What Is The Difference Between Ethereum and Ethereum Classic

If you are someone that is interested in technology, finance or, even just the digital era, I will hazard a guess that you have heard of a little something called Ethereum. While you may have heard its name in articles, or bandied around on internet forums, do you really know what it is?

Did you know there are such things as Ethereum and Ethereum Classic? And can you see the difference between Ethereum and Ethereum Classic?

In today’s world, a place where digital currencies are set to continue growing their market share, this is precisely the sort of knowledge that you should know, so we have helpfully provided you with a complete lowdown. Let’s read on to find out more.

What is Ethereum?

To explain what Ethereum is, could get somewhat complicated- after all this is new technology, the likes of which has not been seen before. At its most straightforward concept, Ethereum is a software platform which is based on blockchain technology.

If you are not sure what blockchain technology is, allow us to explain in brief. The blockchain is a revolutionary and ingenious invention – the brainchild of the brilliant and utterly anonymous Satoshi Nakamoto – the pseudonym behind Bitcoin itself. Since its design, it has grown and evolved into something even more amazing and its implications for the way we work and the way we will work in the future, are astounding.

Imagine a vast spreadsheet full of records of transactions and other data. Imagine that this worksheet is not stored on one computer and shared as a file between millions of people, instead imagine that the spreadsheets are on Google Sheets (in the cloud) and it exists on an infinite number of devices, and each time it is updated, it automatically updates on every other version.

Basically, the blockchain database and all of the information contained on it is not stored in any single, centralised location and this means that the records are entirely public and verifiable meaning it cannot be hacked, corrupted, stolen, or destroyed. As it is hosted by literally millions of computers all at the same time, the information it contains is accessible to anyone at anytime from anywhere. The great thing about blockchain is that it cannot be changed, edited, tampered with or disrupted in any way.

Now, back to Ethereum. It is similar to Bitcoin in some ways that it is a part of a distributed public blockchain network, although there are some pretty significant differences between the two regarding the purpose and what they are both capable of.

With Ethereum, miners work to earn something called Ether which is a type of crypto-token which makes the network work. Apart from being a form of useable and tradeable cryptocurrency, Ether can also be used by developers of applications to fund transaction fees and various services on the Ethereum network.

In a nutshell, “Ethereum is an open source, public, blockchain-based distributed computing platform featuring smart contract functionality”. But what is a smart contract? A smart contract is a bit of computer script which works to facilitate, enforce, and verify negotiations or the performance of a contract. They were created by Nick Szabo way back in 1996 before the blockchain or cryptocurrencies were a “thing”.

The idea is that a smart contract contains one, or some contractual clauses that can be entirely self-executing, partially self-executing, self-enforcing, or a combination of them all. The aim is that a smart contract provides an unparalleled level of security that is entirely superior to traditional arrangements and can also reduce the costs that are associated with other forms of contracting.

An example of this would be in a property transaction where several parties have to complete several actions for the money to be released and settled- the smart contract would only fulfil the obligation of paying the money, once other parties have completed their clauses of the deal. Smart contracts are used with different cryptocurrencies, but they are most prevalent with the Ethereum blockchain where they are referred to as a decentralised application, or DApp.

The most famous of these smart contracts was The DAO, a decentralised autonomous organisation for venture capital funding. It ran on Ethereum and was launched with US$250 million in crowdfunding in 2016. However, it was hacked and then drained of over 3.6 million ETH just three weeks later.

How Was DAO Created?

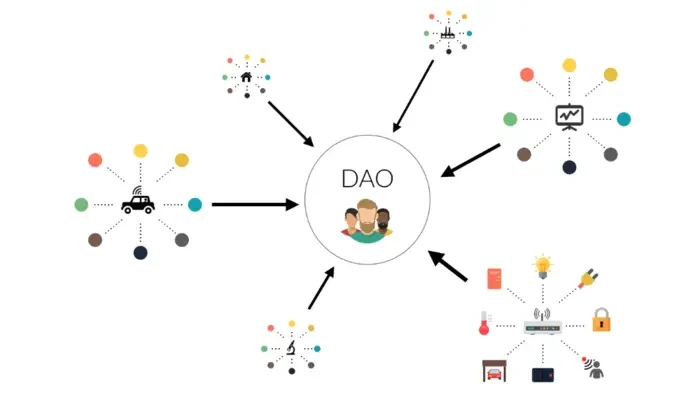

The DAO was a digital decentralised autonomous organisation which was a crowdfunding venture capital fund. Its objective was to provide a new business model, decentralised in nature, to facilitate commercial and non-profit enterprises. It was started on the Ethereum blockchain and had no traditional management, structure, or any authority overseeing it such as a board of directors, as you would find with a conventional structure.

Created from open-source code, DAO was stateless and not tied to any particular country, and as a result, it raised many issues regarding how government regulators may go about attempting to regulate a stateless fund.

The code behind the system was written by a programmer called Christoph Jentzsch and was promptly released on GitHub. Then on 30th of April 2016, a website was launched with a 28-day crowd sale to raise money to fund the concept. The sale of tokens raised a whopping US$34 million in just ten days along with more than US$50 million of Ether just two days later. By the 21st of May, the fund’s Ether value was an impressive US$150 million from only 11,000 investors. By the end of the month, the DAO held around 14% of all the Ether tokens that had been issued to that date.

