The Cryptocurrency market is highly volatile.

In the space of a year, Bitcoin (BTC) gained over 1400% to hit an all-time high of $19,343 on 16th December but has since plummeted to a little over $6,000 in just six gut-wrenching weeks.

So what determines cryptocurrency value and why is the market so volatile?

This article takes an in-depth look at the factors that most influence the price of digital currencies and explains why Bitcoin experienced the heady heights before suffering a Luciferian fall from grace.

Value Factors

Before we address the influencing factors, it’s pertinent to understand how cryptocurrencies have a value in the first place.

After all, the prices are just numbers calculated by a sophisticated algorithm of mathematical equations and recorded on a public ledger known as a blockchain. Digital tokens are not physical assets like precious metals and commodities like oil.

Newcomers to crypto assets can be forgiven for scepticism. If digital tokens do not really exist, how can they have any real value?

In truth, cryptocurrencies work in the same way as fiat currencies. Their value is determined by how much people agree they are worth – plus the factors that also influence FOREX.

Not many people know this, but fiat currencies are essentially worthless and only have value because they are the accepted form of currency. In fact, money is printed by national Mints and given to banks to dispense among the population.

Yet every country in the world is trillions of dollars in debt because banks loan out money they don’t actually have.

The difference between digital currency and fiat currency is that the former is valued for its benefits and usefulness. Money as we know it only has a perceived value because we agree to use it in exchange for goods and services.

The value of cryptocurrency works in the same way and will continue to be valued by how much people use them.

The difference between fiat currency and cryptocurrency is the latter promises to solve the flaws of a corrupt financial system.

Digital assets are managed by blockchain technology which promotes a healthy economy where social conscious and public consensus has more control over inflation and the general cost of living.

Cryptocurrencies are decentralised and not owned by a single controller such as a bank or government. In essence, blockchain technology returns the power to the people to manage financial markets reasonably and sensibly.

However, at the moment, there is a wrestle of power between the blockchain community and the moneymen behind the banks and other financial institutions.

Today, the bankers are winning the battle, but will they win the war?

Number Of Investors

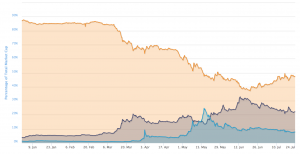

Supply and demand is the basis for the value of any commodity. And so the number of investors that back digital tokens affects the price.

Bitcoin surged in value in 2017 because forward-thinking retailers recognise cryptocurrency will be the way to pay for goods and services in the future.

By adopting Bitcoin early, investors stand to make a significant profit. The substantial increase in 2017 proved that and demonstrated the massive potential for the cryptocurrency.

Blockchain has the faith of the general public because of its promise to avoid recessions like the 2008 bank crash – which was manipulated by financial institutions and mismanaged by banks.

The number of people that invest in cryptocurrencies is also determined by some other factors which we will discuss in more depth throughout this article. But one of the overriding factors of whether people think a coin is worth investing in is the speculative longevity of a particular token.

There are some 1000+ cryptocurrencies on the market. Not all of them will survive. Investors that back the wrong coin stand to lose money.

Therefore, digital coins that are likely to have an actual use in the future are in-demand. The price of Bitcoin rose sharply because casinos accept it. Other online retailers also offered BTC as an alternative payment method.

However, there was an insufficient demand by consumers, and because Bitcoin transactions take around 50 minutes to process, the value per BTC had changed from point-of-sale to the point of completion.

It, therefore, made no sense for merchants to accept Bitcoin as a payment method. The payment gateway, Stripe is the latest firm to ditch the digital currency.

Bitcoin is still the most highly valued crypto asset because investors typically have to trade Bitcoin for other cryptocurrencies. There are only a handful of altcoins that exchanges offer in exchange for fiat currencies including Ethereum and Litecoin.

Therefore, Bitcoin is still receiving a lot of activity which keeps its value high.

However, there are a significant number of altcoins that have better technology than Bitcoin and provide more benefits for adopting digital currencies as a valid means of buying and selling in the future.

Cryptocurrencies will be the way to pay. The question is, which tokens will make the grade.

Political And Banking Regulations

Politics has had a significant impact on the cryptocurrency market – in a negative way.

Just as crypto assets were jogging along nicely, the Chinese government banned trading in cryptocurrencies and closed down several exchanges. The crypto ban in China was recently extended to trading on foreign exchanges as well which has subsequently influenced the latest price drop.

The South Korean government is threatening to do the same, but are wary of a backlash from crypto crazy Koreans. Banks in the United States and the UK are attempting to covertly deny investors a chance of accruing crypto assets by refusing credit card purchases.

In recent weeks, leading credit agencies have all announced they will not permit purchases of cryptocurrencies.

These announcements have caused a dramatic decline in the value of cryptocurrency. Officials allege that investing in Bitcoin is speculative and dangerous because the market is unregulated.

Their pals in the media fuel concerns with reports of cybercrimes and the impending collapse of cryptocurrency predicted by “financial experts.” Yet other traders anticipate big things for cryptocurrency.

When you look at the bigger picture, it is obvious to see why cryptocurrencies provide a solution to the flawed financial system. With this in mind, it is obvious to see why banks are afraid of losing their control over the strings of the economy.

It’s ironic for banks to call out the cryptocurrency market for being unregulated when their “regulated” system is designed to work in their favour.

Let’s not forget; these are also the same people that are aiding the bankruptcy of every country in the world by running up trillions of dollars worth of debt. And here’s another irony. Multiple international banks are trialling the Ripple blockchain. Why?

