OneCoin is what is known as a Ponzi scheme.

It is promoted and marketed like a cryptocoin which has its own private blockchain, by offshore companies in Belize and Dubai which are both owned by controversial, Bulgarian magnate Ruja Ignatova.

It is known as a Ponzi scheme and as the OneCoin scam for several reasons; due to how it has been set up, and due to how many people that are involved in it, have been involved in Ponzi schemes in the past.

What Is a Ponzi Scheme?

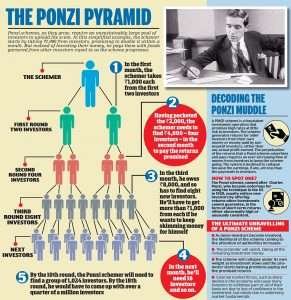

A Ponzi scheme is a fraudulent investment operation, where the operator of the scheme generates returns for older investors through giving them revenue which has been paid by new investors, instead of through legitimate business activities such as trading.

In other words, as new investors are attracted to the scheme, the money that they invest is given to those that have already invested, and the cycle continues.

A Ponzi scheme can be run by either individual persons, a group of persons, or a corporation and they success by attracting new investors by offering short-terms returns that are often very high.

One of the main problems with Ponzi schemes is that companies that run them spend their time focussing on attracting new clients and investors. When this stream of revenue runs out, the scheme falls apart.

The scheme is named after Charles Ponzi who became famous for it during the 1920s. Whilst the idea itself had been mentioned in books such as Martin Chuzzlewit and Little Dorrit, by Charles Dicken, it was Ponzi that turned fiction into fact.

He became rich and famous overnight and his scheme that was based on the arbitrage of international reply coupons, for postage stamps, began to spring a few leaks when he diverted the money of investors to paying himself, and earlier investors.

The OneCoin Concept

The idea behind OneCoin – according to them – is to sell educational materials designed to help traders.

Those that sign up and become members are able to purchase these educational packages that range between €100 and €118,000. Each of these packages contains a number of tokens which can then be used to mine OneCoins.

According to OneCoin, it is able to be mined by servers at two sites – one in Bulgaria and one in Hong Kong. Each purchasable package provides the member with new training materials, which unfortunately has been plagiarised from multiple other sources.

OneCoin and its recruiters stand by the claim that OneCoin doesn’t actually sell cryptocurrency itself, but rather the educational materials, however visitors to recruitment meetings have very different stories to tell.

They claim that the recruiters spend most of the meeting time talking about investing in the cryptocurrency, and very little time talking about the educational materials.

At present, there is no way to exchange OneCoin with any other cryptocurrency.

Before January 2017, one could exchange OneCoins to other currencies via the OneCoin Exchange, which serve as an internal marketplace for those members that had invested in any package higher than the starter one.

But after July 2017, this service was shutdown unexpectedly and out of the blue, never to return again.

When it was up and running, OneCoins could be exchanged for Euros which were then placed in a cryptocurrency wallet where the user and owner could request them for a wire transfer.

Which package you had invested in, determined you transfer and selling limits, which lead to huge restrictions on the currency.

Legal Issues

On the 17th and 18th of January, 2018, the Bulgarian police raided the offices of OneCoin in Sofia upon the request and authorisation of the prosecutors office in Germany, Both German police and Europol were involved in the investigation and the bust, and 14 other companies – all with links to OneCoin were investigated.

Over 50 witnesses were interviewed and OneCoins servers and other forms of evidence were seized. Prior to that, in July 2017, the CEO of OneCoin, Ruja Ignatova faced charges in India with misleading investors regarding the OneCoin brand.

This was following his claim in June that OneCoin was being licensed by the Vietnamese government and was due to receive official digital currency status in the country, as well as being the first Asian government to recognise it.

The Vietnamese government responded by stating that the “proof” OneCoin had presented to support their claims, was forged, contravened MPI regulations, and that the individual who supposedly signed it, did not have the authorisation to do so.

In May of last year, the International Financial Services Commission of Belize made public a warning regarding OneLife Network LTD and their methods of conducting business without any license, permit, or permission from the IFSC, or any other authority in Belize.

The company was requested to cease and desist from all of its illegal business and trading activities.

In April 2017, 19 individuals were arrested in India for organising a OneCoin recruitment evening after police attended undercover to judge the severity of the accusations before deciding whether to act. Further to these arrests, over $3.6m was recovered from nine bank accounts, after $11.1m had already been transferred out before authorities could seize it.

December 2016, saw the Italian Antitrust Authority take out an injunction against OneCoin to prevent the promotion and dissemination of the cryptocurrency OneCoin and they described their activities as “illegal pyramid sales systems” and ordered the immediate cessation of selling and promoting the coin in Italy.

Then in February 2017, the coin was banned completely until further notice.