The DAO Attack and The Consequences of It

The DAO raised significantly more money than its creators expected and this, of course, brought it a lot of attention. Some people had already highlighted that the marketing was better than the execution because there were concerns that the code had specific vulnerabilities, leaving it open for attack.

Once the crowd sale was over, there was much talk around the vulnerabilities and how they should be addressed. One of the creators of the DAO, Stephan Tual announced that a bug had been found but that it posed no risk to the funds in the DAO. While the Ethereum network doesnt’t, and didn’t, have any bugs in it, all networked systems are vulnerable in varying degrees to some attacks.

While DAO programmers were working on fixing the bug, and some other identified issues, an unknown hacker began to start draining the DAO of Ether currency that was collected through the sale of tokens.

By the 18th of June, the hacker had managed to syphon off over 3.6 million Ether into a subsidiary account, otherwise known as a child DAO which had the same structure as the original DAO (which saw the value of Ether drop from just over $20 to under $13).

Several attempts were made to split the DAO to stop more Ether from being stolen, but these efforts failed due to the individuals not being able to get the necessary votes in such a short period.

Due to the popularity of the project and the enormous amounts of money invested in it, the Ether were all stored on one single address which is not preferable for a project of this size and was generally a bad idea. It is believed that the volunteer stopped the attack voluntarily due to the action which was later taken known as the fork. However, another attack was possible at any time.

While over $50 million worth of Ether had been stolen, it was just sat in a child-DAO meaning that it wouldn’t be taken out or accessed due to the DAO smart contract stating explicitly that any funds in a DAO structure, must remain there for 28 days. With this considered, the Ethereum community came up with a wonderful idea.

Creation of Ethereum Classic

There were three options available to the team – do nothing, a soft-fork or a hard-fork. It was argued that making any changes to the system went against the very principles of blockchain and Ethereum, considering the adage that “code is law”. This, however, was voted on and the majority of the community voted on the hard fork option.

Now, this is where things get a little complicated. The concept of a hard-fork when referring to Ethereum is that it is a branch which separates from the main blockchain at a specified point, in this instance, it would stop at the point right before the hacker gained access to the system.

Until that end (block 1920000), the old and new chain would be entirely the same, however, after the hard fork, the two chains become entirely mutually exclusive entities. The new chain was given the name Ethereum, and the old chain was named Ethereum Classic.

The purpose of the hard fork option was to completely refund all of the money that had been syphoned from the DAO and put into the child DAO which was under the control of the hacker. It was done through a refund smart contract which had the only function of “withdraw”.

Therefore, every 100DAO, 1 Ether would be given back to the DAO token holders. It goes without saying that this idea caused a fair bit of controversy and the once united community was divided. Some were anti-hard fork and decided to remain with the old blockchain and refer to it as Ethereum Classic, and others moved to the new blockchain and referred to it merely as Ethereum.

This battle and divide are still raging within the community to this day- centred around both ethics and ideology, it has been dubbed as “the single most important moment in cryptocurrency history”.

How Is Ethereum Classic Different to Ethereum

Those that decided to retain the previous blockchain and stick with Ethereum Classic saw the value of Ether rise from $13 to around $17. Today, the market cap for Ethereum Classic is just over $1.5 billion, and it is ranked as the 5th most expensive cryptocurrency in the world. The question is, why did people decide to stick with the old blockchain when even the creators of Ethereum, moved to the new one?

The answer is something of a philosophical one and has its roots in the battle against financial corruption. Users of ETC place a lot of importance on the fact that blockchain was supposed to be unchangeable and resilient against the wishes of humans.

There are, however, some issues with ETC and these centre around the fact that it is incompatible with the Ethereum Hard Fork. Anyone that is part of the ETC is unable to access any of the future updates that were and are offered by ETH. Another failing is that many believe that ETC is a negative force that serves to attack the concept of Ethereum in the way that it is nothing more than an orphan chain that should be considered illegal.

The good point of ETC is that it honours and sticks to the original concept of Ethereum – something that cannot be changed at the will of a human, or anything else.

Of course, there are problems when it comes to ETH- we have already mentioned the issues around immutability and the philosophy and adage of “code being law”. The other significant point that was pinpointed was that, how can one be sure that there will be no more hard forks in the future? What happens if, on a human whim, one decides to make multiple hard forks and therefore creates various versions of Ethereum?

Such a move would massively devalue and destabilise the cryptocurrency, and the concept of cryptocurrency in general. With hundreds or even thousands of different versions of Ethereum running at the same time, it would be a total disaster.

ETH is now growing at an impressive rate and has the backing of all the key players that were involved in the original creation of Ethereum. The initial hack was reversed, and everyone that lost money in the DAO hack has been refunded. Due to fears over security, a great deal of care is now taken to keep it regularly updated, and it is now backed by a large and very powerful group of over 2000 corporations known as the Enterprise Ethereum Alliance, which desires to use the blockchain to implement smart contracts at Fortune 500 companies. Esteemed members include JP Morgan, Microsoft, Toyota and ING.

It seems clear which chain has the future of Ethereum in its hands, but depending on your moral standpoint, you may decide to go the other way. The difference between Ethereum and Ethereum Classic will always be there, but the choice seems to be obvious.

Crypto Expert