Bitcoin Whales Switch to Buy Amid BTC Price Slumps: Here is Why!

Key Takeaways

- Bitcoin whales have switched to buying despite the ongoing BTC price drop, with BTC surging as low as $89,368 on Tuesday.

- Analysts claim that large holders and institutional investors are taking advantage of this price drop when panic selling rises among the retail traders and short-term sellers.

- Latest market data from multiple sources confirms that BTC whales have been accumulating since late October, continuing their activity amid the broader market downturn.

- Institutional pullback and macro sentiment, like uncertainty in the Fed Rate policies, are fueling BTC’s bearish momentum. Bitcoin’s drop below the $93K Fibonacci 78.6% retracement level is also a depreciating factor.

- Bitcoin currently trades at $91,384.47, displaying a market downtrend of 4.3% compared to the last 24 hours.

According to the latest on-chain data, the number of Bitcoin whale wallets has surged as the price of Bitcoin has dropped this week, plunging as low as $89,368 on Tuesday. Bitcoin, along with the other major cryptocurrencies, has struggled and experienced significant volatility this week. However, the BTC downtrend didn’t affect whales, and an interesting trend of increased whale accumulation has happened amid this active market turbulence.

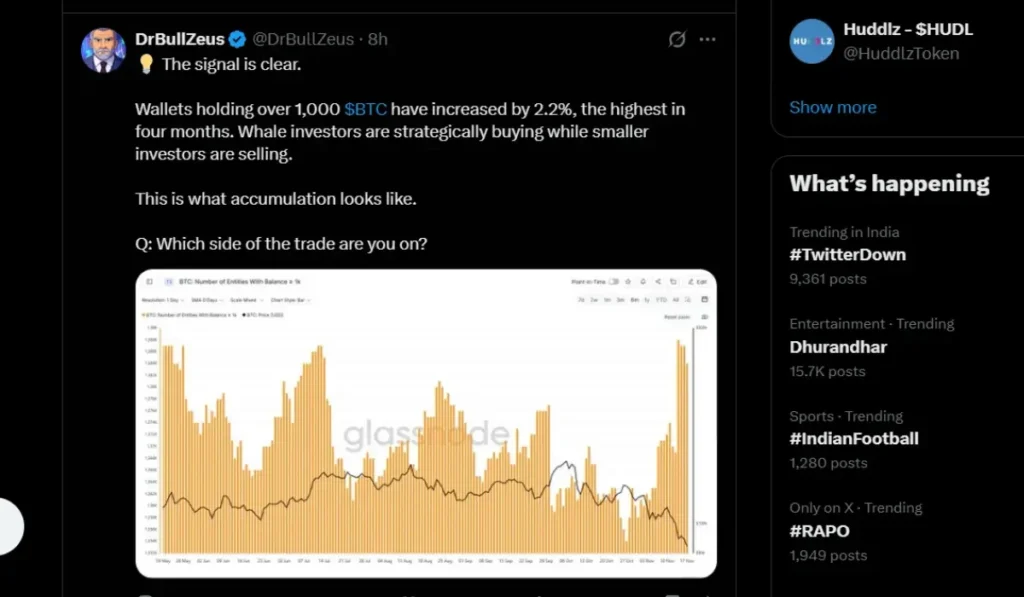

Prominent crypto analytics platform Glassnode confirmed that whales have been accumulating BTC since late October and continued their activity despite the broader market fall. According to Glassnode, a significant spike in November whale activity has been spotted, with the number of whale wallets holding above 1,000 BTC starting from the previous Friday. Expert analysis derived from Glassnode data confirmed that whale wallets’ numbers had fallen to a yearly low of 1,354 on October 27 when BTC was trading at around $114,000, but as of Monday, the number had spiked 2.2% to steady at 1,384, indicating levels not seen in four months.

They also mentioned that Glassnode data shows that the small holders with a small number of BTC holdings have been feeling the pressure of the ongoing price drop. According to their data tracking on November 17, the total number of small wallets has decreased from 980,577(October 27) to 977,420(November 17), reaching a yearly low. The expert analysis concludes that the BTC downtrend impacted smaller investors and made them sell panicly, whereas the whales stayed alert and accumulated at lower prices. Veteran and expert trader DrBullZeus posted on X that the signal was clear. He mentioned that wallets holding over 1,000 $BTC had increased by 2.2%, the highest in four months, and noted that whale investors were strategically buying while smaller investors were selling.

Bitcoin Rebounded and Hit $91,000 Today: A Possible Comeback to $100K Loading?

Bitcoin, the largest cryptocurrency by market capitalization, hit $91,000 today after a sharp correction started earlier this month. According to the latest analysis, 91K will be crucial and act as a key psychological and technical level. Experts are expecting buyers might step up after BTC broke above $91,000 and revive BTC from this ongoing downturn. According to market experts, BTC’s current price movement could be the potential base for a renewed push toward the $100K with ETF inflows and macroeconomic factors fueling it.

Corporate treasury specialist Strategy Inc. completed the purchase of 8,178 BTC for $836 million recently, and the President of El Salvador had bought another 100 million in Bitcoin, making it one of the most in-demand cryptocurrencies, with its distressed price rally. Bitcoin is hovering between $88-$92K; experts believe that $95K–$96K is the resistance BTC needs for a potential breakout above $100K. Currently, the $100K is the major hurdle because BTC failed to hold above this level for a long period of time and tried to break above the price point multiple times.

Grok AI predicted and posted on X that, based on historical post-halving patterns, ongoing ETF inflows, and potential regulatory tailwinds, Bitcoin could climb toward $120,000–$150,000 in the coming months, assuming there were no major economic downturns. He stated that volatility remained high, so a pullback to $80,000 was not out of the question, and added that $220,000 seemed overly optimistic without massive catalysts.

Crypto & Blockchain Expert