Peter Schiff Calls Saylor’s Bitcoin-Only Strategy ‘Fraud,’ Demands Live Debate

Key Takeaways

- Saylor and Schiff are to possibly fight each other at Blockchain Week in Dubai.

- Schiff’s open and candid criticism of Saylor’s business model has sparked industry-wide debates.

- Schiff may seek answers from Saylor on broader aspects if the debate happens.

- Industry is waiting for Saylor’s response.

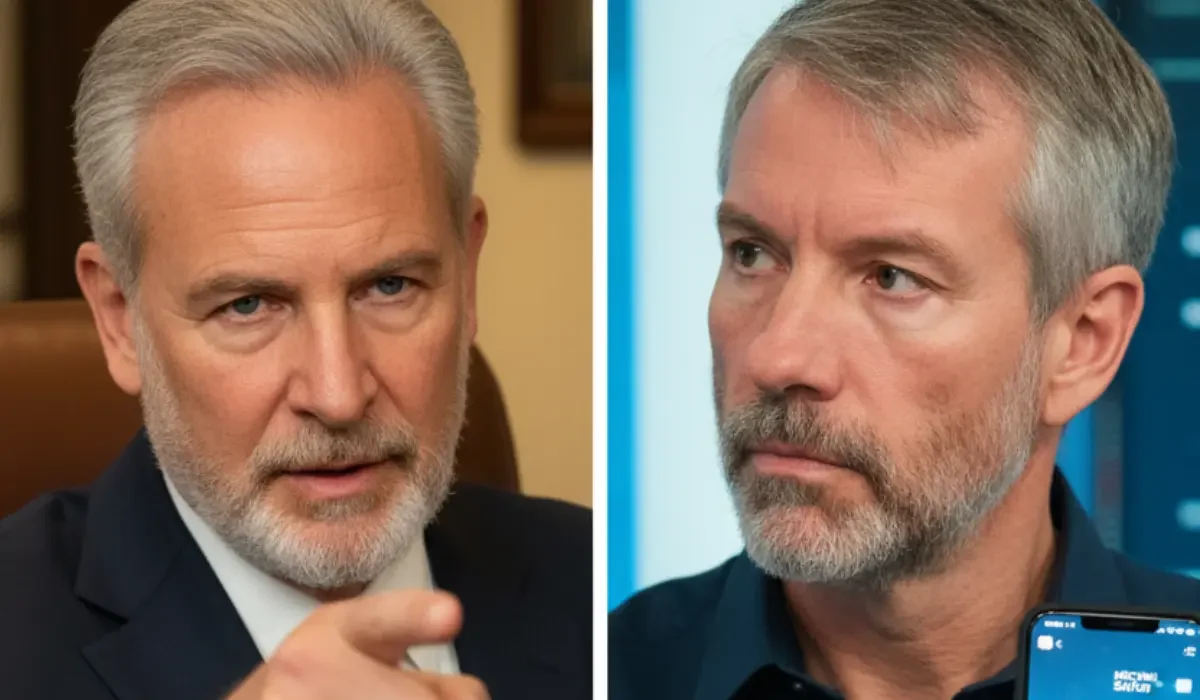

Michael Saylor’s Strategy is facing heat from American Stockbroker Peter Schiff. In a Sunday tweet, Peter Schiff went all out on Strategy as he called it a ‘fraud’. Apparently, Schiff has challenged Saylor to a live debate in Dubai, early December this year.

With the industry’s two top dogs colliding head-on, we will take a look at what is happening here. We will uncover why Schiff is being so openly critical about Strategy and Saylor in this article, while understanding what lies beneath the turmoil.

Peter Schiff and Michael Saylor

Peter Schiff is an American stockbroker who is an open critic of Bitcoin and cryptocurrencies. He is an avid advocate of traditional finance, especially gold, and has been historically critical of the idea of expensive digital assets.

Michael Saylor is an American entrepreneur and avid enthusiast of Bitcoin. According to Saylor, Bitcoin will replace gold as the reserve asset for a non-governmental store of value. Michael Saylor is the chairman and co-founder of Strategy (previously known as MicroStrategy). Strategy’s ticker symbol is MSTR.

The Accusation

With renewed confidence, Schiff has intensified his attack on Saylor. According to Schiff, Strategy, owned and co-founded by Saylor, has a fraudulent business model. Schiff makes this claim based on the argument that the company’s reported earnings are misleading. This argument is based on the fact that Strategy has a large Bitcoin reserve.

According to Schiff, the company’s earnings are unrealized gains denoted by the price of Bitcoins that the company has in its reserve. Schiff goes on to add that this cannot be considered the company’s generated operational profit. Schiff is particularly in dislike of this, since Schiff considers this as ‘masking the company’s true financial health’.

Schiff has also pointed out that since the valuation is largely based on Bitcoin’s price rather than operational value, the company is vulnerable to Bitcoin’s price volatility. Schiff went a step further to strengthen his argument by pointing out that a Strategy having a highly leveraged Bitcoin position could deem the company bankrupt if Bitcoin’s price were to go down.

BTC Exposure Could Risk MSTR Investor Funds

The recent Bitcoin price pullback has reignited Schiff’s arguments. Schiff has been fairly open about his warnings to investors on MSTR. The problem, according to Schiff, lies in Strategy’s increased BTC exposure. Schiff argues that this unjustified exposure could put investors of MSTR at risk during the high volatility of Bitcoin prices.

Schiff has used MSTR’s losses in share value since their highs in late 2024 as evidence for his arguments. This makes sense as MSTR’s losses seem to be amplified when Bitcoin prices have seen falls.

Schiff uses this evidence to convince shareholders of Strategy that the company’s leveraged model increases risk. In addition to this, Schiff points out to investors that the Strategy’s dividend and payout model offers no real security to investors because payments depend entirely on whether the company chooses to issue them, not on any binding obligation.

The Challenge for a Debate

Schiff has long been pushing Saylor for an open debate, which could put their long-running Gold vs Bitcoin disagreement to the test. On his Sunday tweet, Schiff has specifically challenged Saylor to face him on stage at Binance Blockchain Week in Dubai, a venue that would draw significant attention from both crypto supporters and traditional finance audiences.

Changpeng Zhao, Binance co-founder, has also promoted the idea of the matchup as it would open doors to new insights in the industry. Schiff, on the other hand, is hoping to use the opportunity to expose Strategy’s misleading business model and to criticize Saylor for making such Bitcoin-centric approaches to a public company.

Conclusion

As the tensions between Schiff and Saylor have reached a boiling point, so has the war between traditional finance and Bitcoin finance. Schiff’s arguments cover broader aspects of the risks posed by the leveraged positions, non-realistic gains, and the volatility of Bitcoin’s price.

While critics of Schiff have taken to the social media firestorm by stating that the Bitcoin-centric corporate models represent the future. According to them, Bitcoin is the future and not traditional assets like gold.

A rare clarity will possibly come out if Schiff and Saylor go head-to-head at the Blockchain Week in Dubai. Regardless of what the outcome of the debate is, the feud underscores the high risks surrounding Bitcoin’s role in corporate strategy and global finance.

Also Read: Japan Plans to Classify Crypto Under Insider Trading Rules, Cut Taxes

Crypto & Blockchain Expert