Other jurisdictions have taken a similar no-nonsense approach to OneCoin, such as Hungary who issued a warning that it is nothing more than a pyramid scheme, and China where investors were arrested and assets totalling over $30m were seized.

The company and the scheme in general is being observed by multiple global jurisdictions such as ones in Bulgaria, Finland, Sweden, Norway, Thailand, and Latvia.

At present, OneCoin is still legal in these countries but the authorities have been warned of the risks involved in the business, and businesses of its type.

Who Is Behind OneCoin?

The mysterious management behind OneCoin is lead by the infamous Dr Ruja Ignatova.

Hailing from Bulgaria, he has set up and managed a company that is present in every one of the continents, regardless of the controversy that follows him.

Dr Ignatova lived in Bulgaria until the age of 10 before moving to Germany. She found the move hard – learning a new language, studying, and trying to prove herself was easier said than done.

She finished her studies, progressed to be a businesswoman, and then discovered her flair for entrepreneurialism. She earned a PhD in Law from the University of Konstanz, a Law Degree from the University of Oxford, a Master of Law from the University of Konstanz, and a Master of Economics from the University of Hagen.

Before she started OneCoin, she worked as an associate at McKinsey and Company, and was responsible for leading one of the largest and most well-known asset management funds in Bulgaria, called CSIF, where she was in charge of managing more than €250m.

She was recognised as “Businesswoman of the Year” in Bulgaria in 2014, and “Interational Businesswoman of the Year” in 2012. She was unofficially crowned as the Queen of Crypto and was known as one of the leading visionaries and experts in the field, globally.

Whilst she, as a businesswoman, claims that she is transparent, the dealings of OneCoin are a little less so. Take 2016 for example, it transpired that the live “switching on” of a new and improved “blockchain” was nothing other than a smokescreen.

Unbeknownst to the investors in OneCoin, just two days prior to the “switching on”, the company had tried to hire a blockchain developer whose task it would be to design and implement a working blockchain.

The developer in question was a Norweigan called Bjorn Bjercke, a blockchain guru with over 19 years’ experience in IT and project management. He was contacted by a recruitment agency and offered a very high salary to develop a blockchain and to turn a company’s SQL server into a blockchain.

This revelation was further confirmation that OneCoin was a scam as you cannot run a decentralised currency on an SQL server.

The fact that there was no blockchain present was a huge blow to the many investors that had signed up to OneCoin believing there was. Many stated that it was the main reason they signed up and this outrage lead to multi investigations into their practices.

Is OneCoin Definitely a Scam?

There are many out there that say they have become rich, or done well through OneCoin, but are they to be believed and is it really a scam?

The answer is, yes, it is.

Through subsequent investigations into funds received by OneCoin, it seems much of the money has made its way back into Ignatova’s native Bulgaria.

$19 million in total has been invested into property deals which include her, and a whole array of morally questionable individuals and companies.

These include, former politicians, nefarious businessmen, and those with links to organised crime.

Whilst Ignatova is the face of the company, the complex web of shell companies that are operated by OneCoin Limited, have links to well known crime figures such as the Bulgarian “Cocaine King” Hristofos Amanatidis who was charged in absentia with numerous drug charges by the Bulgarian police.

His girlfriend has a majority ownership in a company which holds some of Ignatova’s properties as an asset and another of his ex-girlfriends is a shareholder in a similar set up.

The Future Of OneCoin

Who really knows?

As jurisdictions around the world, continue to crack down on OneCoin and its investors and promotors, at the same time its popularity is still increasing.

But that comes down to lack of understanding on how a true cryptocurrency should work, combined with a greed to get rich quick.

OneCoin are full of wonderful and amazing claims, but once you look further there really is very little to back it up. Once investors start to see their balance update over time, and no real money come in, they will start to realise just how much they have been had.

Once people realise that they will never have any direct control over their balances or funds, then they will start to understand it is a scam.

The final bit of proof, and the biggest bit of proof that the whole thing is nothing more than a dirty, Ponzi scheme, is the fact that OneCoin claim that the currency runs on a blockchain, yet multiple witnesses, whistle-blowers, and trouble-shooters have proven conclusively that it does not and that no blockchain related to the OneCoin network exists- at all.

Also there is one more thing that is worth considering – you cannot exchange OneCoin and not one person has ever bought anything with a OneCoin directly- this should be proof enough that this is not worth your time, or your energy.

OneCoin scam is just one of many that have flooded the cryptocurrency space recently. BitConnect is a yet another example of the cryptocurrency scams.

![Bitcoin Buyer Review of Official Website [2022] bitcoin buyer review featured image](https://bitemycoin.com/wp-content/uploads/2022/04/bitcoin-buyer-review-featured-218x150.jpg)

![Bitcoin Digital | Official Website Review [2022] bitcoin digital review featured](https://bitemycoin.com/wp-content/uploads/2022/04/bitcoin-digital-featured-218x150.jpg)