 2025, that depends on several other factors such as BTC’s price, electricity costs, the efficiency of mining hardware, and local regulatory and tax regimes.

The average home miner is unlikely to recoup the cost of hardware and electricity, making profitability a hard challenge. The most recommended method for mining Bitcoin is either joining a mining pool or a cloud-based service.

This situation may improve in the future when innovation in ASIC mining hardware can once again make it more profitable to solo mine, allowing small miners to re-enter the network. This will greatly decentralize the blockchain and uphold the original vision of Satoshi Nakamoto, Bitcoin’s pseudonymous founder.

Crypto & Blockchain Expert