Because they know the current financial system is ready to collapse. We had the credit crunch in 2008. Next time it will be the Credit Crash.

The authorities are already paving the way for cryptocurrencies. Numerous national Mints including the UK, Australia, China, and Russia are creating a gold-backed cryptocurrency.

Even the Bank of England, the puppeteers of the financial system, are toying with the idea of introducing digital currency – “backed by central banks”.

There’s the real kicker. Banks, and the law-makers in Government they sponsor, don’t want independent companies and a public ledger to have any control over the financial system.

Yet they are perfectly happy for crypto coins to replace fiat currencies. Needless to say, the lawmakers will impose their own “regulations” on digital currencies – but it will be on their terms and in their favour.

Utility

The value of any commodity is only worth the value of its purpose. At the moment, cryptocurrencies, other than BTC, are just an investment tool.

Investors can’t use them to buy and sell anything other than other altcoins. But several cryptocurrencies have the potential to serve a purpose in the real world from the virtual world.

The only token that does have any use today is BTC. A growing number of online retailers adopted Bitcoin to offer customers an alternative payment method.

However, Bitcoin technology is not efficient enough to perform online transactions efficiently. It’s perhaps one of the reasons, BTC is dramatically losing value at the moment.

On the other hand, several cryptocurrencies have the potential to replace BTC as the leading digital token. Banks have been piloting the Ripple blockchain for a couple of years now.

A few weeks ago, money lenders, Moneygram announced they were trialling XRP to speed up international transfers. Rumour has it that Western Union is plotting a similar process.

This partnership will obviously give Ripple a practical purpose within the financial system thus we expect the value of XRP to increase over the coming months significantly.

Ethereum, a smart contract platform designed to eliminate fraud, bypass brokers and protect copyright among other things, is another blockchain that offers enormous potential as a utility in the real world.

Ultimately, the value of a cryptocurrency will be determined by its practical use – because the value of cryptocurrency is calculated by the number of people using it and the price people are prepared to invest in it.

The more useful a cryptocurrency is at solving real-world problems, the more valuable it is to end-users.

Blockchain Technology

The blockchain technology that powers cryptocurrency has a significant part to play in the value. Digital assets that solve real-world problems from the digital space we mentioned above are more likely to attract investors. Thus the perceived value is higher.

In general, the casual investors will look for blockchain that offers security and privacy because this is what they most want when buying and selling goods online.

People want to know their digital assets are safe and their identity is private. Not all digital currencies offer these type of desirables. Another issue with Bitcoin.

Professional investors and crypto experts will look further ahead to determine which blockchain technologies offer the most potential.

For example, TRONIX is a cryptocurrency that is specifically designed to allow consumers to purchase entertainment from international sources without having to pay bank charges or worry about illegal downloads.

Here you can see a valid and unique purpose for TRON blockchain technology, and because the digital entertainment industry is a multi-billion dollar industry, TRONIX will appeal to long-term investors.

Ripple is another prime example. XRP transactions can be processed in a matter of minutes, which is far faster than rival blockchains – and speed is a significant factor in online purchases.

If you’re contemplating investing in the cryptocurrency market, get clued up on blockchain technology that has the potential to make a real difference.

Market Manipulation

It’s well known that professional financial traders manipulate crypto markets for their gain.

Because the cryptocurrency market is officially “unregulated”, it is rife with pump and dump scams by insider traders that are deliberately manipulating the markets at the expense of other investors.

When you see a sharp rise in cryptocurrency prices, followed by a massive drop, it is the work of “Whales.” Whales is an industry term to describe a group of investors working together to buy a digital token and own a large percentage of it.

Other investors see movement in the market and invest in the token. These investors are known as “weak hands.”

Market manipulators then use a tactic known as “rinse and repeat“. They start gradually selling off their crypto assets at the inflated price and make a tidy profit.

When they sell, the price drops which prompts weak hands to start panic selling. Market manipulators then rebuy the coins when the price hits a new low and repeat the process.

Another method used by Whales is to create buy and sell walls inside a cryptocurrency exchange. These walls are independent of the actual transactions and manipulated by conspiratorial groups.

Transactions are typically made via an order book that stipulates the price the trader wants to buy and sell currency.

A strong buy wall is a signal that more people are investing in an asset than selling which shows good sentiment in the market and makes a currency appear strong.

However, fake walls can be erected by Whales to persuade traders that are not in the loop to buy assets. When the asset hits a price, they are happy with they sell their holdings at a high rate and collapse the wall, thus pocketing the money of other investors.

Overall

Governments are not wrong when they say buying cryptocurrencies is dangerous – but it is only dangerous because of the moneymen hiding in the dark shadows of financial institutions looking to steal your money.

One crucial thing to remember is that digital currencies are a relatively new invention, and only in the last 12 months they experienced a sort of boom.

It will take a long time for cryptocurrency market to stabilise itself.

Knowing when to buy and when to bail is essential, thus knowing what determines cryptocurrency value is vital.

If you are interested in coins other than Bitcoin, read our guide on How To Choose a Cryptocurrency To Invest – it will make it easier to understand the lifecycle of the currency.

![Bitcoin Buyer Review of Official Website [2022] bitcoin buyer review featured image](https://bitemycoin.com/wp-content/uploads/2022/04/bitcoin-buyer-review-featured-218x150.jpg)

![Bitcoin Digital | Official Website Review [2022] bitcoin digital review featured](https://bitemycoin.com/wp-content/uploads/2022/04/bitcoin-digital-featured-218x150.jpg)