Is It A Good Time To Invest In Dogecoin (DOGE)? What Does The Market Indicate?

Dogecoin (DOGE), the world’s most popular memecoin, has officially dipped into an oversold territory as recent market performance indicates growing concerns about the fading strength of the memecoin sector.

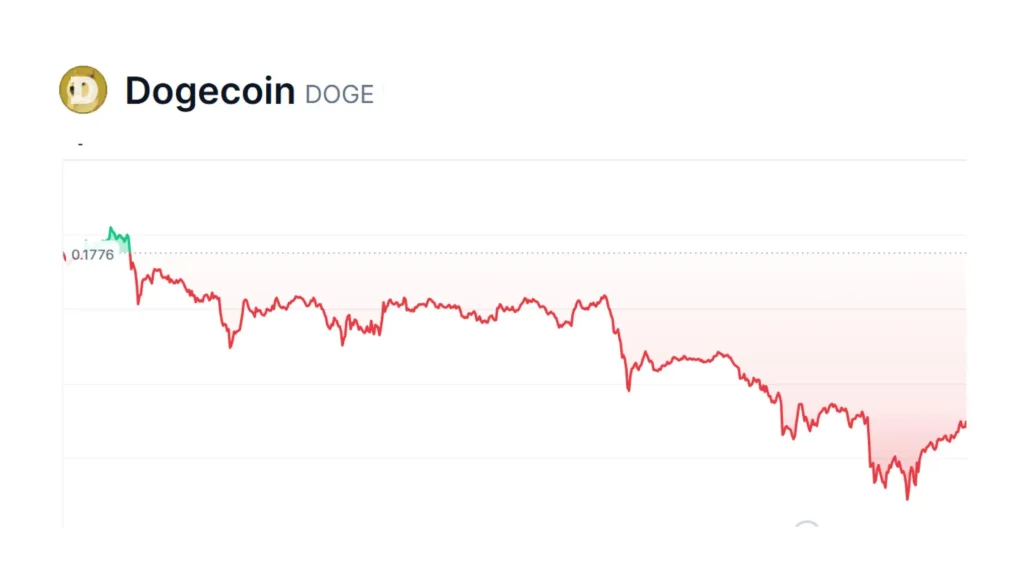

Over the past 24 hours, the price of DOGE has plunged by about 4%, pushing it below $0.16 for the first time since April. The memecoin breached multiple support levels, including $0.21 and $0.18, in the past two days, and has been surpassed by Tron (TRX) in the crypto market cap rankings. Over the past 30 days, DOGE has lost nearly 36% of its value.

Bulls Refrain from DOGE as Memecoin Demand Continues to Decline

The memecoin’s daily Relative Strength Index (RSI) is currently at 29.36, indicative of an “oversold” level where investors often tend to buy at lowered prices. However, unlike in March, when a similar RSI later triggered an 18% surge in price, this time around, DOGE bulls are nowhere to be found.

At press time, DOGE is trading at $0.1544 and is currently below its daily low from Sunday, June 22, 2025. According to technical indicators, there are no signs of potential reversal yet. The last time the token’s RSI dipped below 30, its price hit a floor near $0.12 before recovering. Then, there was a supportive RSI divergence followed by a substantial increase in trading volume. Compare that to current circumstances, and there is neither, with the volume remaining the same while the price continues to fall.

Another concern for DOGE is the lack of any significant support breakout. In March, the RSI’s push from the floor lined up with consolidation candles and a bullish RSI cross pattern on the price chart. However, this time around, the RSI signal line (Red) is still dominant, and the downward slope does not look like it has flattened.

On the bigger picture, DOGE has been on a slow downward trend since early June, dropping over 40% from its 2025 high above $0.26. Short-term price bounces haven’t lasted, and every support level the memecoin tested eventually broke. Unless this pattern changes, the “oversold” condition may be just another signal that will be ignored by a market that still isn’t convinced by its prospects.

The latest price correction is not specific to Dogecoin but is reflective of a broader decline across the altcoin market. Bitcoin’s (BTC) sideways trading near the $104,000 to $106,000 range over the past month has weighed heavily on altcoins. Fading investor interest in memecoins has also played a role in the decline, with Shiba Inu (SHIB) and PEPE down around 30% over the past month.

What’s Next for Dogecoin (DOGE)?

Now that DOGE is once again trading below the $0.16 mark, the outlook for the memecoin is turning increasingly bearish. Prominent trader and crypto analyst Ali Martinez reiterated in an X post how crucial the price range between $0.16 and $0.22 is for the 9th largest cryptocurrency. The analyst noted that a daily close outside this price range would signal the next major move, either upward or downward, by as much as 60%.

According to Martinez, that signal is now trending downward and could pave the way for a sharp 60% price correction if selling pressure rises. From a technical perspective, this would result in DOGE aiming for a price as low as $0.088, a level not seen since the early stages of its rally in August 2021.

The next support level for DOGE sits around $0.13, and unless it can recover rapidly above $0.16 in the coming days, then its price may be heading toward a much deeper retracement, one that could ultimately define Dogecoin’s position in the current market cycle.

There is hope on the horizon, with applications for spot Dogecoin ETFs currently under review at the US Securities and Exchange Commission (SEC), but its prospects are yet to offset DOGE’s bearish price action. According to Bloomberg senior ETF analyst James Seyffart, the probability of the SEC approving a Dogecoin ETF is now about 90%, with only similar products based on Litecoin (LTC), Solana (SOL), and XRP having a higher chance of approval at 95%.

To sum it up, DOGE is technically in an oversold position, but the market isn’t responding in the way that bulls hoped it would. We will have to wait for stronger reversal signals, such as a spike in trading volume or a break in the downward momentum, to guarantee that this is a mere price correction before a massive surge for the memecoin.

Crypto & Blockchain Expert